Analysis of the performance of enterprises in the LED display industry chain from 2024 to 2025: Diff

- author:

- 2025-04-30 15:11:07

Recently, influential companies in the industries such as TCL Technology, Alto Electronics, Xinyichang, Nanji Light, and Delong Laser have announced their latest performance reports. Under the combined effect of fluctuations in the global macroeconomic environment and differences in the strategic focus of various companies, the performance of these companies has shown a clear divergence trend. However, after digging deeply into each sub-track track, it is not difficult to find that many differentiated growth highlights still emerge, bringing new thinking and inspiration to the development of the industry.

In terms of business segments, the semiconductor display business is undoubtedly the core growth point of TCL Technology. In 2024, the sector achieved operating income of 104.3 billion yuan, a year-on-year increase of 25%; net profit reached 6.23 billion yuan, a year-on-year improvement of 6.24 billion yuan; operating cash flow also increased by 36% year-on-year to 27.4 billion yuan. The sales area of semiconductor display products reached 5819 square meters, a year-on-year increase of 9.72%.

As a key carrier of TCL Technology's semiconductor display business, TCL China Star's annual revenue in 2024 is 89.668 billion yuan, and its operating profit and net profit are 5.64 billion yuan and 5.544 billion yuan respectively.

In the field of large size, TCL Huaxing relies on its production capacity advantages of high-generation lines and high-quality customer structure to effectively promote the development of TV panels towards large size and high-end. During the reporting period, the proportion of products in size of 55 inches and above in the TV panel business increased to 82%, and the proportion of 65 inches and above reached 56%. Sales of products in large size such as 85 inches and 98 inches increased rapidly.

In the field of large size, TCL Huaxing relies on its production capacity advantages of high-generation lines and high-quality customer structure to effectively promote the development of TV panels towards large size and high-end. During the reporting period, the proportion of products in size of 55 inches and above in the TV panel business increased to 82%, and the proportion of 65 inches and above reached 56%. Sales of products in large size such as 85 inches and 98 inches increased rapidly.

In the field of medium size, TCL Caxing is actively expanding IT and vehicle-mounted businesses. On the one hand, the t9 production line has steadily promoted production capacity growth and accelerated the introduction of brand customers; on the other hand, the 6th generation LTPS production line has accelerated the adjustment of business structure. Shipments of notebooks and tablet products maintained steady growth, while the in-vehicle field followed the trend of large screens and high-end products. Its LTPS in-vehicle screens successfully supplied high-end models from many leading car companies.

In the field of small size, TCL Huaxing focuses on the high-end market, continuously optimizes its product and customer structure, and achieves significant growth in shipments of flexible oled products. In addition, in terms of technological innovation, TCL Huaxing has made breakthroughs in cutting-edge technology fields such as Micro-LED, Mini-LED direct display and silicon-based Micro-LED, and has actively promoted AR glasses, Mini-LED and other products in multiple business areas with customers. Application promotion.

Entering the first quarter of 2025, TCL Technology achieved operating income of 40.1 billion yuan, a slight increase of 0.4% year-on-year; parent net profit increased significantly by 322% to 1.01 billion yuan; operating cash flow also increased by 83% year-on-year to 12.1 billion yuan, showing a good recovery trend.

In terms of regional market performance, Alto Electronics achieved revenue of 470 million yuan in the domestic market, a year-on-year increase of 37.64%; revenue in overseas markets was 252 million yuan, a year-on-year decrease of 20.32%. In terms of products, its LED video display system achieved revenue of 342 million yuan, shipments increased by 23.81% year-on-year, production increased by 51.04% year-on-year, and inventories increased by 45.55% year-on-year. This was mainly due to the decline in product sales prices, and The decrease in shipments of outdoor low-density products and the increase in shipments of indoor high-density products.

As the core application area that Alto Electronics has focused on in recent years, the film and television industry has achieved remarkable results in 2024. The company continues to increase market development efforts, and achieved revenue from applications in the film and television industry of approximately 154 million yuan, a year-on-year increase of 13.14%. In the field of film playback, as of the end of the reporting period, Alto Electronics has delivered a total of 36 LED movie screens, with projects covering more than 20 cities around the world, and many projects are in progress. In the field of virtual shooting, it has undertaken 25 XR/VP virtual studio projects in 2024. So far, it has undertaken a total of 92 XR/VP virtual studio projects worldwide, and has been successfully applied to well-known domestic and foreign companies such as Nvidia, Tencent, Microsoft, Amazon, China Film Group, Toei Japan, and some Hollywood film and television production companies.

