Xinyichang's transformation path: Strategic layout and breakthroughs in the fields of Mini LED and s

- author:

- 2025-03-06 11:23:10

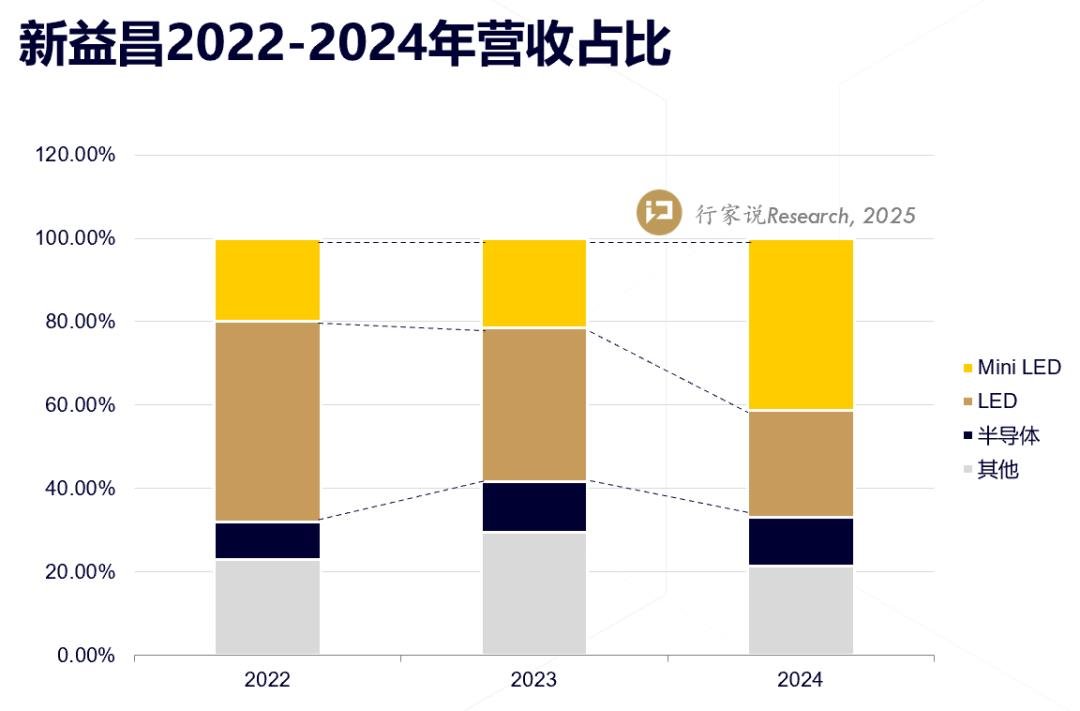

Recently, Xinyichang announced its 2024 performance report. During this year, Xinyichang achieved a total operating income of 933.9881 million yuan and a net profit of 43.0413 million yuan. Although revenue and profits are facing certain pressure, according to the order details disclosed by Xinyichang's investors, and experts say Research's statistics on the deployment of Mini LED equipment by new display downstream manufacturers, Xinyichang has made great achievements in the field of Mini LED die bonders. In 2024, its Mini LED die bonding machine revenue is expected to be in the range of 350 million-400 million yuan, accounting for more than 40% of total revenue, and Mini LED and semiconductor high-end products revenue may account for more than 50%. High-end product driving strategy Initial results. It should be noted that the above data is estimated by experts based on previous financial reports, investor exchanges and market research, and the exact figures are subject to corporate announcements.

Mini LED die bonding equipment is widely used in the Mini RGB (LED display market) and Mini LED backlight market. According to experts and Research data, the overall output value of the LED display industry in 2024 will be approximately 40.2 billion yuan. Although it dropped by 4% year-on-year, the proportion of Mini COBs continues to rise. At the same time, driven by the national subsidy policy of replacing the old with the new, the Mini LED backlight market has ushered in a period of rapid development. Against the background of a sluggish economic environment and adjustment of supply and demand structure, the LED industry not only faces challenges from traditional business stock cycles, but also needs to deal with issues such as intensified market competition. Under this circumstance, companies have accelerated the pace of high-end business transformation and actively explored the second growth curve. This article will take Xinyichang as an example to deeply analyze the following key issues: Why did Xinyichang choose the Mini LED and semiconductor market as the direction of technological transformation? In the special economic cycle, how does Xinyichang cope with short-term pressure and plan for future development by optimizing its business structure?

