Yunying Valley Western Headquarters Project Signing: Behind the capital layout, the industry is warm

- author:

- 2025-07-11 09:56:24

At a time when the industry's technological iteration is accelerating and the market landscape is reshaping, every step of the company's strategic layout has attracted much attention. After going to Hong Kong to submit its prospectus in June, Yunying Valley has recently completed the signing of another major western headquarters project with a total investment of 250 million yuan and officially landed in Chengdu High-tech Zone.—— This series of actions not only demonstrates its determination to deeply cultivate in the display field, but also reflects the development trend of the industry driven by both capital and technology. However, behind the investment plans of many companies that often cost hundreds of millions or even billions, the phenomenon that the industry's investment figures are bright and the actual implementation is difficult cannot be ignored.""

Implementation of the western headquarters project, focusing on display technological innovation

On July 8, the Western Core Highland·Digital New Ecological Industry Investment Promotion Conference and the China Mobile Ecological Chain Enterprise Park Inspection Activity were held in Chengdu High-tech Zone."" This event became a platform for the centralized implementation of high-quality projects. Five high-energy projects were signed on site, with a total investment of 1.68 billion yuan. The investors included listed companies, national specialized and new giants, unicorns and Forbes top enterprises., focusing on the layout of core industrial chains such as integrated circuits, new displays, and artificial intelligence, injecting new momentum into regional industrial development.""

The Yunying Valley Western Headquarters project invested by Yunying Valley Technology Co., Ltd. is one of them. The project is located at the hub of the intersection of the two advantageous industrial chains of integrated circuits and new displays in Chengdu High-tech Zone, with a total investment of 250 million yuan, mainly focusing on display technology innovation and product research and development. Based on the two core products of AMOLED display driver chips and Micro oled display driver backplane chips, Yunyinggu plans to further deploy display and touch integrated technology and Micro LED display driver technology, broaden the breadth of product terminal applications, build a multi-dimensional product matrix, and promote the large-scale commercialization of display and touch integrated technology in AMOLED display panels and the commercial application of Micro LED display technology.

Data shows that Yunying Valley is a company specializing in the research and development of OLED display driver chips with display technology research and development as its core. It adopts the Fabless (fabless) operation model. Its main products include AMOLED display driver chips and Micro OLED silicon based display driver chips. Drive backplane chip. From the perspective of business layout, its western headquarters project is highly consistent with the industrial chain advantages of Chengdu High-tech Zone, and is expected to achieve coordinated development through the regional industrial ecology.

The road to capital has been bumpy, and market performance has steadily increased

Yunying Valley has taken frequent actions in the capital market, but its capitalization process has not been smooth sailing. On June 26, Yunying Valley officially submitted a listing application to the Hong Kong Stock Exchange, planning to list on the main board of Hong Kong. CICC and CITIC Securities serve as joint sponsors, and the overall valuation of the company is approximately 8.5 billion yuan. The net proceeds from this IPO are planned to be mainly used to support the research and development and optimization of AMOLED TDDI chips and expand application scenarios, support the research and development and optimization of Micro-OLED and Micro-LED display driver backplanes, strategic investment or acquisition, and use as working capital, etc.

Looking back on its capital path, it can be said that it has experienced twists and turns: its A-share IPO plan failed in early 2023; in November 2024, although it received a control takeover offer from a listed company, the transaction was also terminated in March this year. However, continued capital support has helped its development. Sky Eye Inspection shows that since its establishment, Yunying Valley has completed 9 rounds of financing. It has a strong investor lineup, including many well-known manufacturers such as Xiaomi, Hubble, and BOE, as well as market-oriented VC institutions such as Sequoia China, Qiming Venture Capital, and Northern Lights Venture Capital, as well as state-owned investment platforms such as Guangdong Semiconductor and Integrated Circuit Investment Fund, Guokai Science and Technology Innovation, Shenzhen High-tech Investment and Ceyuan Capital.