In the first quarter of 2025, Alto Electronics achieved revenue of 185 million yuan, a year-on-year increase of 2.72%; its parent net profit achieved a significant increase, reaching 13.6 million yuan, a year-on-year increase of 2140%, and its profitability was significantly improved.

The company said that the change in revenue is mainly due to the proactive promotion of strategic transformation, the proactive reduction of the scale of traditional LED business, and the focus of development on new display and semiconductor technology fields, which has led to certain pressure on performance in the short term. From the perspective of product structure, crystal bonders are Xinyichang's main source of income. In 2024, crystal bonders 'revenue will reach 731 million yuan, and a total of 3012 crystal bonders were sold that year. The revenue of Xinyichang Mini LED die fixer in 2024 will be 350 - 400 million yuan, accounting for 40% of total revenue. The revenue of Mini LEDs and semiconductors may account for more than 50% of high-end products. The high-end product driving strategy has initially shown results.

Looking to the future, Xinyichang believes that crystal bonder equipment will develop in the direction of ultra-high precision, software intelligence, and equipment integration, in order to achieve the goal of reducing production costs and improving production efficiency and precision. However, in the first quarter of 2025, Xinyichang's performance still faces challenges. Operating income was 227 million yuan, a year-on-year decrease of 13.78%; net profit attributable to the parent company was 11.6963 million yuan, a year-on-year decrease of 59.58%; net profit deducted from non-profit was 11.4552 million yuan, a year-on-year decrease of 58.77%.

Antarctic Light's main product is backlit display modules, which will achieve revenue of 449 million yuan in 2024. The main reasons for the changes in the company's performance are: first, optimizing the business structure and layout, and gradually expanding the main product backlight display modules to size products, effectively improving the profitability of the products and improving the gross profit margin of the products; second, Continue to implement cost-reduction and efficiency improvement measures, strengthen cost control, reduce operating costs, and at the same time improve capital use efficiency and operation management efficiency, and promote the development of backlight display modules in the direction of size.

In terms of strategic planning, Antarctic Light plans to actively promote the commercialization process of Mini/Micro-LED technology, and plans to invest in the construction of Mini/Micro-LED display module production projects in a timely manner according to market demand during the opportunity period for the commercialization of new display technologies. Through core technology research and collaborative innovation of the entire industry chain, we will build differentiated technical barriers and enhance our core competitiveness in the field of new displays. In the first quarter of 2025, Antarctic Light achieved operating income of 186 million yuan, a year-on-year increase of 265.54%; net profit attributable to the parent company was 29.729 million yuan, a year-on-year increase

