TCL Technology added 6.045 billion yuan to its core assets, and its controlling proportion in Shenzh

- author:

- 2025-12-18 10:26:21

TCL Technology (000100.SZ) announced today that it plans to acquire a 10.7656% stake in its controlling subsidiary Shenzhen Huaxing Optoelectronics Semiconductor Display Technology Co., Ltd.(hereinafter referred to as Shenzhen Huaxing Semiconductor) for 6.045 billion yuan in cash. After the completion of this transaction, TCL Technology's total shareholding in Shenzhen CSOT will increase significantly from 84.2105% to 94.9761%. According to analysis, this measure will effectively increase the company's profitability and further consolidate its core competitiveness in the semiconductor display field.

This equity acquisition is regarded as a key strategic layout for TCL Technology to firmly focus on its main semiconductor display business and optimize its asset structure. By strengthening its control over its core subsidiaries, TCL Technology will further consolidate its leading position in the global size display field, especially enhance its strategic leadership over high-generation panel production lines, thereby more fully grasping the industry's upcoming recovery and growth opportunities, injecting strong impetus into subsequent performance growth.

Lock in high-generation scarce production lines and strengthen the core competitiveness of its main business. Public information shows that Shenzhen Huaxing Semiconductor is a global leader in the semiconductor display field, with its core assets being two G11-generation high-generation panel production lines, TCL Huaxing t6 and t7 production lines. These two production lines mainly focus on the production of ultra-large size display products such as 65-inch, 75-inch, 85-inch and 98-inch, and have significant scarcity advantages in the global market. At present, there are only 5 high-generation production lines of G10.5 and above worldwide, and TCL Huaxing's t6 and t7 production lines account for two seats, demonstrating strong industry barriers.

It is worth noting that these two high-generation production lines not only have the world's leading cutting efficiency, but also through in-depth collaborative cooperation with leading brand customers, they continue to maintain technological leadership in ultra-high definition (4K/8K) displays, Mini LED backlights, and high refresh rates. As the core force in promoting the large-screen and high-end upgrade of global TVs, the stable production capacity and high-end product layout of t6 and t7 production lines have become the core moat of TCL Technology in the competition in the display industry. After the completion of this acquisition, TCL Technology will more fully integrate core production line resources, further amplify the competitive advantages of its main business, and consolidate its leading position in the industry.

The profitability of underlying assets continues to strengthen and the debt structure is significantly optimized. Financial data disclosed in the announcement shows that Shenzhen Huaxing Semiconductor has performed steadily in recent years and its profitability has continued to improve. As of December 31, 2024, the company's total assets reached 68.040 billion yuan and net assets were 44.850 billion yuan; in 2024, it achieved operating income of 24.158 billion yuan and net profit of 2.807 billion yuan. Entering 2025, its operating quality will be further optimized. As of June 30, total assets were 64.769 billion yuan, and net assets increased to 46.564 billion yuan; in the first half of 2025, it achieved operating income of 12.023 billion yuan and net profit of 1.709 billion yuan.

By comparison, it can be seen that in just half a year, Shenzhen Huaxing Semiconductor's debt scale has decreased by nearly 5 billion yuan, its asset-liability ratio has dropped below 30%, and its financial structure has become healthier; at the same time, the company's net profit margin has increased steadily from 11.6% in 2024 to 14% in the first half of 2025, and profitability continues to increase. As TCL Technology increases its controlling ratio to a high of approximately 95%, the profits of the underlying assets will be more fully included in the consolidated statements of the listed company, directly increasing the level of profits attributable to shareholders of the parent company. Against the backdrop of the current balance between supply and demand in the panel industry and the stabilization and recovery of mainstream product prices, this increase in controlling stake will significantly amplify TCL Technology's performance flexibility in this round of industry cycle, enabling it to seize market recovery opportunities at a more unified strategic pace.

Multiple positive factors are superimposed, and the panel market has burst into a new cycle in response to demand. At the end of 2025, the TV panel market has gradually entered the peak season for stocking. Looking forward to 2026, the global display industry is expected to usher in new opportunities for demand explosion. Multiple positive factors will provide panel companies with solid demand support.

On the one hand, 2026, as a global sports year, will become an important engine driving the growth of display demand. The most eye-catching event is the World Cup, co-hosted by the United States, Canada and Mexico. The event will open in June. It is understood that the number of participating teams in this World Cup will be expanded to 48, the number of games will increase to 104, and the race schedule will last for 40 days. It is expected to become the largest World Cup in history and the longest viewing cycle. FIFA expects that global viewers will exceed 5 billion. This phenomenal event will greatly stimulate the purchase demand for large-screen and high-definition TVs in homes and public places. In addition, the upcoming Winter Olympics in Milan and Cortina, as well as the intensive Intercontinental Cup, Tennis Grand Slam, NBA playoffs and other events throughout the year, will form a sustained demand-driven drive and further boost the display equipment market. The boom will especially drive the upgrading of audio-visual equipment in mature markets such as North America and Europe.

On the other hand, the continuation of domestic consumption-promoting policies will inject a boost into the market. The Central Economic Work Conference has clearly deployed that two new policies will continue to be implemented and optimized in 2026, namely, a new round of trade-in actions for consumer goods. This means that the national subsidy policy for home appliances fully implemented in 2025 will be continued and the market will be launched in a more precise way. Public data shows that from January to November 2025, the national subsidy policy has driven sales of related commodities to exceed 2.5 trillion yuan, benefiting more than 360 million people, effectively activating the renewal potential of the existing market. The continued efforts of policies in 2026 are expected to further stimulate consumption willingness, especially to significantly boost home appliances such as ultra-large size high-end TVs with higher unit prices, and build a solid demand base for panel manufacturers.

Driven by multiple positive factors, the demand side of the panel market has shown positive signals. TrendForce Consulting data shows that in December 2025, the prices of mainstream size TV panels generally stopped falling and stabilized. Among them, the prices of the full range of panels from 32 to 65 inches tended to be flat, and some non-strategic orders even showed a slight increase of US$1 -2 per piece. The market price increase atmosphere has taken shape.

Looking forward to the future, as panel prices stabilize and rebound, the trend of large size continues to deepen, and the proportion of high-end products continues to increase, TCL Technology is expected to rely on Shenzhen Caxing Semiconductor's strong competitive advantages and the performance thickening effect brought by its high proportion of shareholding to be in the industry. In the upward cycle, fully enjoy market dividends and release performance growth potential, shareholders of listed companies will also better share Shenzhen Caxing Semiconductor's operating results and economic benefits.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Nova Nebula, Abison, BOE, and Lianjian Optoelectronics have their own highlights and challenges in i

-

Viktor and Noros Technology: Light up ultra-bright Micro LED chips and accelerate the new journey of

-

Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

-

Jiangxi Zhaochi Semiconductor: An innovative pioneer in the semiconductor field

-

Abbison shines at the 2025 ISLE exhibition, leading the innovative experience of LED display

-

The Minister of National Education of Senegal led a delegation to visit the Central Academy of Drama

-

Interpretation of San 'an Optoelectronics' 2024 Annual Report and 2025 First Quarterly Report

-

Riyadh and Saudi EHG Group join hands to illuminate a new future of display and lighting in the Midd

-

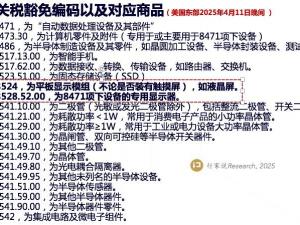

The United States adjusts its tariff policy, showing that trade frictions on related products have e

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e