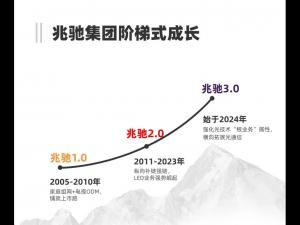

From" the perspective of the second curve" theory, when the company's first growth curve (such as the traditional LED display business) reaches its peak and shows a slowdown, new businesses, products or models are introduced to start the second growth stage and become a reality. A key path to sustainable development. At present, the traditional LED business has entered a stock cycle. Xinyichang has decisively reduced some of its traditional LED die bonder business and made every effort to expand the Mini LED die bonder and semiconductor die bonder markets. This forward-looking strategic adjustment is highly in line with the industry trend of increasing Mini LED penetration and explosive growth in demand in the semiconductor market.

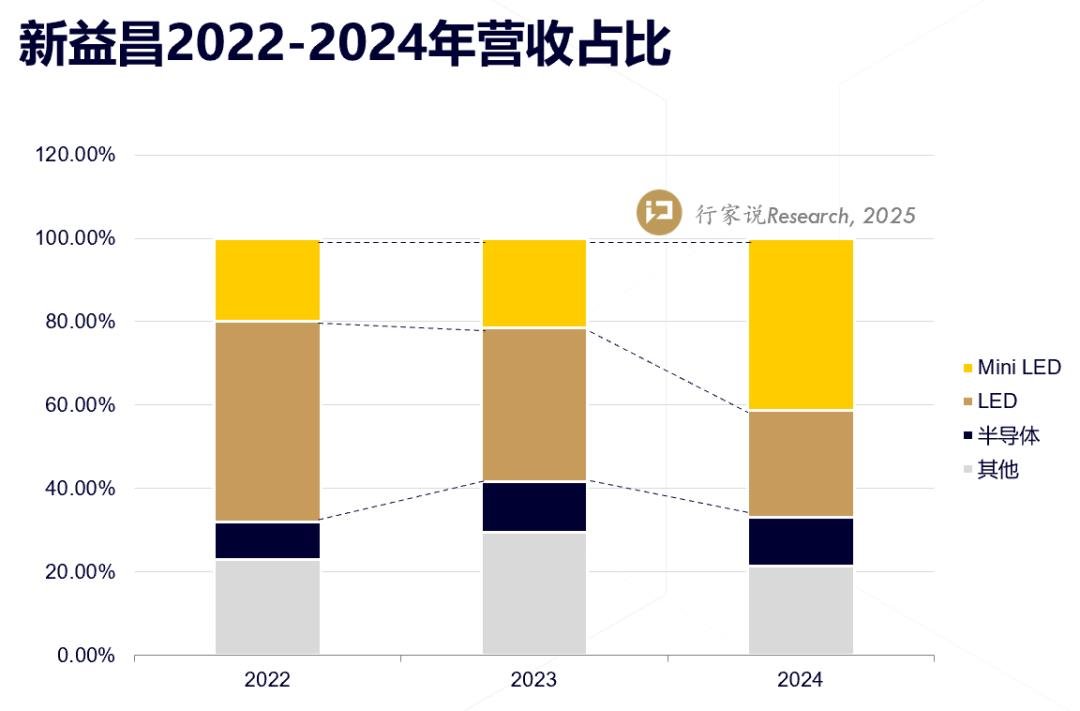

Mini LED die fixation machines are the fastest-growing business segment of Xinyichang. As a leading company in the field of Mini LED die bonders, Xinyichang has significant technological and brand advantages. In 2022, the Mini LED die bonding machine business will account for 20% of total revenue, and by 2024, this proportion is expected to exceed 40%.

