Nova Nebula, Abison, BOE, and Lianjian Optoelectronics have their own highlights and challenges in i

- author:

- 2025-04-22 09:35:10

Recently, well-known companies in the industries such as Nova Nebula, Abison, BOE, and lianjian Optoelectronics have issued performance-related announcements, demonstrating the diverse development trend of the LED and display industry.

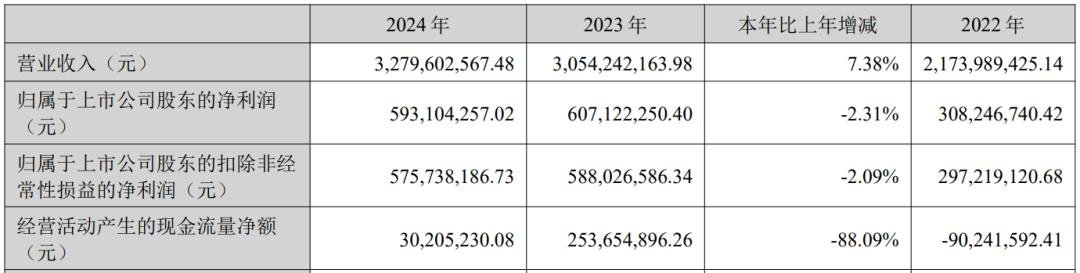

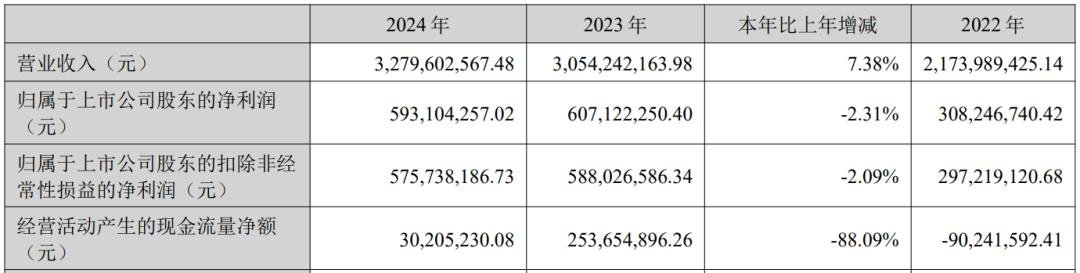

Nova Nebula released its 2024 annual report and the first quarter report for 2025 on April 18. In 2024, the company achieved operating income of 3.28 billion yuan, a year-on-year increase of 7.38%. In terms of market distribution, domestic market revenue was 2.653 billion yuan, a year-on-year increase of 2.85%; overseas markets performed well, with revenue reaching 626 million yuan, a year-on-year increase of 32.03%. In the product segment, revenue from LED display control systems was 1.514 billion yuan, a year-on-year increase of 5.02%; revenue from Media Processing Service systems was 1.343 billion yuan, a year-on-year increase of 5.30%; revenue from cloud-based information release and management systems was 198 million yuan, a year-on-year increase of 24.64%. However, operating profit and net profit attributable to the parent decreased by 2.31% compared with the same period last year.

Nova Nebula pointed out that the performance change is mainly due to the external macro environment bringing challenges to the domestic market, while the overseas market growth is strong. At the same time, the company's early layout in the MLED field has achieved results, the relevant income has grown rapidly, and the expansion of downstream high value-added fields has also improved the gross profit. Entering the first quarter of 2025, Nova Nebula's performance declined, with revenue of 621 million yuan, down 8.83% year-on-year; net profit attributable to the parent was 102 million yuan, down 16.54% year-on-year; and non-net profit attributable to the parent was 97.838 million yuan, down 16.01% year-on-year.

Nova Nebula pointed out that the performance change is mainly due to the external macro environment bringing challenges to the domestic market, while the overseas market growth is strong. At the same time, the company's early layout in the MLED field has achieved results, the relevant income has grown rapidly, and the expansion of downstream high value-added fields has also improved the gross profit. Entering the first quarter of 2025, Nova Nebula's performance declined, with revenue of 621 million yuan, down 8.83% year-on-year; net profit attributable to the parent was 102 million yuan, down 16.54% year-on-year; and non-net profit attributable to the parent was 97.838 million yuan, down 16.01% year-on-year.

