Perspective on the financial reports of 6 LED display companies: Market structure and technological

- author:

- 2025-04-25 14:25:47

Recently, six key companies in the LED display field, including Liard, Vision, Guoxing Optoelectronics, Hongli Zhihui, Xiamen Cinda, and Longli Technology, have successively released their 2024 annual reports or the first quarterly report of 2025, providing an important observation window for the development of the industry.

From the perspective of regional markets, due to weak downstream demand, domestic business achieved direct sales revenue of 2.525 billion yuan and channel revenue of 761 million yuan. The scale and proportion of revenue have changed. The overseas market has become the highlight. With vigorous expansion of overseas markets, revenue has reached 2.788 billion yuan, a year-on-year increase of about 10%, and its proportion in total revenue has increased to 45.64%. Among them, Asia, Africa and Latin America accounted for overseas smart display revenue. The proportion rose to 34%, a year-on-year increase of nearly 40%.

From the perspective of regional markets, due to weak downstream demand, domestic business achieved direct sales revenue of 2.525 billion yuan and channel revenue of 761 million yuan. The scale and proportion of revenue have changed. The overseas market has become the highlight. With vigorous expansion of overseas markets, revenue has reached 2.788 billion yuan, a year-on-year increase of about 10%, and its proportion in total revenue has increased to 45.64%. Among them, Asia, Africa and Latin America accounted for overseas smart display revenue. The proportion rose to 34%, a year-on-year increase of nearly 40%.

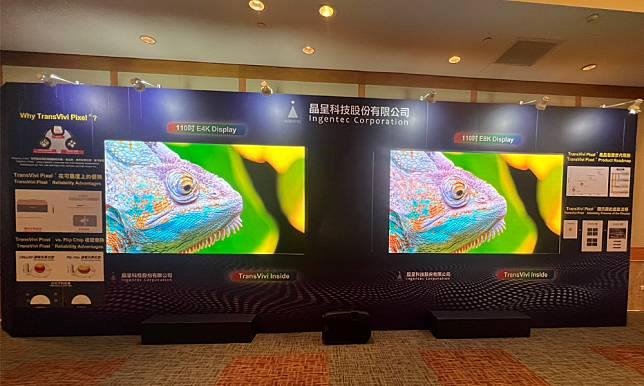

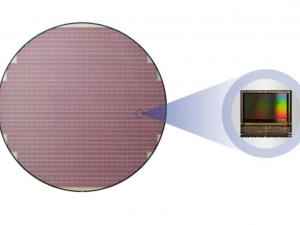

Since listing Micro LED as a strategic product in 2022, Liard has continued to increase investment and achieve results. In 2024, the revenue of Micro LED business will exceed 800 million yuan, and new orders are expected to be between 900 - 1.1 billion yuan. At the same time, the first phase of substrate-less Micro LED production capacity of 1200kk /month has been successfully put into operation, and the second phase of production expansion is also It is progressing steadily and is expected to reach production capacity in the third quarter of 2025. In terms of technical layout, Liard will focus on investing in COB technology research and development in 2024, and will also cooperate with panel companies to promote the research and development of COG Micro LED products.