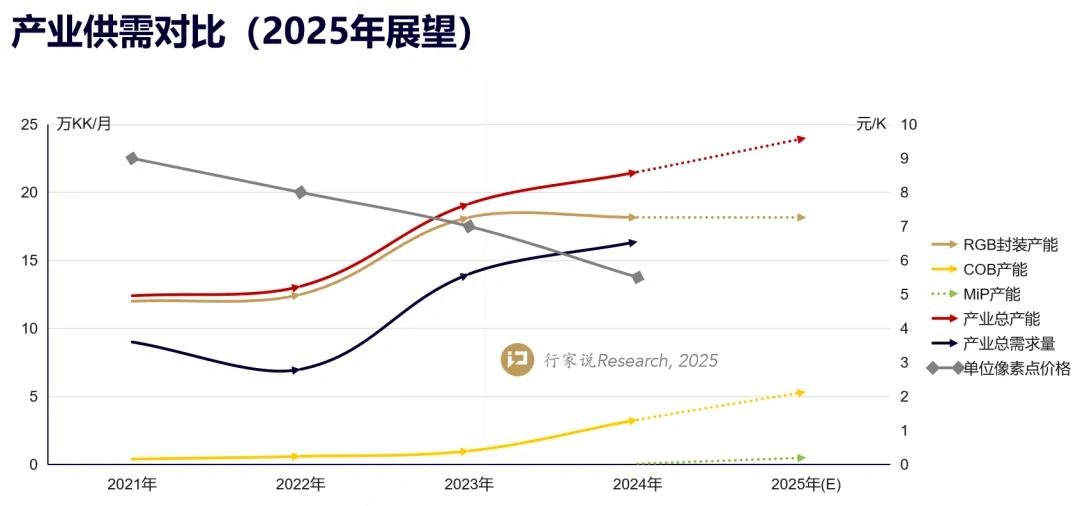

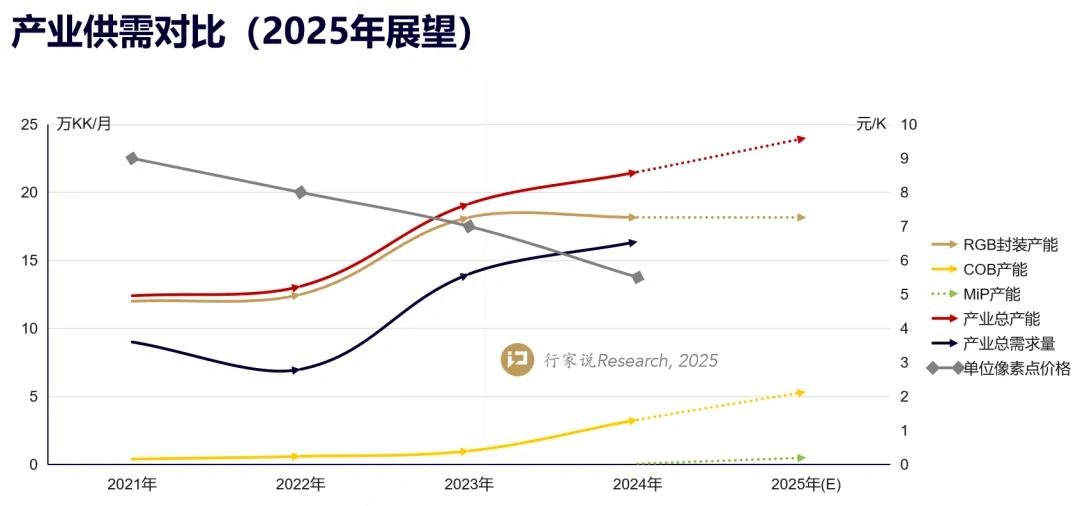

Mini LED market penetration continues to rise, which is an important driving force for the growth of Xinyichang's Mini LED die fixer business. As the industry's demand for equipment surges, Xinyichang's Mini LED die bonder business is expected to nearly triple growth. According to experts, Research estimates that COB production capacity has exceeded 50,000 square meters per month, and Mini LED backlights shipments have exceeded 13 million units. In the RGB market, COB will become one of the important trends in industrial development in 2024 and enter the stage of large-scale application. In addition to COB, Mini LED die bonders can also be used in RGB packaging fields such as MIP. In the existing market, the industry continues to promote spacing reduction to open up new market space. The demand for new equipment by enterprises has prompted Mini LED die bonders to accelerate the update and iteration. Whether it is from the perspective of technological innovation or product competition, Mini LED will usher in new development opportunities. Mini LED die bonding machines are sustainable in terms of commercial operations and technology research and development, and are expected to further promote the sales of Xinyichang Mini LED products. growth.

In addition to focusing on the Mini LED business, Xinyichang is also actively deploying high-end equipment fields such as semiconductor packaging. In 2021, Xinyichang Semiconductor's equipment revenue will increase significantly by 890.23% year-on-year, becoming an important turning point in the development of the company.

The market potential for semiconductor packaging equipment is huge. China's 14th Five-Year Plan lists advanced packaging as a key research direction. As the world's largest semiconductor market, China's scale far exceeds that of the LED die bonder market, and there is broad space for domestic substitution. The semiconductor packaging business is expected to become a new profit growth point for Xinyichang. In the field of semiconductor packaging, Xinyichang relies on its accumulated technological advantages in the field of LED die bonders to quickly enter the semiconductor die bonders market. Its products have covered power devices, IGBTs and other packaging application scenarios, and has successfully cooperated with Huawei, Changjiang Electric, Tongfuwei, Huatian, Lite, Infineon, Jiasheng and other leading domestic and foreign companies have established cooperation to achieve product delivery.