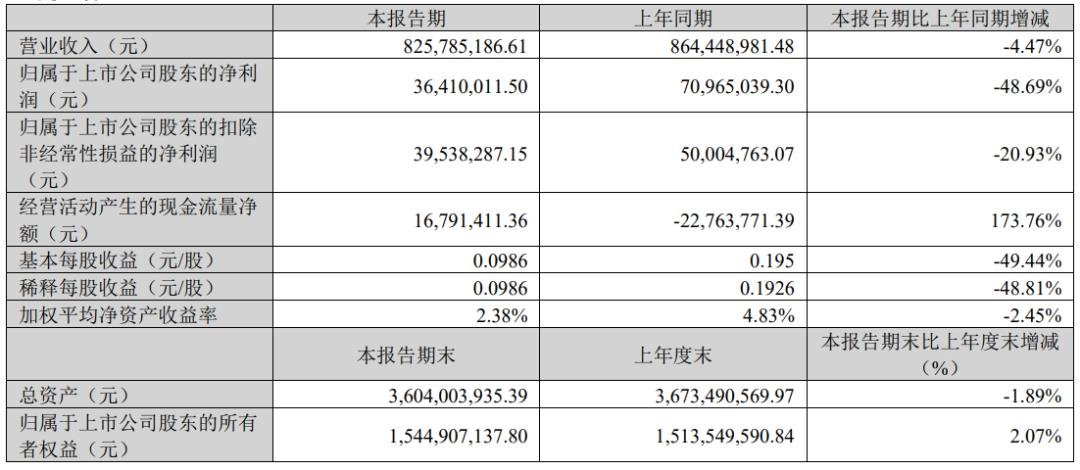

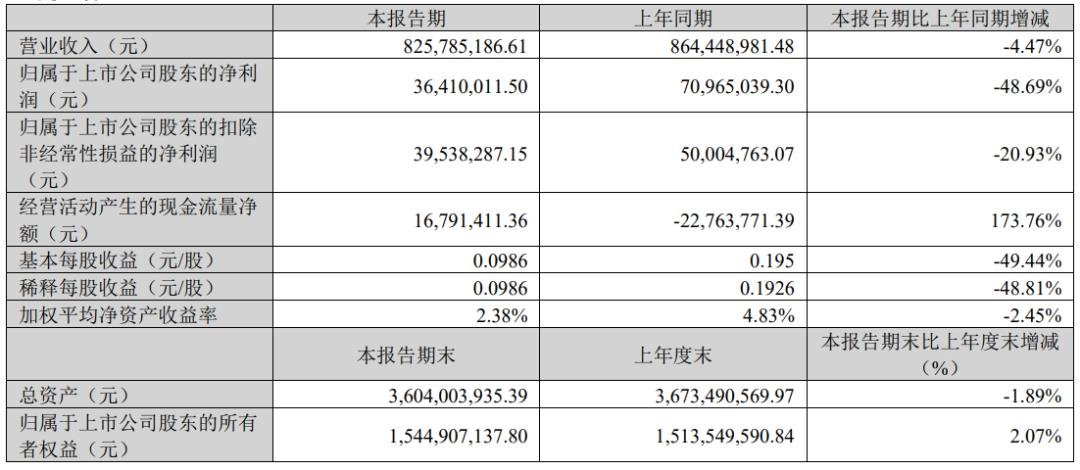

Also on April 18, Abison released its first quarter report for 2025, and its performance showed a downward trend. During the reporting period, the company achieved revenue of 826 million yuan, a year-on-year decrease of 4.47%; net profit attributable to the parent company was 36 million yuan, a year-on-year decrease of 48.69%; and non-net profit attributable to the parent company was 40 million yuan, a year-on-year decrease of 20.93%.