TCL Technology: Semiconductor display business becomes growth engine

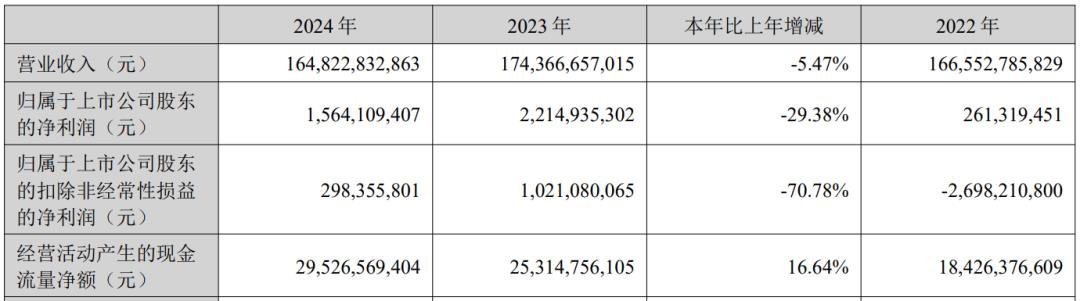

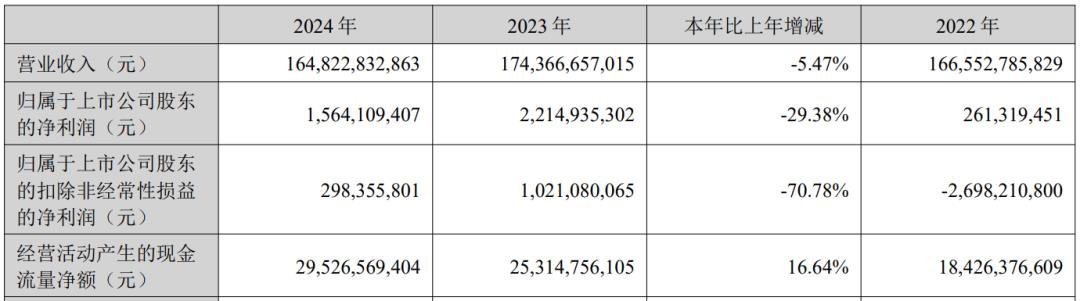

On April 29, TCL Technology disclosed its 2024 annual report and 2025 first quarterly report. Data shows that TCL Technology's overall revenue in 2024 will reach 164.8 billion yuan, down 5.47% from the previous year; net profit attributable to the parent company will be 1.56 billion yuan, down 29.38% year-on-year; non-net profit attributable to the parent company has dropped significantly by 70.78%, only 298 million yuan. However, it is worth noting that its operating cash flow performance was outstanding, reaching 29.5 billion yuan, a year-on-year increase of 16.64%.

In terms of business segments, the semiconductor display business is undoubtedly the core growth point of TCL Technology. In 2024, the sector achieved operating income of 104.3 billion yuan, a year-on-year increase of 25%; net profit reached 6.23 billion yuan, a year-on-year improvement of 6.24 billion yuan; operating cash flow also increased by 36% year-on-year to 27.4 billion yuan. The sales area of semiconductor display products reached 5819 square meters, a year-on-year increase of 9.72%.

As a key carrier of TCL Technology's semiconductor display business, TCL China Star's annual revenue in 2024 is 89.668 billion yuan, and its operating profit and net profit are 5.64 billion yuan and 5.544 billion yuan respectively.

In the field of large size, TCL Huaxing relies on its production capacity advantages of high-generation lines and high-quality customer structure to effectively promote the development of TV panels towards large size and high-end. During the reporting period, the proportion of products in size of 55 inches and above in the TV panel business increased to 82%, and the proportion of 65 inches and above reached 56%. Sales of products in large size such as 85 inches and 98 inches increased rapidly.

In the field of large size, TCL Huaxing relies on its production capacity advantages of high-generation lines and high-quality customer structure to effectively promote the development of TV panels towards large size and high-end. During the reporting period, the proportion of products in size of 55 inches and above in the TV panel business increased to 82%, and the proportion of 65 inches and above reached 56%. Sales of products in large size such as 85 inches and 98 inches increased rapidly. In the field of medium size, TCL Caxing is actively expanding IT and vehicle-mounted businesses. On the one hand, the t9 production line has steadily promoted production capacity growth and accelerated the introduction of brand customers; on the other hand, the 6th generation LTPS production line has accelerated the adjustment of business structure. Shipments of notebooks and tablet products maintained steady growth, while the in-vehicle field followed the trend of large screens and high-end products. Its LTPS in-vehicle screens successfully supplied high-end models from many leading car companies.

In the field of small size, TCL Huaxing focuses on the high-end market, continuously optimizes its product and customer structure, and achieves significant growth in shipments of flexible oled products. In addition, in terms of technological innovation, TCL Huaxing has made breakthroughs in cutting-edge technology fields such as Micro-LED, Mini-LED direct display and silicon-based Micro-LED, and has actively promoted AR glasses, Mini-LED and other products in multiple business areas with customers. Application promotion.

Entering the first quarter of 2025, TCL Technology achieved operating income of 40.1 billion yuan, a slight increase of 0.4% year-on-year; parent net profit increased significantly by 322% to 1.01 billion yuan; operating cash flow also increased by 83% year-on-year to 12.1 billion yuan, showing a good recovery trend.

Alto Electronics: Continue to exert efforts in the field of film and television applications.