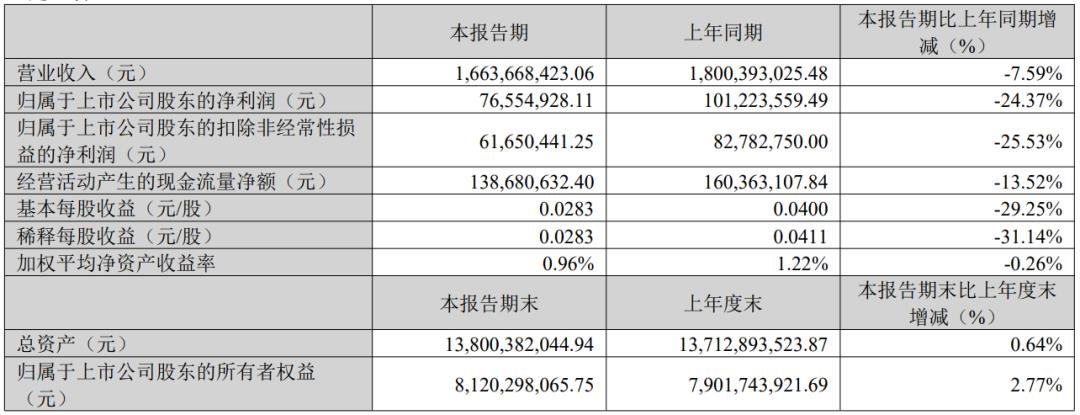

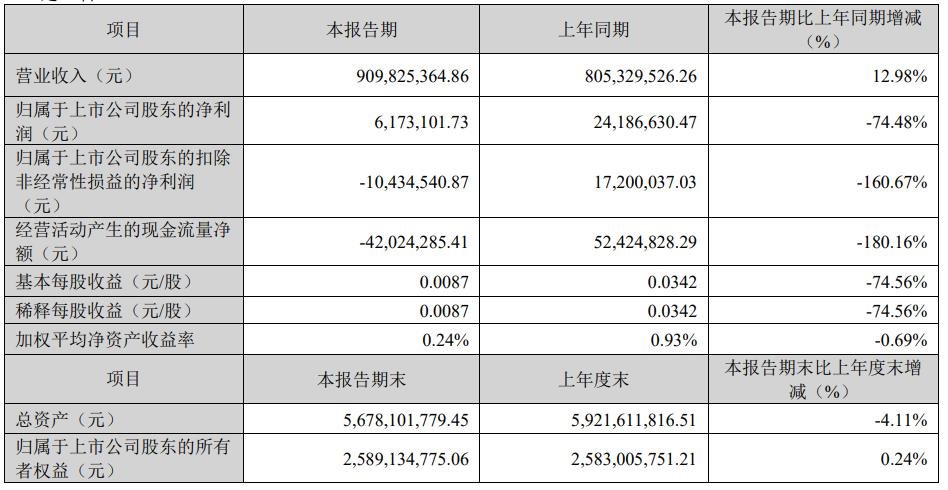

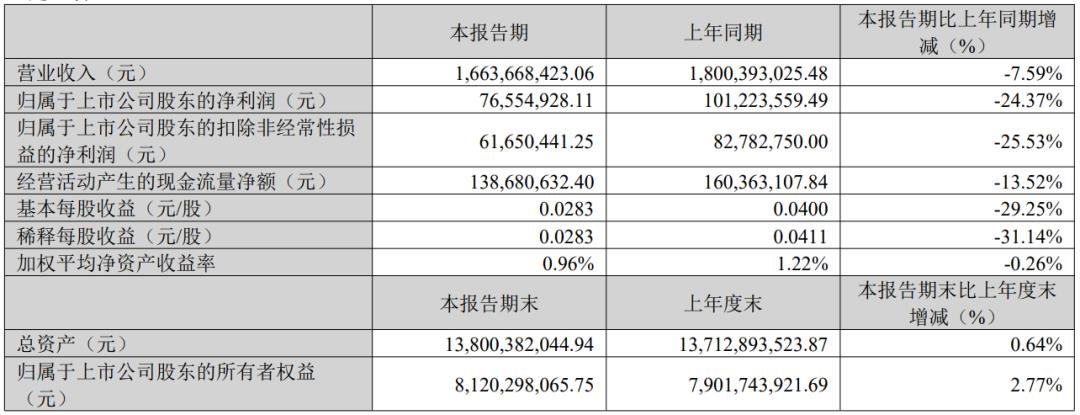

In terms of market expansion, Liard actively promotes the implementation of diversified products. In the field of motion capture, it helps in the production of works such as "Fengshen" trilogy and "Black Myth: Wukong"; in terms of LED movie screens, it has established a joint venture with Huaxia Film to participate in HDR LED version film plate making. As of April 2025, Huanying Island LED Cinema has signed more than 20 projects across the country; in terms of all-in-one machine products, it has launched LED 3D folding all-in-one machines, quantum dot all-in-one machines, etc. At the strategy conference in April 2025, Liard proposed to embrace AI and lead the development strategy of visual effects in the next three years, and released a new generation of Hi-Micro technology and new products. This technology uses a short side less than 30 m substrateless Micro chip, adapted to new display technology, to meet high-end display needs. In the first quarter of 2025, Liard achieved revenue of 1.664 billion yuan, net profit attributable to the parent company of 76.5549 million yuan, and net operating cash flow of 139 million yuan.

Its Qingsong Optoelectronics performed well, with revenue of 566 million yuan, a year-on-year increase of 21.15%, and net profit of 15.3206 million yuan, a year-on-year increase of 166%.

Its Qingsong Optoelectronics performed well, with revenue of 566 million yuan, a year-on-year increase of 21.15%, and net profit of 15.3206 million yuan, a year-on-year increase of 166%.