The announcement shows that the decline in net profit attributable to parent shareholders was mainly due to comprehensive factors such as increased provision for impairment of accounts receivable during the reporting period, increased fair value losses on securities investments and reduced government subsidies. As a leading company exporting overseas, Abison has also responded to the tariff policy. The company's product sales revenue exported to the United States in 2024 will account for about 15% of its annual sales revenue. It is expected to remain flat or decrease slightly this year. The company's overseas market covers a wide range of 140 countries. Abbison believes that the United States 'increased tariffs will have limited long-term impact on its overall business, and will reduce the impact through measures such as price increases and optimization of production processes.

The announcement shows that the decline in net profit attributable to parent shareholders was mainly due to comprehensive factors such as increased provision for impairment of accounts receivable during the reporting period, increased fair value losses on securities investments and reduced government subsidies. As a leading company exporting overseas, Abison has also responded to the tariff policy. The company's product sales revenue exported to the United States in 2024 will account for about 15% of its annual sales revenue. It is expected to remain flat or decrease slightly this year. The company's overseas market covers a wide range of 140 countries. Abbison believes that the United States 'increased tariffs will have limited long-term impact on its overall business, and will reduce the impact through measures such as price increases and optimization of production processes.

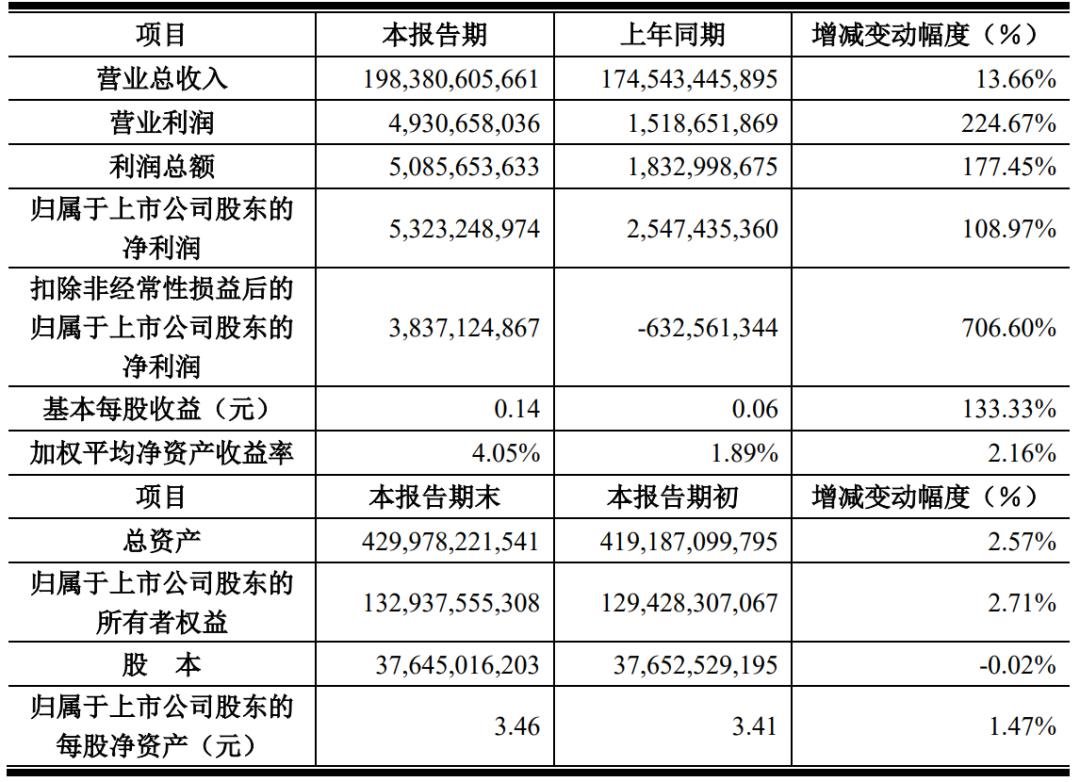

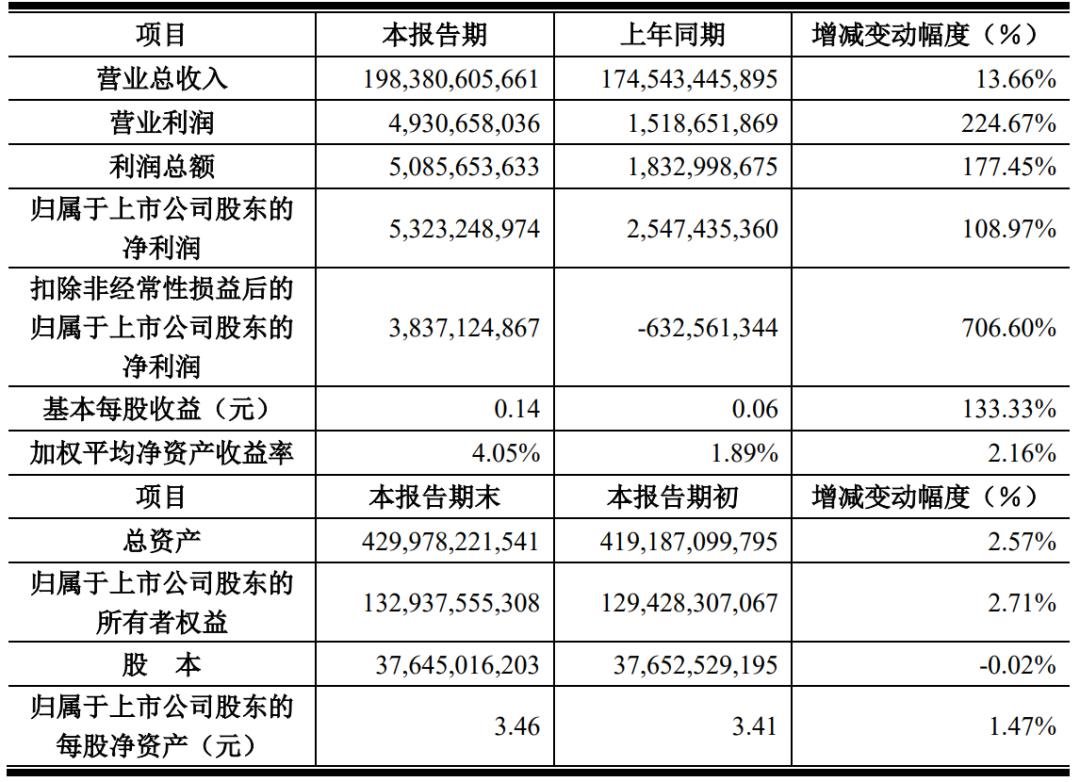