On the evening of April 28, Alto Electronics announced its 2024 annual report and its 2025 quarterly report. In 2024, Alto Electronics achieved revenue of 722 million yuan, a year-on-year increase of 9.78%, but the net profit attributable to the parent company was-38.53 million yuan, a year-on-year decrease of 379.65%; the non-net profit attributable to the parent company was-38.4036 million yuan, a year-on-year decrease of 490.75%.

In terms of regional market performance, Alto Electronics achieved revenue of 470 million yuan in the domestic market, a year-on-year increase of 37.64%; revenue in overseas markets was 252 million yuan, a year-on-year decrease of 20.32%. In terms of products, its LED video display system achieved revenue of 342 million yuan, shipments increased by 23.81% year-on-year, production increased by 51.04% year-on-year, and inventories increased by 45.55% year-on-year. This was mainly due to the decline in product sales prices, and The decrease in shipments of outdoor low-density products and the increase in shipments of indoor high-density products.

As the core application area that Alto Electronics has focused on in recent years, the film and television industry has achieved remarkable results in 2024. The company continues to increase market development efforts, and achieved revenue from applications in the film and television industry of approximately 154 million yuan, a year-on-year increase of 13.14%. In the field of film playback, as of the end of the reporting period, Alto Electronics has delivered a total of 36 LED movie screens, with projects covering more than 20 cities around the world, and many projects are in progress. In the field of virtual shooting, it has undertaken 25 XR/VP virtual studio projects in 2024. So far, it has undertaken a total of 92 XR/VP virtual studio projects worldwide, and has been successfully applied to well-known domestic and foreign companies such as Nvidia, Tencent, Microsoft, Amazon, China Film Group, Toei Japan, and some Hollywood film and television production companies.

In the first quarter of 2025, Alto Electronics achieved revenue of 185 million yuan, a year-on-year increase of 2.72%; its parent net profit achieved a significant increase, reaching 13.6 million yuan, a year-on-year increase of 2140%, and its profitability was significantly improved.

Xinyichang: Short-term performance under strategic transformation is under pressure