Judging from market performance, Yunying Valley's growth has been confirmed to some extent. According to its prospectus, Yunying Valley's sales volume will exceed 50 million units in 2024, and the supply share of AMOLED display driver chips among all global smartphone brands will increase from 1.2% in 2022 to 4.0% in 2024. In terms of financial data, from 2022 to 2024, Yunying Valley's revenue was 551 million yuan, 720 million yuan and 891 million yuan respectively, showing a steady increase.

Third-party perspective: Industry concerns behind investment numbers

Regarding the signing of the Yunying Valley Western Headquarters project and its plan to go public in Hong Kong, industry analysts believe that this is an important measure for companies to use capital to expand their business and enhance their technical strength. ldquo; Chengdu High-tech Zone's advantages in the integrated circuit and new display industry chain can provide good ecological support for Yunying Valley's R & D and industrial implementation. The investment scale of 250 million yuan is suitable for companies focusing on technology-intensive fields such as display driver chips. It is within a relatively reasonable range and will help them make breakthroughs in core technologies. rdquo;

But at the same time, it shows that the long-standing phenomenon of falsely high investment figures in the industry has also triggered a lot of discussion."" A business owner who has been deeply involved in the display industry for many years bluntly said: Nowadays, many bosses in the display industry may not even be able to provide 5 million yuan in working capital, but they have to cooperate with the slogan of investing 1 billion or 2 billion yuan. In the end, the project often ends up because the capital chain broke and the bloody collapse." This kind of puffy investment plan not only wastes resources, but also disrupts the market's judgment of the true development status of the industry."" rdquo;

Another industry observer also said: A company's investment planning needs to match its own strength and market demand." For enterprises like Yunying Valley with a certain revenue base and capital attention, the investment plan of 250 million yuan is relatively reliable, but they still need to be vigilant about whether follow-up funds can be received on time and whether projects can be implemented as planned. After all, it shows that the industry has large investment in technology research and development and a long cycle, and many projects eventually fail, not because the technology is not good, but because the capital chain cannot keep up. rdquo;

Future Outlook: Moving forward amidst opportunities and challenges

Yunying Valley's actions in capital and industrial layout have undoubtedly added weight to its development in the display field. The Western Headquarters project focuses on core products such as AMOLED display driver chips and Micro OLED display driver backplane chips, as well as the expansion of display and touch integrated technology and Micro LED display driver technology, which are in line with the technological development trend of the display industry. If it can be successfully implemented and achieved technological breakthroughs, it is expected to occupy a place in the fierce market competition.

However, competition in the display industry has already entered a white-hot stage, the speed of technology iteration continues to accelerate, and the market is demanding higher and higher products. Yunying Valley not only faces competitive pressure from domestic and foreign counterparts, but also needs to deal with multiple challenges such as uncertainty in technology research and development and capital chain management. Whether its listing in Hong Kong can be successful and whether the western headquarters project can be advanced as planned will affect its future development direction.

In the wave of the display industry, Yunying Valley's layout is just a microcosm. Whether it is the pursuit of capital or the competition of technology, the enterprises that can ultimately survive and develop must be those who can down-to-earth and accurately grasp market and technological trends. The industry also needs more pragmatic investment and layout to truly promote the progress of display technology and the healthy development of the industry.

TAG:

Guess you want to see it

Popular information

-

Pay attention to policies! Multiple layout helps high-quality development of the LED display industr

-

The large screen of the Wannian County Science and Technology and Culture Center in Shangrao, Jiangx

-

Shanghai's OLED driver chip-related company disbanded: it planned to invest more than 18 billion yua

-

TCL Huaxing Wuhan 5.5-generation printing OLED experimental line is expected to achieve small-batch

-

The sale of LGD Guangzhou LCD production line has entered administrative approval

-

Abison Linyungu Series Yi Manufacturing Base opens grandly

-

Extraordinary set sail MLED display project: lighting up a new dawn for the optoelectronic industry