In terms of wire bonding machine business, Xinyichang has acquired semiconductor wire bonding technical capabilities by acquiring a 75% stake in Kaijiu Automation. It plans to extend its business to the field of LED wire bonding machines and build a collaborative sales model for" solid crystal + wire bonding" equipment. In 2024, the Xinyichang wire welding machine prototype has entered the trial production verification stage.

Building new business growth poles is often accompanied by short-term performance pressures. The contraction of the traditional LED equipment business has put pressure on revenue. The Mini LED die bonder market is not yet fully mature, and it will still take time to increase the volume of semiconductor equipment. Under this circumstance, Xinyichang actively adjusted its business strategies, seized structural market opportunities, and combined its performance data for the first three quarters of 2024 to provide clear insights into its response measures.

In the first three quarters of 2024, Xinyichang's research and development expenses reached 66.9694 million yuan, accounting for 8.7% of revenue, an increase of 0.84 percentage points over the same period last year. In the first half of 2024, Xinyichang added 31 new patents and obtained a total of 349 patents and 155 software copyrights. In October 2023, the Xinyichang high-end intelligent equipment manufacturing base project officially started and laid the foundation stone. The total investment of the capital increase and expansion project is 600 million yuan, and the annual output value is expected to exceed 680 million yuan. A semiconductor intelligent equipment manufacturing base and R & D center will be built. In January 2025, the manufacturing base has been successfully capped.

In the first three quarters of 2024, Xinyichang's net cash flow from operating activities/operating income ratio increased from negative to positive to 20%. Mainly due to the improved efficiency of accounts receivable collection and the increase in orders for Mini LED and semiconductor equipment, the company's cash flow will remain stable in 2024. Stable cash flow provides strong support for R & D investment and production capacity expansion.

In the field of Mini LEDs and LED equipment, Xinyichang has established a large and high-quality customer base, including well-known companies such as SAMSUNG, BOE, Konka Optoelectronics, Abison, Zhouming, Lijingwei, Zhaochi Jingxian, Lehman Optoelectronics, Jufei Optoelectronics, Skyworth, San 'an Optoelectronics, Guoxing Optoelectronics, Ruifeng Optoelectronics, and Yiguang Electronics. Extensive customer resources help Xinyichang continue to expand its market influence and enhance brand awareness.