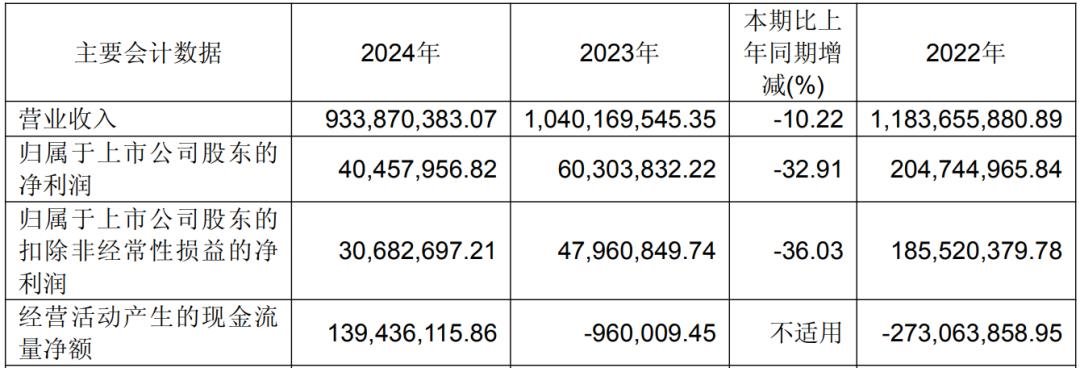

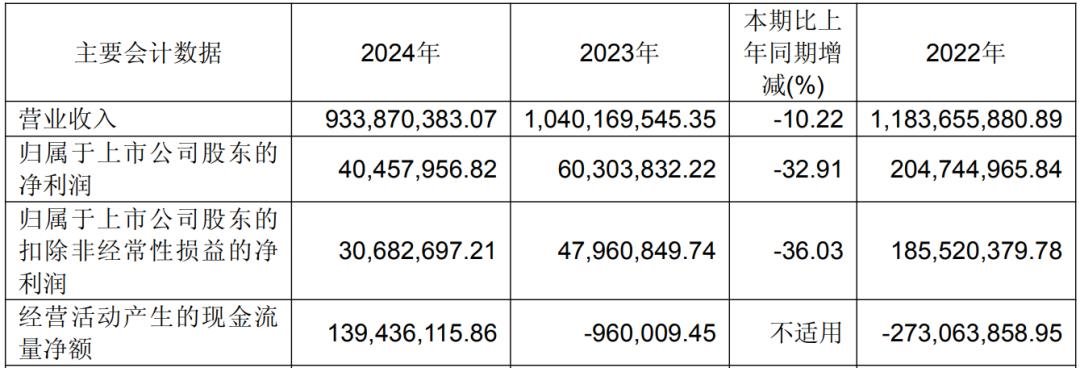

Xinyichang's recently released 2024 annual report and first quarter 2025 performance report show that the company's operating income in 2024 was 934 million yuan, a year-on-year decrease of 10.22%; The net profit attributable to the parent was 40.458 million yuan, a year-on-year decrease of 32.91%; the non-net profit attributable to the parent was 30.6827 million yuan, a year-on-year decrease of 36.03%.

The company said that the change in revenue is mainly due to the proactive promotion of strategic transformation, the proactive reduction of the scale of traditional LED business, and the focus of development on new display and semiconductor technology fields, which has led to certain pressure on performance in the short term. From the perspective of product structure, crystal bonders are Xinyichang's main source of income. In 2024, crystal bonders 'revenue will reach 731 million yuan, and a total of 3012 crystal bonders were sold that year. The revenue of Xinyichang Mini LED die fixer in 2024 will be 350 - 400 million yuan, accounting for 40% of total revenue. The revenue of Mini LEDs and semiconductors may account for more than 50% of high-end products. The high-end product driving strategy has initially shown results.

Looking to the future, Xinyichang believes that crystal bonder equipment will develop in the direction of ultra-high precision, software intelligence, and equipment integration, in order to achieve the goal of reducing production costs and improving production efficiency and precision. However, in the first quarter of 2025, Xinyichang's performance still faces challenges. Operating income was 227 million yuan, a year-on-year decrease of 13.78%; net profit attributable to the parent company was 11.6963 million yuan, a year-on-year decrease of 59.58%; net profit deducted from non-profit was 11.4552 million yuan, a year-on-year decrease of 58.77%.