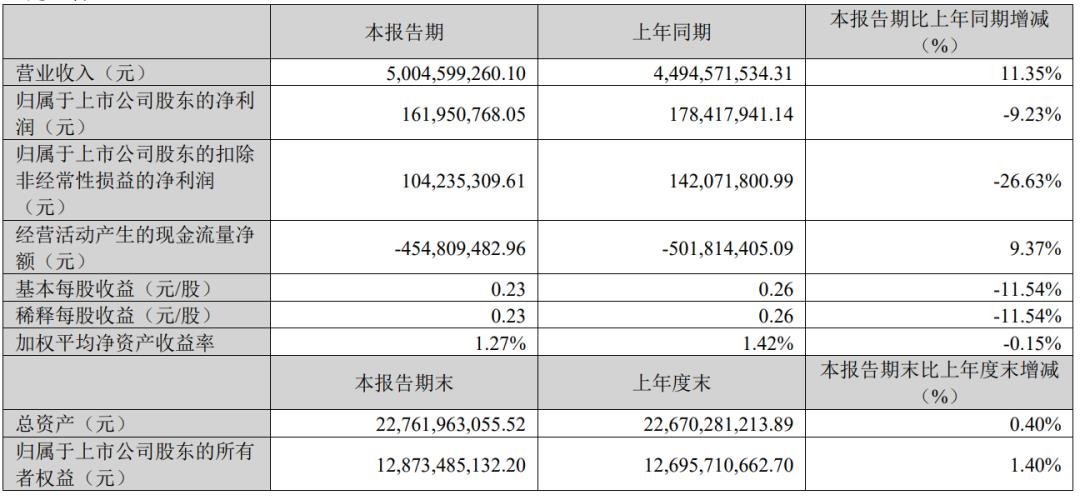

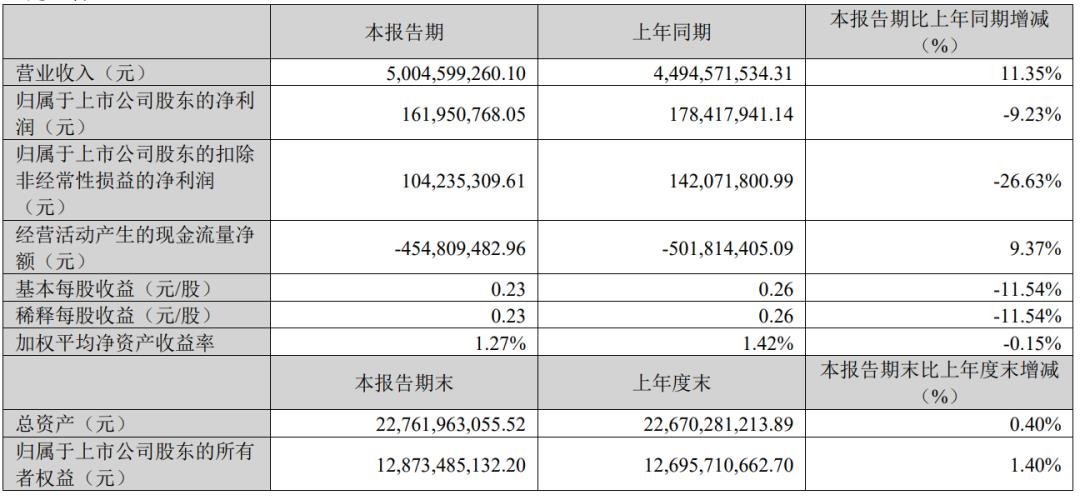

In the LED display business field, Vision's products cover 120 - 299-inch LED all-in-one machines, 135 - 216-inch COB all-in-one machines, indoor and outdoor engineering screens, naked-eye 3D screens, movie screens, etc., and are widely used in various scenarios. Its LED all-in-one machine market share has ranked first in the domestic market for six consecutive years. In terms of interactive display technology, we promote the implementation of global Miniled TV solutions by integrating Local Dimming algorithm and optimizing hardware design and software algorithms. In the first quarter of 2025, Vision Source's total operating income was 5.005 billion yuan, a year-on-year increase of 11.35%. The net profit attributable to the parent company was 162 million yuan, a year-on-year decrease of 9.23%. The net profit deducted was 104 million yuan, a year-on-year decrease of 26.63%.

In the first quarter of the exhibition, Guoxing Optoelectronics focused on displaying MIP innovative application products, such as MIP devices such as MIP-CIMD12 and MIP-AIMD19, as well as series products such as MIP0404 modules and MIP0303 modules and light-drive integrated solutions. At the ISLE exhibition, the MIP large screen created by Guoxing Optoelectronics and Yuanheng Optoelectronics uses independently developed MIP devices and GOB packaging solutions, with a dot spacing of P0.9mm, demonstrating its technical strength.

In the first quarter of the exhibition, Guoxing Optoelectronics focused on displaying MIP innovative application products, such as MIP devices such as MIP-CIMD12 and MIP-AIMD19, as well as series products such as MIP0404 modules and MIP0303 modules and light-drive integrated solutions. At the ISLE exhibition, the MIP large screen created by Guoxing Optoelectronics and Yuanheng Optoelectronics uses independently developed MIP devices and GOB packaging solutions, with a dot spacing of P0.9mm, demonstrating its technical strength.

In terms of product structure, the revenue from the LED semiconductor packaging business was 3.248 billion yuan, accounting for 76.88% of the total revenue, and the gross profit margin was 15.39%; the revenue from the LED automotive lighting business was 809 million yuan, accounting for 19.15% of the total revenue.

In terms of product structure, the revenue from the LED semiconductor packaging business was 3.248 billion yuan, accounting for 76.88% of the total revenue, and the gross profit margin was 15.39%; the revenue from the LED automotive lighting business was 809 million yuan, accounting for 19.15% of the total revenue.