Mini LED die bonding equipment is widely used in the Mini RGB (LED display market) and Mini LED backlight market. According to experts and Research data, the overall output value of the LED display industry in 2024 will be approximately 40.2 billion yuan. Although it dropped by 4% year-on-year, the proportion of Mini COBs continues to rise. At the same time, driven by the national subsidy policy of replacing the old with the new, the Mini LED backlight market has ushered in a period of rapid development. Against the background of a sluggish economic environment and adjustment of supply and demand structure, the LED industry not only faces challenges from traditional business stock cycles, but also needs to deal with issues such as intensified market competition. Under this circumstance, companies have accelerated the pace of high-end business transformation and actively explored the second growth curve. This article will take Xinyichang as an example to deeply analyze the following key issues: Why did Xinyichang choose the Mini LED and semiconductor market as the direction of technological transformation? In the special economic cycle, how does Xinyichang cope with short-term pressure and plan for future development by optimizing its business structure?

Taking Mini LED and semiconductor products as" the second curve"

From" the perspective of the second curve" theory, when the company's first growth curve (such as the traditional LED display business) reaches its peak and shows a slowdown, new businesses, products or models are introduced to start the second growth stage and become a reality. A key path to sustainable development. At present, the traditional LED business has entered a stock cycle. Xinyichang has decisively reduced some of its traditional LED die bonder business and made every effort to expand the Mini LED die bonder and semiconductor die bonder markets. This forward-looking strategic adjustment is highly in line with the industry trend of increasing Mini LED penetration and explosive growth in demand in the semiconductor market.

Mini LED die bonders: A key business with strong growth momentum

Mini LED die fixation machines are the fastest-growing business segment of Xinyichang. As a leading company in the field of Mini LED die bonders, Xinyichang has significant technological and brand advantages. In 2022, the Mini LED die bonding machine business will account for 20% of total revenue, and by 2024, this proportion is expected to exceed 40%.

Mini LED market penetration continues to rise, which is an important driving force for the growth of Xinyichang's Mini LED die fixer business. As the industry's demand for equipment surges, Xinyichang's Mini LED die bonder business is expected to nearly triple growth. According to experts, Research estimates that COB production capacity has exceeded 50,000 square meters per month, and Mini LED backlights shipments have exceeded 13 million units. In the RGB market, COB will become one of the important trends in industrial development in 2024 and enter the stage of large-scale application. In addition to COB, Mini LED die bonders can also be used in RGB packaging fields such as MIP. In the existing market, the industry continues to promote spacing reduction to open up new market space. The demand for new equipment by enterprises has prompted Mini LED die bonders to accelerate the update and iteration. Whether it is from the perspective of technological innovation or product competition, Mini LED will usher in new development opportunities. Mini LED die bonding machines are sustainable in terms of commercial operations and technology research and development, and are expected to further promote the sales of Xinyichang Mini LED products. growth.

High-end equipment such as semiconductor packaging: potential businesses ready for development

In addition to focusing on the Mini LED business, Xinyichang is also actively deploying high-end equipment fields such as semiconductor packaging. In 2021, Xinyichang Semiconductor's equipment revenue will increase significantly by 890.23% year-on-year, becoming an important turning point in the development of the company.

The market potential for semiconductor packaging equipment is huge. China's 14th Five-Year Plan lists advanced packaging as a key research direction. As the world's largest semiconductor market, China's scale far exceeds that of the LED die bonder market, and there is broad space for domestic substitution. The semiconductor packaging business is expected to become a new profit growth point for Xinyichang. In the field of semiconductor packaging, Xinyichang relies on its accumulated technological advantages in the field of LED die bonders to quickly enter the semiconductor die bonders market. Its products have covered power devices, IGBTs and other packaging application scenarios, and has successfully cooperated with Huawei, Changjiang Electric, Tongfuwei, Huatian, Lite, Infineon, Jiasheng and other leading domestic and foreign companies have established cooperation to achieve product delivery.

In terms of wire bonding machine business, Xinyichang has acquired semiconductor wire bonding technical capabilities by acquiring a 75% stake in Kaijiu Automation. It plans to extend its business to the field of LED wire bonding machines and build a collaborative sales model for" solid crystal + wire bonding" equipment. In 2024, the Xinyichang wire welding machine prototype has entered the trial production verification stage.