Antarctic Light: Business optimization brings profit improvement The

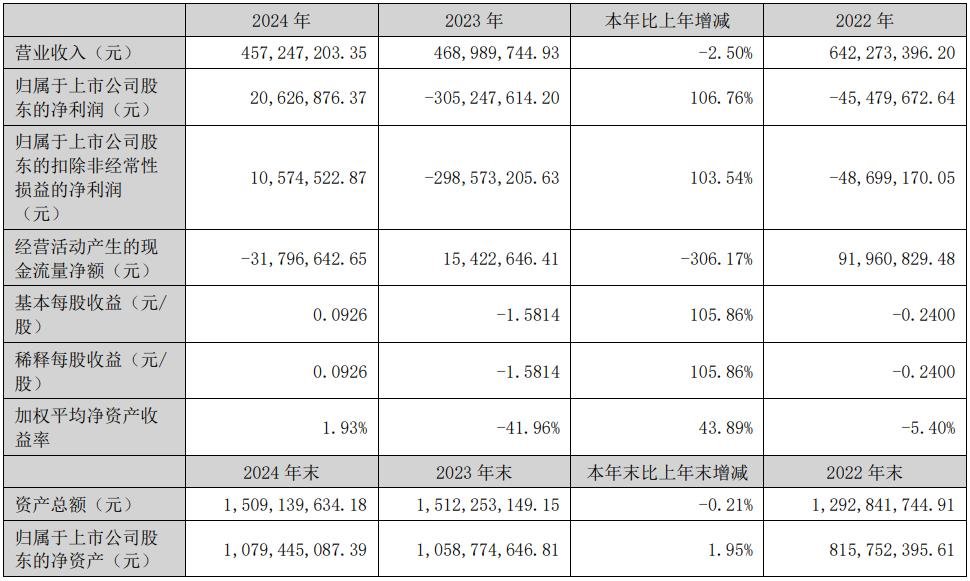

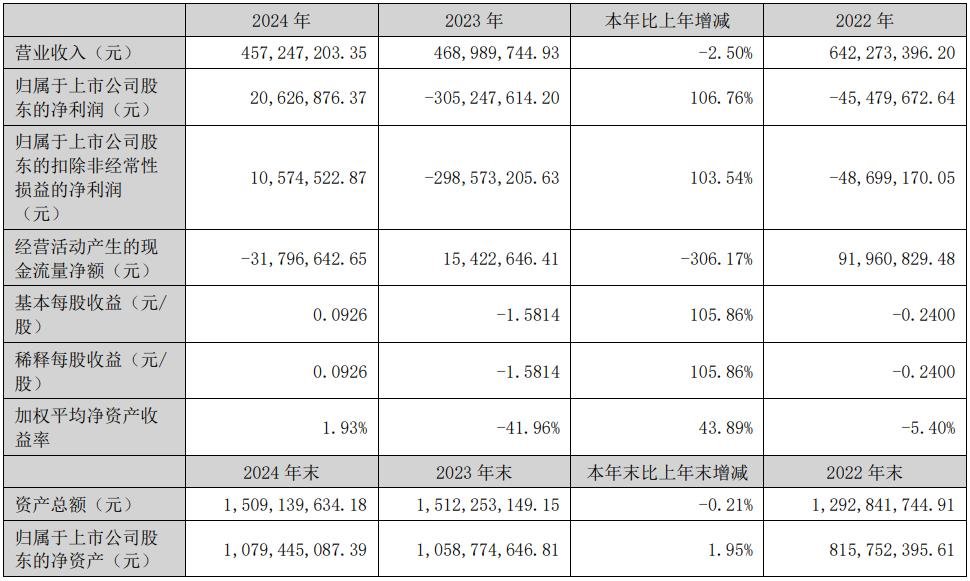

2024 annual report and the first quarter 2025 performance report released by Antarctic Light show that the company's operating income in 2024 was 457 million yuan, a year-on-year decrease of 2.50%; However, the net profit attributable to the parent company was 20.6269 million yuan, a year-on-year increase of 106.76%; the net profit deducted from non-profit was 10.5745 million yuan, a year-on-year increase of 103.54%.

Antarctic Light's main product is backlit display modules, which will achieve revenue of 449 million yuan in 2024. The main reasons for the changes in the company's performance are: first, optimizing the business structure and layout, and gradually expanding the main product backlight display modules to size products, effectively improving the profitability of the products and improving the gross profit margin of the products; second, Continue to implement cost-reduction and efficiency improvement measures, strengthen cost control, reduce operating costs, and at the same time improve capital use efficiency and operation management efficiency, and promote the development of backlight display modules in the direction of size.

In terms of strategic planning, Antarctic Light plans to actively promote the commercialization process of Mini/Micro-LED technology, and plans to invest in the construction of Mini/Micro-LED display module production projects in a timely manner according to market demand during the opportunity period for the commercialization of new display technologies. Through core technology research and collaborative innovation of the entire industry chain, we will build differentiated technical barriers and enhance our core competitiveness in the field of new displays. In the first quarter of 2025, Antarctic Light achieved operating income of 186 million yuan, a year-on-year increase of 265.54%; net profit attributable to the parent company was 29.729 million yuan, a year-on-year increase

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

COB production capacity expansion boom: Industry companies accelerate their layout and show confiden

-

Ming Xincheng, a subsidiary of Hongli Zhihui: Use light as a pen to paint the colorful night view of

-

Powerful giant color: a shining star in the journey of great country brands

-

Exploring Liard·Virtual Motion-point Mini AI holographic toy: The dream collision of technology and

-

Kopin wins tens of millions of dollars contract to tackle military AR Micro LEDs

-

Kalette: The journey to compete in overseas markets, and the strength shines with glory

-

Kopin wins $10 million military contract, Micro LED technology reshapes military AR display landscap

-

Cross-border collision between technology and sports: Liard helps the world's first humanoid robot h

-

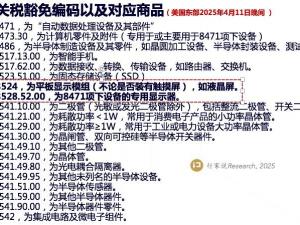

The United States adjusts its tariff policy, showing that trade frictions on related products have e

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e