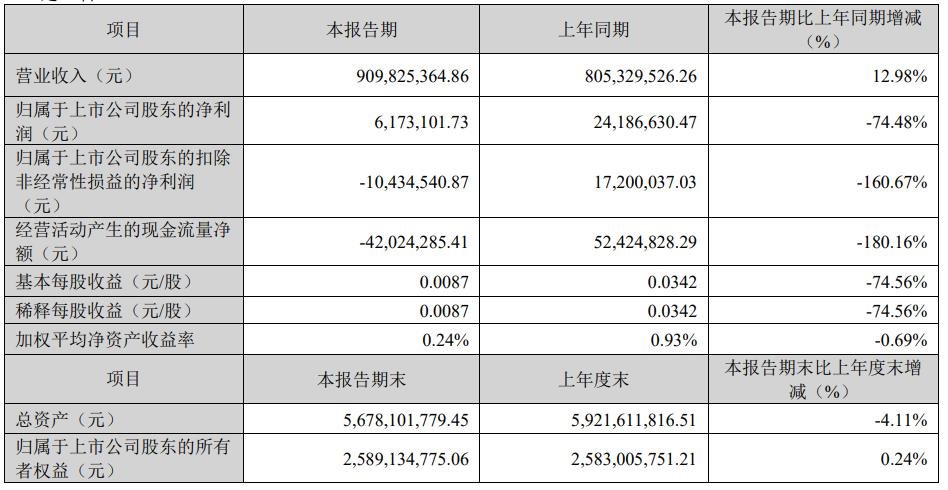

In the field of LED direct display, Hongli Zhihui achieved order growth and mass production breakthroughs for key customers, and the Mini LED display business improved. It launched the Hongyi series of large size module P1.25 products and Hongping P0.78 ultra-small spacing products. In the field of Mini LED backlights, it has consolidated its leading position in VR applications and actively expanded new scenarios. In the automotive field, Hongli Zhihui has launched multiple vehicle-mounted backlight projects. The first vehicle-mounted backlight module has been mass-produced. The vehicle-level LED field is expected to enter the mass production stage in 2025. ADB headlights and Mini LED taillights have also been completed. The production, cooperation with two-wheeled vehicle customers to develop the motorcycle ADB headlight project is expected to be implemented in 2025. In the first quarter of 2025, the company's total operating income was 910 million yuan, a year-on-year increase of 12.98%, and the parent's net profit was 6.1731 million yuan, a year-on-year decrease of 74.48%.

At the 2025 ISLE exhibition, its Cinda Optoelectronics demonstrated indoor XR series, DCI series, outdoor ultra-high-brightness series and four-in-one products, which are widely used in the film and television industry, commercial displays and outdoor scenes. In recent years, Cinda Optoelectronics has focused on market segments and launched a variety of upgrade products to expand application possibilities for different scenarios such as XR virtual shooting, LED movie screens, and LED rental markets.

At the 2025 ISLE exhibition, its Cinda Optoelectronics demonstrated indoor XR series, DCI series, outdoor ultra-high-brightness series and four-in-one products, which are widely used in the film and television industry, commercial displays and outdoor scenes. In recent years, Cinda Optoelectronics has focused on market segments and launched a variety of upgrade products to expand application possibilities for different scenarios such as XR virtual shooting, LED movie screens, and LED rental markets.

Liard: Micro LED strategy has achieved remarkable results, and overseas markets have become growth engines