Short-term operational flexibility and risk resistance

Building new business growth poles is often accompanied by short-term performance pressures. The contraction of the traditional LED equipment business has put pressure on revenue. The Mini LED die bonder market is not yet fully mature, and it will still take time to increase the volume of semiconductor equipment. Under this circumstance, Xinyichang actively adjusted its business strategies, seized structural market opportunities, and combined its performance data for the first three quarters of 2024 to provide clear insights into its response measures.

R & D investment continues to increase

In the first three quarters of 2024, Xinyichang's research and development expenses reached 66.9694 million yuan, accounting for 8.7% of revenue, an increase of 0.84 percentage points over the same period last year. In the first half of 2024, Xinyichang added 31 new patents and obtained a total of 349 patents and 155 software copyrights. In October 2023, the Xinyichang high-end intelligent equipment manufacturing base project officially started and laid the foundation stone. The total investment of the capital increase and expansion project is 600 million yuan, and the annual output value is expected to exceed 680 million yuan. A semiconductor intelligent equipment manufacturing base and R & D center will be built. In January 2025, the manufacturing base has been successfully capped.

The cash flow situation has improved significantly

In the first three quarters of 2024, Xinyichang's net cash flow from operating activities/operating income ratio increased from negative to positive to 20%. Mainly due to the improved efficiency of accounts receivable collection and the increase in orders for Mini LED and semiconductor equipment, the company's cash flow will remain stable in 2024. Stable cash flow provides strong support for R & D investment and production capacity expansion.

The customer structure is continuously optimized

In the field of Mini LEDs and LED equipment, Xinyichang has established a large and high-quality customer base, including well-known companies such as SAMSUNG, BOE, Konka Optoelectronics, Abison, Zhouming, Lijingwei, Zhaochi Jingxian, Lehman Optoelectronics, Jufei Optoelectronics, Skyworth, San 'an Optoelectronics, Guoxing Optoelectronics, Ruifeng Optoelectronics, and Yiguang Electronics. Extensive customer resources help Xinyichang continue to expand its market influence and enhance brand awareness.

During the short-term market fluctuations, how companies use technological innovation to break through the limit of the stock cycle has become the focus of the industry. By implementing the technology reuse + horizontal expansion strategy, Xinyichang has successfully built a matrix of technology-based products such as Mini LED die bonders and semiconductor die bonders, increasing the proportion of high-end products, and optimizing its business and product structure. Although revenue and profits are under pressure in the short term, business momentum has been transformed. This structural adjustment strategy is highly in line with the industry development trend of growing demand for new generation packaging and rapid penetration of Mini LEDs.

In addition, Xinyichang has laid a solid foundation for corporate development by deeply binding leading customers, continuously improving R & D capabilities, and strengthening intelligent manufacturing capabilities, and meeting the development opportunities and challenges of the new LED display industry and semiconductor industry in the future with a more stable operating system. In the future, Xinyichang is expected to continue to make efforts in the fields of Mini LEDs and semiconductors, setting a new benchmark for the development of the industry.TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Zhouming Technology and Kalette jointly empowered, and the two museums in Shenzhen bloom the beauty

-

Liard has been listed as one of Fortune's top 50 science and technology companies in China, demonstr

-

Hisense Video, Guoxing Optoelectronics, and BOE Varitronix disclose H1 results

-

AUO Optronics 'consolidated revenue in March 2025 was 25.9 billion yuan

-

Lehman Optoelectronics shines in InfoComm China 2025, demonstrating the charm of cutting-edge LED di

-

Liard shines ISLE 2025, leading new changes in LED display technology

-

Zhouming Technology joins hands with Time Coordinates to accelerate the capitalization layout of dig

-

Li Jun, Chairman of Liard Group, helps his hometown's public welfare undertakings and contributes to

-

Abbison at the Osaka World Expo: The cultural narrative of LED display and industry breakthrough

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e