BOE disclosed its first-quarter 2025 results forecast and 2024 results express on April 15, and delivered an outstanding report card. In the first quarter of 2025, the company's operating income increased by more than 10% year-on-year, setting a record high for revenue in the first quarter; the net profit attributable to the parent company is expected to be 1.6 billion yuan-1.65 billion yuan, a year-on-year increase of 63% - 68%; the net profit deducted from non-profit is 1.3 billion yuan-1.4 billion yuan, a year-on-year increase of 118% - 135%. The growth in performance was due to the increase in volume and price of the industry as a whole, especially TV products, the significant growth in the LCD business, and the good performance of flexible AMoled in the mid-to-low-end smartphone field. Looking back on 2024, BOE achieved operating income of 198.381 billion yuan, a year-on-year increase of 13.66%; net profit attributable to the parent company was 5.323 billion yuan, a year-on-year increase of 108.97%; and net profit deducted was 3.837 billion yuan, a year-on-year increase of 706.6%.

Specifically, the LCD business has grown significantly in TV applications, the degree of large size has increased, and the market demand has improved; flexible AMOLED shipments have reached approximately 140 million units, and the product structure has been optimized; the MLED business strategy has focused significantly, and other emerging businesses have also achieved varying degrees of growth.

Specifically, the LCD business has grown significantly in TV applications, the degree of large size has increased, and the market demand has improved; flexible AMOLED shipments have reached approximately 140 million units, and the product structure has been optimized; the MLED business strategy has focused significantly, and other emerging businesses have also achieved varying degrees of growth.