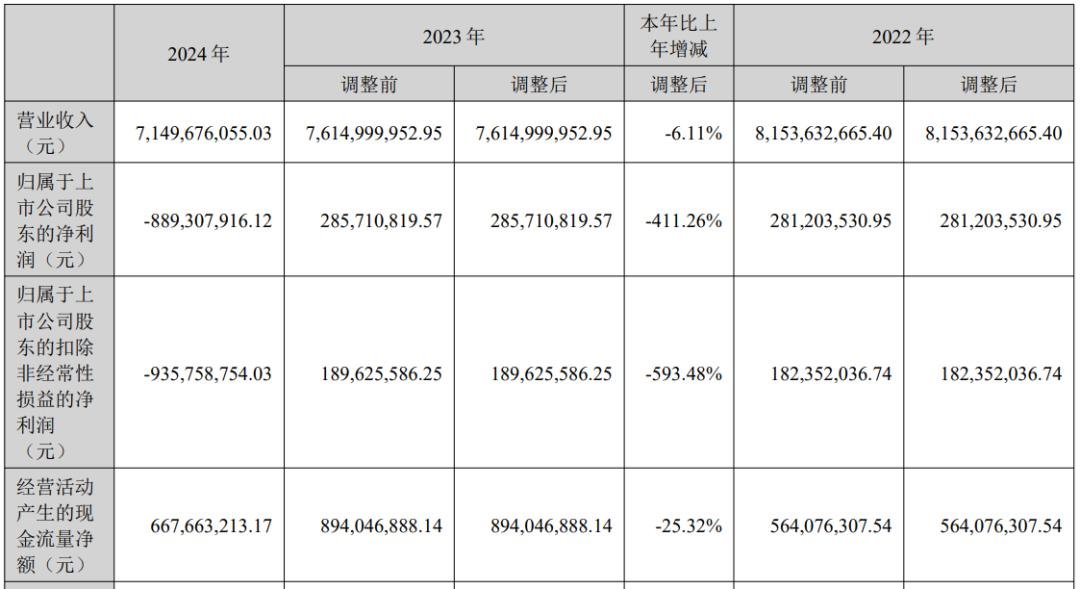

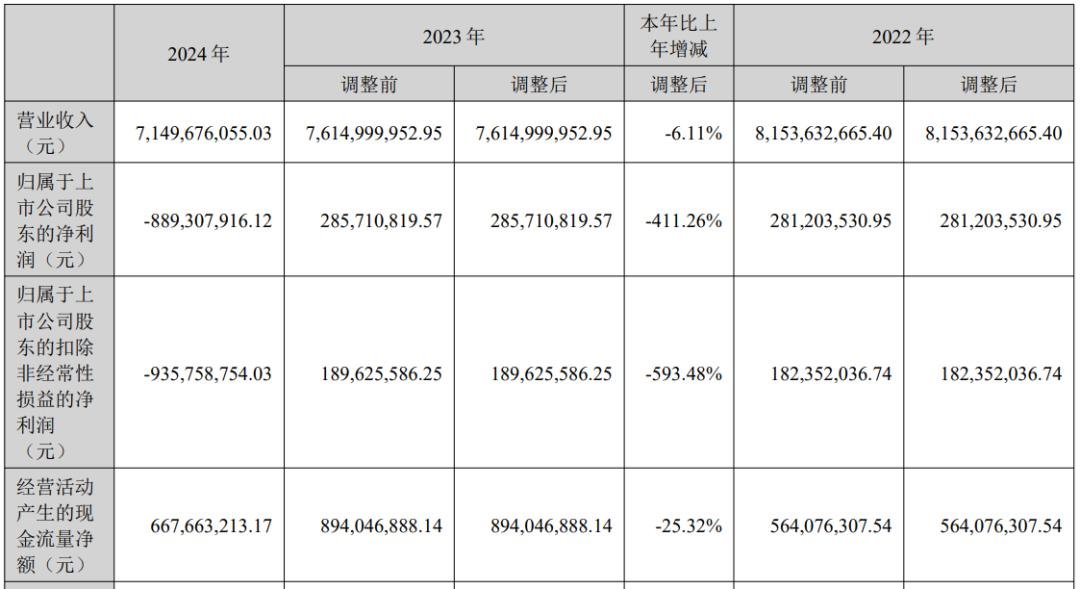

. On April 23, Liard announced its 2024 annual report and its 2025 quarterly report. In 2024, the company's overall revenue will reach 7.150 billion yuan, but the parent's net profit will be-889 million yuan. It is worth noting that net operating cash flow performed well, reaching 668 million yuan, and smart display business revenue was 6.109 billion yuan, accounting for more than 85% of total revenue. From the perspective of regional markets, due to weak downstream demand, domestic business achieved direct sales revenue of 2.525 billion yuan and channel revenue of 761 million yuan. The scale and proportion of revenue have changed. The overseas market has become the highlight. With vigorous expansion of overseas markets, revenue has reached 2.788 billion yuan, a year-on-year increase of about 10%, and its proportion in total revenue has increased to 45.64%. Among them, Asia, Africa and Latin America accounted for overseas smart display revenue. The proportion rose to 34%, a year-on-year increase of nearly 40%.

From the perspective of regional markets, due to weak downstream demand, domestic business achieved direct sales revenue of 2.525 billion yuan and channel revenue of 761 million yuan. The scale and proportion of revenue have changed. The overseas market has become the highlight. With vigorous expansion of overseas markets, revenue has reached 2.788 billion yuan, a year-on-year increase of about 10%, and its proportion in total revenue has increased to 45.64%. Among them, Asia, Africa and Latin America accounted for overseas smart display revenue. The proportion rose to 34%, a year-on-year increase of nearly 40%. Since listing Micro LED as a strategic product in 2022, Liard has continued to increase investment and achieve results. In 2024, the revenue of Micro LED business will exceed 800 million yuan, and new orders are expected to be between 900 - 1.1 billion yuan. At the same time, the first phase of substrate-less Micro LED production capacity of 1200kk /month has been successfully put into operation, and the second phase of production expansion is also It is progressing steadily and is expected to reach production capacity in the third quarter of 2025. In terms of technical layout, Liard will focus on investing in COB technology research and development in 2024, and will also cooperate with panel companies to promote the research and development of COG Micro LED products.

In terms of market expansion, Liard actively promotes the implementation of diversified products. In the field of motion capture, it helps in the production of works such as "Fengshen" trilogy and "Black Myth: Wukong"; in terms of LED movie screens, it has established a joint venture with Huaxia Film to participate in HDR LED version film plate making. As of April 2025, Huanying Island LED Cinema has signed more than 20 projects across the country; in terms of all-in-one machine products, it has launched LED 3D folding all-in-one machines, quantum dot all-in-one machines, etc. At the strategy conference in April 2025, Liard proposed to embrace AI and lead the development strategy of visual effects in the next three years, and released a new generation of Hi-Micro technology and new products. This technology uses a short side less than 30 m substrateless Micro chip, adapted to new display technology, to meet high-end display needs. In the first quarter of 2025, Liard achieved revenue of 1.664 billion yuan, net profit attributable to the parent company of 76.5549 million yuan, and net operating cash flow of 139 million yuan.

Vision: Revenue growth and profit decline coexist, and the advantages of LED all-in-one machines are solid

