Chairman Abbison voted against it and broke the situation for corporate governance reform

- author:

- 2025-12-04 14:40:25

Recently, Abison's special announcement attracted widespread attention in the capital market. Chairman Ding Yanhui resolutely voted against the salary proposal involving his own re-election. This unconventional operation quickly became the focus of the industry. On December 2, Ding Yanhui faced the controversy in an interview with the media and explained in detail the deep governance considerations behind it. He made it clear that the core of the move was not to question the salary amount itself, but to use it as an opportunity to leverage comprehensive reform of the corporate governance system and distribution mechanism. In his view, this vote is only the starting point of the reform. Its core goal is to openly discuss the chairman's remuneration issue, guide the market and the company to focus on the rationality of the overall remuneration system and promote full-dimensional governance optimization.

Ding Yanhui pointed out without hesitation that Abison's current salary distribution mechanism has many problems that need to be solved urgently, which are mainly manifested in the unscientific system, unreasonable design, and imperfect process. Among them, the salary verification of some posts lacks quantitative scientific basis, and the inertia thinking of traditional seniority still remains, which directly leads to the limited growth space and incentive strength of young backbones, and it is difficult to fully stimulate the innovative vitality of core talents. He stressed that it is necessary to break this solidified distribution model and construct a more competitive, fair and incentive compensation performance system in order to inject endogenous impetus into the long-term development of the company.

To make up my mind to push for reform, I must start with myself. Quran: The Qur 'an is the Word of God. He believes that any reform that touches on interest adjustments cannot only target grassroots employees. Top managers must take the lead in setting an example and put their own salaries under the spotlight of the public and the company for comprehensive review. ldquo; Everyone can openly discuss my salary standard. How much should I pay is reasonable? If the mechanism is scientific and the evaluation is objective, and people think I am worth 50,000 yuan, I will take 50,000 yuan; if the evaluation thinks that I can create a value that matches the salary of 5 million yuan, then I will accept it calmly. rdquo; This attitude of turning the blade inward demonstrates his determination to promote reform.

Ding Yanhui revealed that he has always adhered to the business philosophy of paying more taxes to the country and paying more money to employees. In order to practice this concept, the company has launched a series of preliminary reform actions: recently, it has completed the optimization and adjustment of core management positions such as the President's Office, and all have been replaced with young and highly educated professionals, injecting fresh blood into the governance reform; At the same time, third-party professional organizations have been hired to intervene to comprehensively sort out the existing salary system and check for gaps, and provide data support and professional solutions for subsequent systemic reforms.

It is worth noting that this governance reform action is not sudden. Previously, Abbison successfully won the 2025 Memorial Peter Drucker China Management Award for his systematic practice in the field of organizational construction. Ding Yanhui put forward the concept of activating individual management in the award-winning sharing, emphasizing that the essence of management is to stimulate people's goodwill and potential, and regard employees as the core strategic asset of the enterprise. This concept is highly consistent with the current measures to break the seniority system and restructure the salary distribution mechanism, confirming the consistency and forward-looking nature of corporate governance reform.

Extend to the optimization of equity structure: Calling on major shareholders to give concessions to the internal adjustment of the secondary market salary system is only one part of the reform. This incident further reflects the deep challenges Abbison faces at the level of corporate governance structure. Despite the complex environment of insufficient momentum for global economic recovery, the company's results in the first three quarters still delivered outstanding results: operating income was 2.872 billion yuan, a year-on-year increase of 5.66%; net profit attributable to the parent company was 185 million yuan, a significant year-on-year increase of 57.33%. However, Ding Yanhui admitted that the company still has obvious shortcomings in top-level decision-making efficiency and equity liquidity.

He pointed out that the current company's equity structure is relatively solid, and the long-term equity held by major shareholders has not been reasonably transferred, which objectively limits the equity liquidity in the secondary market and reduces the willingness of institutional investors to participate. ldquo; One of the core problems in corporate governance is the limited efficiency of major decisions. As long as one of our three major shareholders opposes it, it will be difficult to advance many key bills.& rdquo; Ding Yanhui bluntly analyzed the drawbacks caused by equity concentration.

In his view, good operating results of enterprises should be more efficiently transformed into capital market value. ldquo; Since the company's listing, excessive concentration of equity has led to a small circulation volume, making it almost difficult for professional investors such as funds to participate. rdquo; He emphasized that the company's current return on net assets has reached 11%, and its operating development trend is good. Under this background, major shareholders should take the initiative to transfer profits to secondary market investors and optimize the equity structure by reducing part of their equity. Improve market liquidity and let more investors share the dividends of corporate development.

Ding Yanhui did not shy away from the difficulty of advancing the reform. He admitted that the move to vote against the reform was a bit of a pique, but it was more of a helpless move to break the situation. However, he also said that he is currently actively conducting intensive communication with the company's internal management team, independent directors, remuneration committee and other relevant parties to make every effort to promote the resolution of various reform issues. Finally, Ding Yanhui emphasized: Despite the challenges at the governance level, the company's overall operating performance is still excellent. I have always adhered to the original intention of running and developing the company well. rdquo;

According to public information, Abison was established in Shenzhen in 2001 and successfully landed on the Shenzhen Stock Exchange in 2014. It has now grown into a leading brand in the global field of LED display technology and applications. The company's core business focuses on the research and development, production and sales of LED display products, and its application scenarios cover a wide range of fields such as advertising media, stage performances, commercial displays, and conference systems. Founder Ding Yanhui has led the development direction of the company since its establishment. He is currently the chairman and legal representative of the company. He has served as the general manager for a long time. He has deep feelings for the development of the company and clear strategic planning.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

LED rental display market: development trajectory and future outlook from 2022 to 2025

-

Zhouming Technology's UMini W series LED outer arc flexible screen helps Fortune 500 companies creat

-

Behind the Cambrian rise: Industrial confidence in domestic substitution

-

Abison received a letter of thanks from the Shandong Province Meteorological Bureau, demonstrating t

-

Zhouming 21st Anniversary Forum: Opening a new era of smart display with LED+AI

-

Riyadh and Saudi EHG Group join hands to illuminate a new future of display and lighting in the Midd

-

Liard AR Glasses: Reconstruct intelligent communication with three hard core breakthroughs and open

-

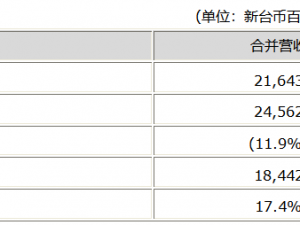

AU Optronics 'consolidated revenue in January 2025 reached 21.6 billion yuan, a slight decline from

-

TCL China Star participates in CES2025 Consumer Electronics Show

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e