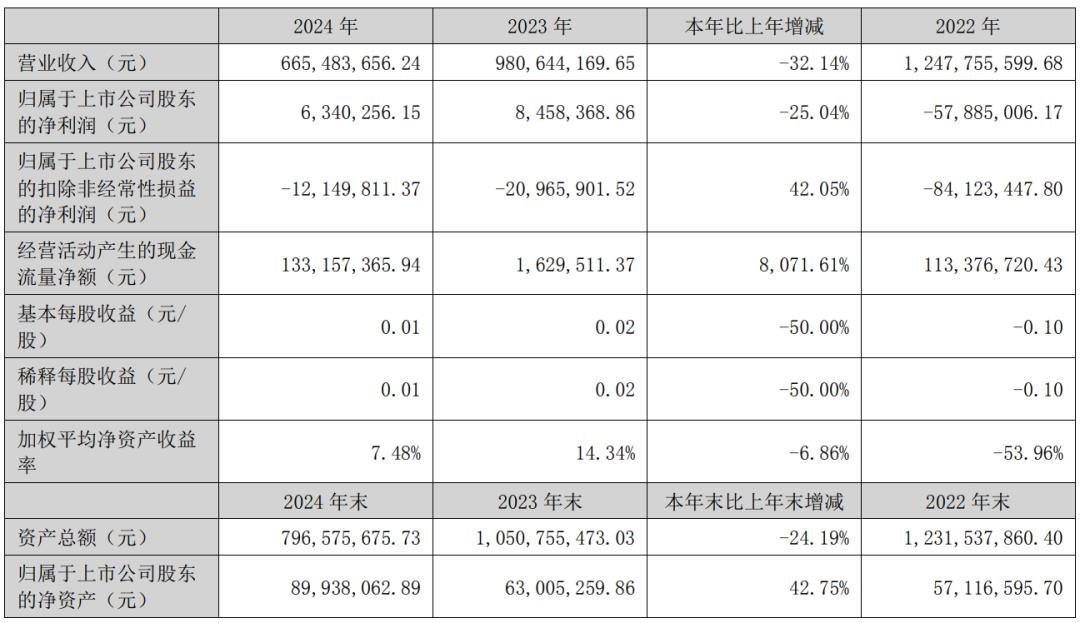

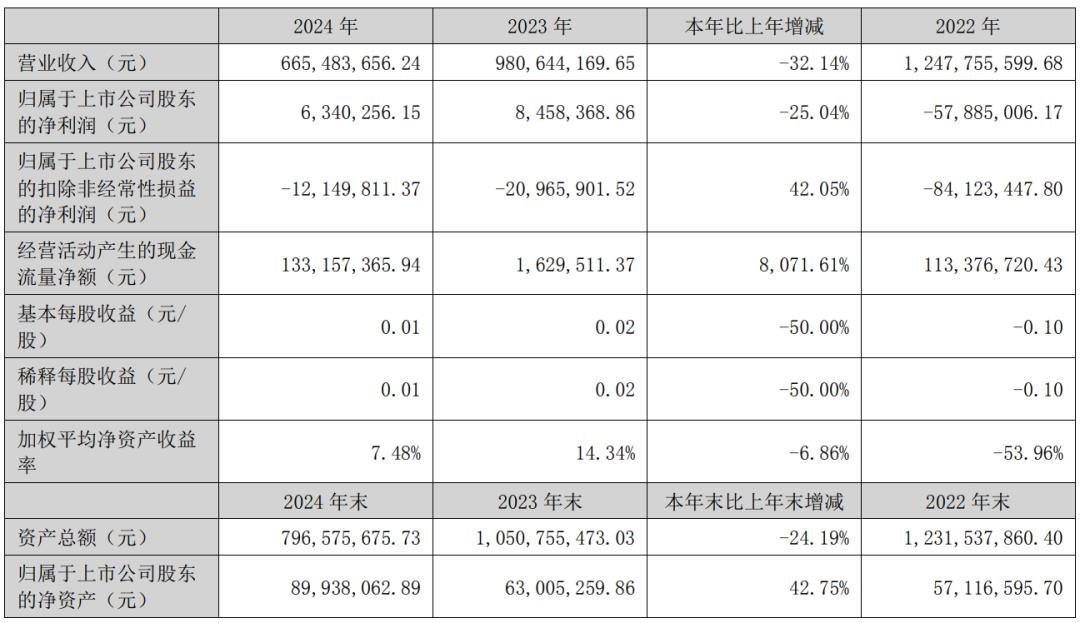

The 2024 annual report released by Lianjian Optoelectronics on April 16 showed that the company's operating income was 665 million yuan, a year-on-year decrease of 32.14%; the net profit attributable to the parent company was 6.3403 million yuan, a year-on-year decrease of 25.04%.