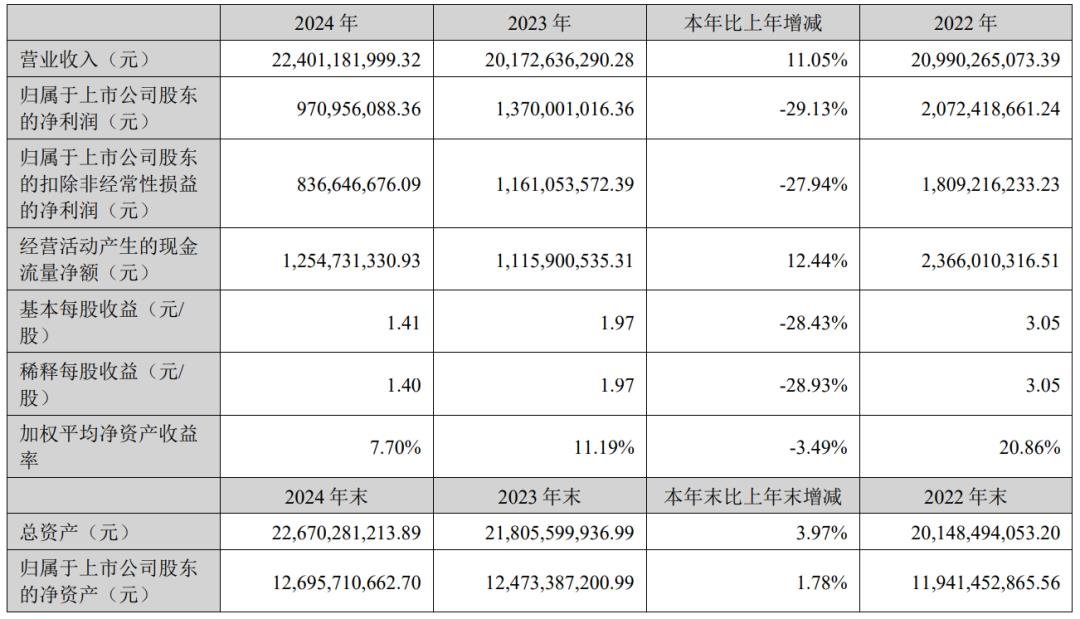

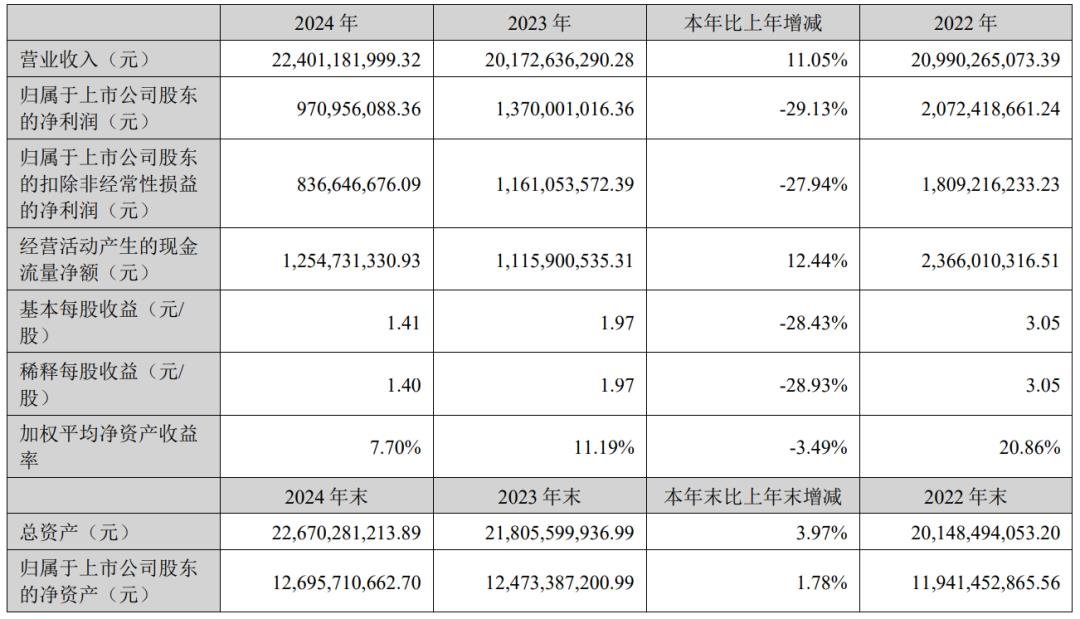

. Vision's 2024 annual report and 2025 quarterly report released show that the company's operating income in 2024 reached 22.401 billion yuan, a year-on-year increase of 11.05%, but the net profit attributable to the parent company was 971 million yuan, a year-on-year decrease of 29.13%, and non-net profit was 837 million yuan, a year-on-year decrease of 27.94%. Its Qingsong Optoelectronics performed well, with revenue of 566 million yuan, a year-on-year increase of 21.15%, and net profit of 15.3206 million yuan, a year-on-year increase of 166%.

Its Qingsong Optoelectronics performed well, with revenue of 566 million yuan, a year-on-year increase of 21.15%, and net profit of 15.3206 million yuan, a year-on-year increase of 166%. In the LED display business field, Vision's products cover 120 - 299-inch LED all-in-one machines, 135 - 216-inch COB all-in-one machines, indoor and outdoor engineering screens, naked-eye 3D screens, movie screens, etc., and are widely used in various scenarios. Its LED all-in-one machine market share has ranked first in the domestic market for six consecutive years. In terms of interactive display technology, we promote the implementation of global Miniled TV solutions by integrating Local Dimming algorithm and optimizing hardware design and software algorithms. In the first quarter of 2025, Vision Source's total operating income was 5.005 billion yuan, a year-on-year increase of 11.35%. The net profit attributable to the parent company was 162 million yuan, a year-on-year decrease of 9.23%. The net profit deducted was 104 million yuan, a year-on-year decrease of 26.63%.