-

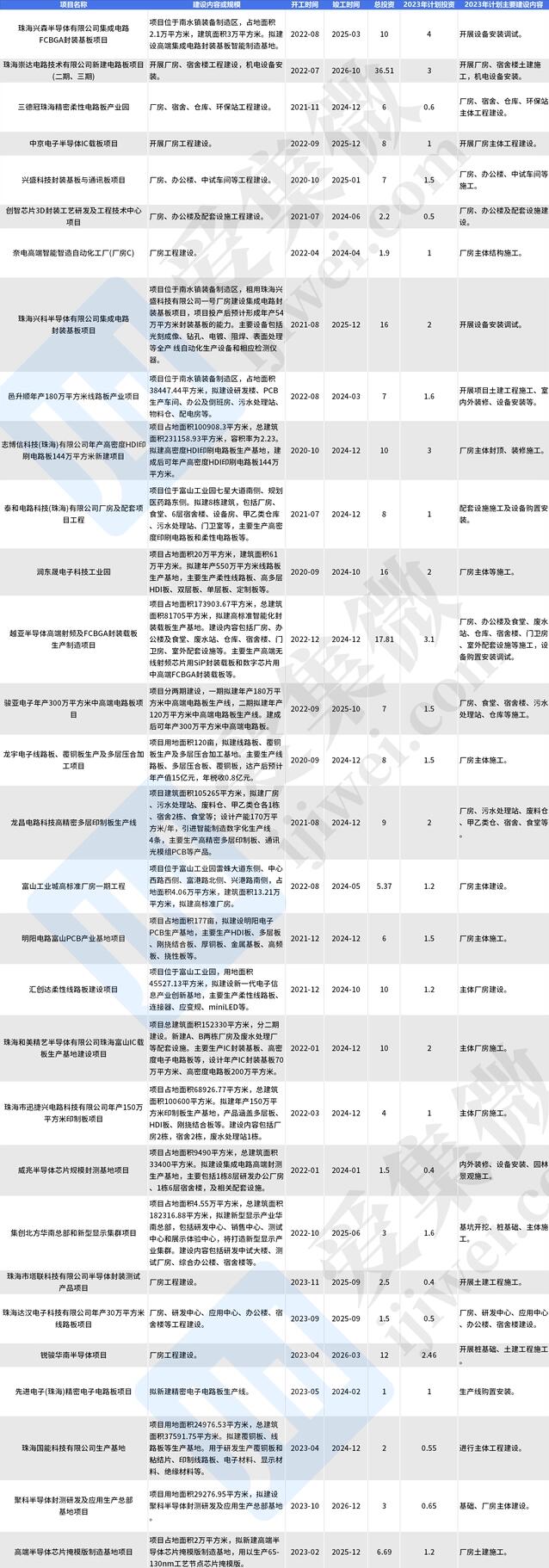

The release of key construction projects in Zhuhai City in 2023 includes projects such as Chuang Nor

-

Huike Mini-LED Project: Lighting up a new blueprint for Liuyang's new display industry

-

New Year's vitality starts! Large LED screen helps Shenzhen Marathon run out of Shenzhen speed

the charts

- The large screen of the Wannian County Science and Technology and Culture Center in Shangrao, Jiangx

- Inspur's new ultra-high definition display manufacturing base opened in Jinan with an annual output

- New Year's vitality starts! Large LED screen helps Shenzhen Marathon run out of Shenzhen speed

- Pay attention to policies! Multiple layout helps high-quality development of the LED display industr

- The release of key construction projects in Zhuhai City in 2023 includes projects such as Chuang Nor

- Abison Linyungu Series Yi Manufacturing Base opens grandly

- Shanghai's OLED driver chip-related company disbanded: it planned to invest more than 18 billion yua

- The sale of LGD Guangzhou LCD production line has entered administrative approval

- TCL Huaxing Wuhan 5.5-generation printing OLED experimental line is expected to achieve small-batch

- Extraordinary set sail MLED display project: lighting up a new dawn for the optoelectronic industry