Announcement analysis shows that in 2024, the domestic market will be affected by factors such as the slowdown in investment in various industries, the reduction of government procurement projects, and consumption downgrades. The demand in the display market will decline, especially in the channel sector. In contrast, overseas markets have shown steady growth, with exports from Asia, Europe and North America performing outstandingly, and emerging markets such as Southeast Asia and the Middle East, represented by India, have continued to grow demand for displays, becoming a new growth point for the industry.

Announcement analysis shows that in 2024, the domestic market will be affected by factors such as the slowdown in investment in various industries, the reduction of government procurement projects, and consumption downgrades. The demand in the display market will decline, especially in the channel sector. In contrast, overseas markets have shown steady growth, with exports from Asia, Europe and North America performing outstandingly, and emerging markets such as Southeast Asia and the Middle East, represented by India, have continued to grow demand for displays, becoming a new growth point for the industry.

Nova Nebula released its 2024 annual report and the first quarter report for 2025 on April 18. In 2024, the company achieved operating income of 3.28 billion yuan, a year-on-year increase of 7.38%. In terms of market distribution, domestic market revenue was 2.653 billion yuan, a year-on-year increase of 2.85%; overseas markets performed well, with revenue reaching 626 million yuan, a year-on-year increase of 32.03%. In the product segment, revenue from LED display control systems was 1.514 billion yuan, a year-on-year increase of 5.02%; revenue from Media Processing Service systems was 1.343 billion yuan, a year-on-year increase of 5.30%; revenue from cloud-based information release and management systems was 198 million yuan, a year-on-year increase of 24.64%. However, operating profit and net profit attributable to the parent decreased by 2.31% compared with the same period last year.

Nova Nebula pointed out that the performance change is mainly due to the external macro environment bringing challenges to the domestic market, while the overseas market growth is strong. At the same time, the company's early layout in the MLED field has achieved results, the relevant income has grown rapidly, and the expansion of downstream high value-added fields has also improved the gross profit. Entering the first quarter of 2025, Nova Nebula's performance declined, with revenue of 621 million yuan, down 8.83% year-on-year; net profit attributable to the parent was 102 million yuan, down 16.54% year-on-year; and non-net profit attributable to the parent was 97.838 million yuan, down 16.01% year-on-year.

Nova Nebula pointed out that the performance change is mainly due to the external macro environment bringing challenges to the domestic market, while the overseas market growth is strong. At the same time, the company's early layout in the MLED field has achieved results, the relevant income has grown rapidly, and the expansion of downstream high value-added fields has also improved the gross profit. Entering the first quarter of 2025, Nova Nebula's performance declined, with revenue of 621 million yuan, down 8.83% year-on-year; net profit attributable to the parent was 102 million yuan, down 16.54% year-on-year; and non-net profit attributable to the parent was 97.838 million yuan, down 16.01% year-on-year. Also on April 18, Abison released its first quarter report for 2025, and its performance showed a downward trend. During the reporting period, the company achieved revenue of 826 million yuan, a year-on-year decrease of 4.47%; net profit attributable to the parent company was 36 million yuan, a year-on-year decrease of 48.69%; and non-net profit attributable to the parent company was 40 million yuan, a year-on-year decrease of 20.93%.

The announcement shows that the decline in net profit attributable to parent shareholders was mainly due to comprehensive factors such as increased provision for impairment of accounts receivable during the reporting period, increased fair value losses on securities investments and reduced government subsidies. As a leading company exporting overseas, Abison has also responded to the tariff policy. The company's product sales revenue exported to the United States in 2024 will account for about 15% of its annual sales revenue. It is expected to remain flat or decrease slightly this year. The company's overseas market covers a wide range of 140 countries. Abbison believes that the United States 'increased tariffs will have limited long-term impact on its overall business, and will reduce the impact through measures such as price increases and optimization of production processes.