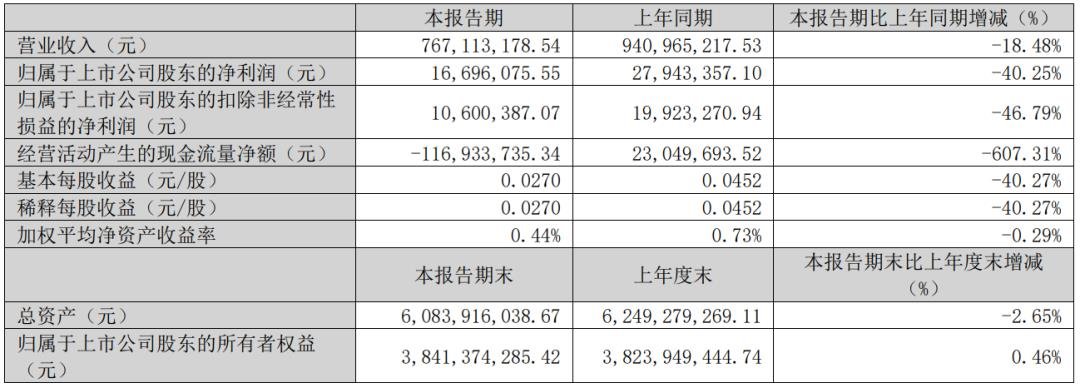

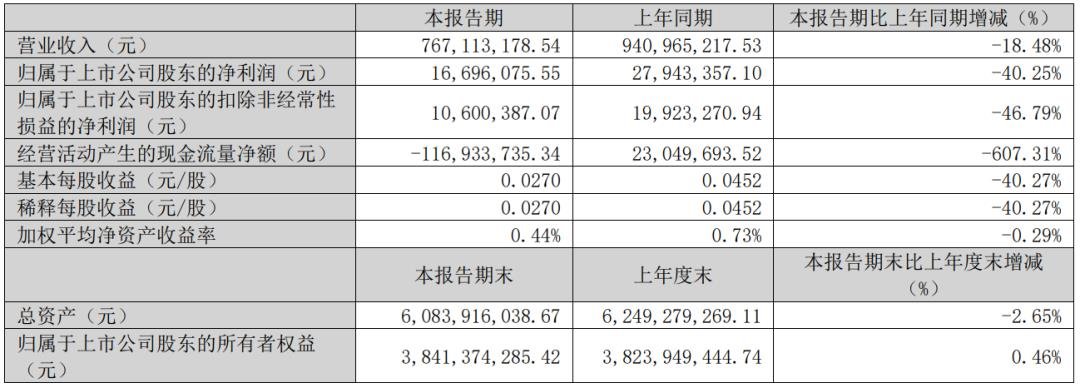

Guoxing Optoelectronics: Revenue fell in the first quarter. MIP technology became the focus of display.

Guoxing Optoelectronics 'report for the first quarter of 2025 showed that operating income was 767 million yuan, a year-on-year decrease of 18.48%, and net profit attributable to the parent company was 16.6961 million yuan, a year-on-year decrease of 40.25%. In the first quarter of the exhibition, Guoxing Optoelectronics focused on displaying MIP innovative application products, such as MIP devices such as MIP-CIMD12 and MIP-AIMD19, as well as series products such as MIP0404 modules and MIP0303 modules and light-drive integrated solutions. At the ISLE exhibition, the MIP large screen created by Guoxing Optoelectronics and Yuanheng Optoelectronics uses independently developed MIP devices and GOB packaging solutions, with a dot spacing of P0.9mm, demonstrating its technical strength.

In the first quarter of the exhibition, Guoxing Optoelectronics focused on displaying MIP innovative application products, such as MIP devices such as MIP-CIMD12 and MIP-AIMD19, as well as series products such as MIP0404 modules and MIP0303 modules and light-drive integrated solutions. At the ISLE exhibition, the MIP large screen created by Guoxing Optoelectronics and Yuanheng Optoelectronics uses independently developed MIP devices and GOB packaging solutions, with a dot spacing of P0.9mm, demonstrating its technical strength.