The announcement shows that the decline in net profit attributable to parent shareholders was mainly due to comprehensive factors such as increased provision for impairment of accounts receivable during the reporting period, increased fair value losses on securities investments and reduced government subsidies. As a leading company exporting overseas, Abison has also responded to the tariff policy. The company's product sales revenue exported to the United States in 2024 will account for about 15% of its annual sales revenue. It is expected to remain flat or decrease slightly this year. The company's overseas market covers a wide range of 140 countries. Abbison believes that the United States 'increased tariffs will have limited long-term impact on its overall business, and will reduce the impact through measures such as price increases and optimization of production processes. BOE disclosed its first-quarter 2025 results forecast and 2024 results express on April 15, and delivered an outstanding report card. In the first quarter of 2025, the company's operating income increased by more than 10% year-on-year, setting a record high for revenue in the first quarter; the net profit attributable to the parent company is expected to be 1.6 billion yuan-1.65 billion yuan, a year-on-year increase of 63% - 68%; the net profit deducted from non-profit is 1.3 billion yuan-1.4 billion yuan, a year-on-year increase of 118% - 135%. The growth in performance was due to the increase in volume and price of the industry as a whole, especially TV products, the significant growth in the LCD business, and the good performance of flexible AMoled in the mid-to-low-end smartphone field. Looking back on 2024, BOE achieved operating income of 198.381 billion yuan, a year-on-year increase of 13.66%; net profit attributable to the parent company was 5.323 billion yuan, a year-on-year increase of 108.97%; and net profit deducted was 3.837 billion yuan, a year-on-year increase of 706.6%.

Specifically, the LCD business has grown significantly in TV applications, the degree of large size has increased, and the market demand has improved; flexible AMOLED shipments have reached approximately 140 million units, and the product structure has been optimized; the MLED business strategy has focused significantly, and other emerging businesses have also achieved varying degrees of growth.

Specifically, the LCD business has grown significantly in TV applications, the degree of large size has increased, and the market demand has improved; flexible AMOLED shipments have reached approximately 140 million units, and the product structure has been optimized; the MLED business strategy has focused significantly, and other emerging businesses have also achieved varying degrees of growth. The 2024 annual report released by Lianjian Optoelectronics on April 16 showed that the company's operating income was 665 million yuan, a year-on-year decrease of 32.14%; the net profit attributable to the parent company was 6.3403 million yuan, a year-on-year decrease of 25.04%.

Announcement analysis shows that in 2024, the domestic market will be affected by factors such as the slowdown in investment in various industries, the reduction of government procurement projects, and consumption downgrades. The demand in the display market will decline, especially in the channel sector. In contrast, overseas markets have shown steady growth, with exports from Asia, Europe and North America performing outstandingly, and emerging markets such as Southeast Asia and the Middle East, represented by India, have continued to grow demand for displays, becoming a new growth point for the industry.

Announcement analysis shows that in 2024, the domestic market will be affected by factors such as the slowdown in investment in various industries, the reduction of government procurement projects, and consumption downgrades. The demand in the display market will decline, especially in the channel sector. In contrast, overseas markets have shown steady growth, with exports from Asia, Europe and North America performing outstandingly, and emerging markets such as Southeast Asia and the Middle East, represented by India, have continued to grow demand for displays, becoming a new growth point for the industry. TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Hongli Zhihui's operating income in 2024 will hit a record high, and its high-quality development mo

-

Zhouming Technology: Light up the new dimension of Sanlitun movie viewing and reshape the new audio-

-

Video wall renewal in summer: Two new LCD video walls!

-

Liard·Virtual Moving Points Appears at the Beijing Film Festival: Spatial computing technology build

-

BOE Huacan Micro LED business enters a new stage and comprehensively promotes industrial development

-

Lehman Optoelectronics helps Xi'an Xianyang International Airport open a new chapter in smart travel

-

MiP display technology: Breaking through traditional boundaries and reshaping the visual future

-

TCL China Star debuts at ICDT 2023, and multiple innovative products shine in the audience

-

Liard: An outstanding practitioner of the first-time economy, innovation drives change in multiple f

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e