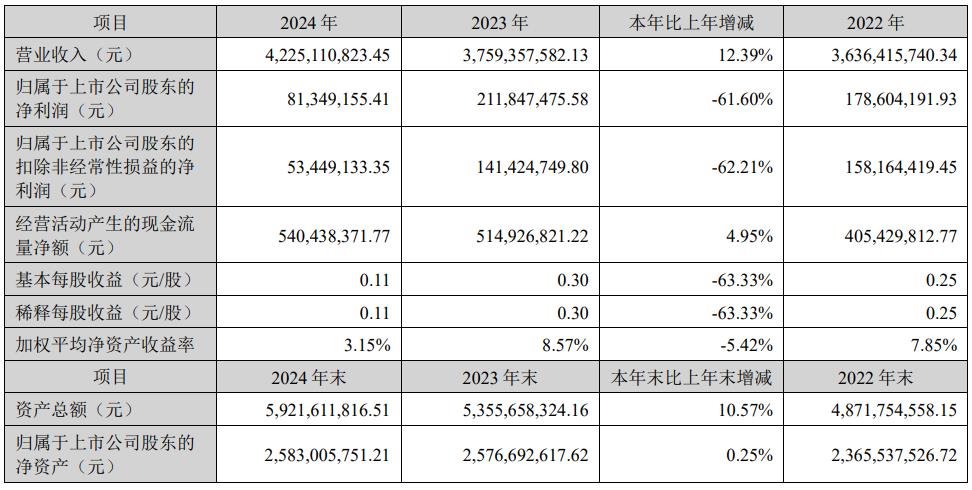

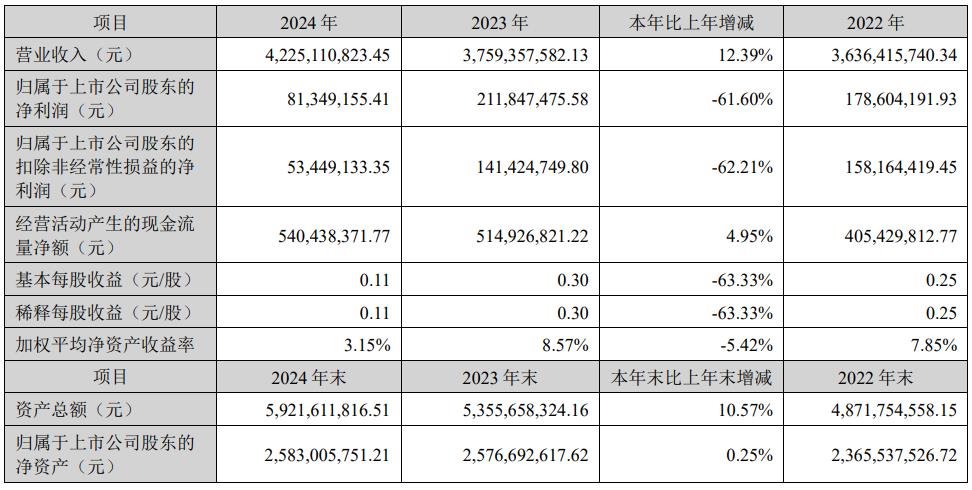

Hongli Zhihui: Expanding in multiple fields, the vehicle specification market is expected to exceed

Hongli Zhihui's 2024 annual report and 2025 quarterly report show that the company's operating income in 2024 will be 4.225 billion yuan, a year-on-year increase of 12.39%, but the net profit attributable to the parent company will be 81.3492 million yuan, a year-on-year decrease of 61.60%, and non-net profit will be 53.4491 million yuan, a year-on-year decrease of 62.21%. In terms of product structure, the revenue from the LED semiconductor packaging business was 3.248 billion yuan, accounting for 76.88% of the total revenue, and the gross profit margin was 15.39%; the revenue from the LED automotive lighting business was 809 million yuan, accounting for 19.15% of the total revenue.

In terms of product structure, the revenue from the LED semiconductor packaging business was 3.248 billion yuan, accounting for 76.88% of the total revenue, and the gross profit margin was 15.39%; the revenue from the LED automotive lighting business was 809 million yuan, accounting for 19.15% of the total revenue. In the field of LED direct display, Hongli Zhihui achieved order growth and mass production breakthroughs for key customers, and the Mini LED display business improved. It launched the Hongyi series of large size module P1.25 products and Hongping P0.78 ultra-small spacing products. In the field of Mini LED backlights, it has consolidated its leading position in VR applications and actively expanded new scenarios. In the automotive field, Hongli Zhihui has launched multiple vehicle-mounted backlight projects. The first vehicle-mounted backlight module has been mass-produced. The vehicle-level LED field is expected to enter the mass production stage in 2025. ADB headlights and Mini LED taillights have also been completed. The production, cooperation with two-wheeled vehicle customers to develop the motorcycle ADB headlight project is expected to be implemented in 2025. In the first quarter of 2025, the company's total operating income was 910 million yuan, a year-on-year increase of 12.98%, and the parent's net profit was 6.1731 million yuan, a year-on-year decrease of 74.48%.

Xiamen Cinda: Revenue declined but profits increased. Focusing on market segments,

Xiamen Cinda's first quarter 2025 report showed that revenue was approximately 7.011 billion yuan, a year-on-year decrease of 45.58%, and net profit attributable to the parent company was 8.0567 million yuan, a year-on-year increase of 611.78%, deducting non-net profit loss of 46.6997 million yuan, a year-on-year decrease of 57.73%. At the 2025 ISLE exhibition, its Cinda Optoelectronics demonstrated indoor XR series, DCI series, outdoor ultra-high-brightness series and four-in-one products, which are widely used in the film and television industry, commercial displays and outdoor scenes. In recent years, Cinda Optoelectronics has focused on market segments and launched a variety of upgrade products to expand application possibilities for different scenarios such as XR virtual shooting, LED movie screens, and LED rental markets.

At the 2025 ISLE exhibition, its Cinda Optoelectronics demonstrated indoor XR series, DCI series, outdoor ultra-high-brightness series and four-in-one products, which are widely used in the film and television industry, commercial displays and outdoor scenes. In recent years, Cinda Optoelectronics has focused on market segments and launched a variety of upgrade products to expand application possibilities for different scenarios such as XR virtual shooting, LED movie screens, and LED rental markets.

Longli Technology: Both revenue and profit have increased, and the results of diversified layout have emerged.

On April 23, Longli Technology announced its 2024 annual report and the 2025 first quarterly report. In 2024, the company's total operating income will be 1.320 billion yuan, a year-on-year increase of 28.64%, and the attributable net profit will be 106 million yuan, a year-on-year increaseTAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Lehman Optoelectronics shines with LED China, and the full-scene ecological layout demonstrates its

-

The display industry has two hot days: The reshaping of the global landscape behind the surge in TCL

-

TCL Huaxing takes over LGD Guangzhou factory and opens up a new pattern for the display industry

-

Lehman Optoelectronics LED screen lights up Johannesburg, South Africa!

-

Development of LED rental screen market and rise of black light products

-

Lehman enjoys the Shining Hong Kong Spring Lantern Show to showcase the achievements of green smart

-

MicroLED C SEED N1 TVs on display at CEDIA Expo 2024 in Denver, Colorado: Seamless integration of lu

-

AI glasses are in full swing, and giants are competing to enter the game to seize the new track

-

BOE MLED shines in ISE 2025, leading new changes in display technology

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e