Mulinsen adds 1.88 billion yuan to Mexico: Build a new production complex to seize opportunities in

- author:

- 2025-12-18 10:14:29

Recently, according to the Mexican Industry Network, Mulinción, a leading company in the LED industry, announced a major overseas layout plan: through its subsidiary Mulinción Mexico, it will invest in building a research and development, manufacturing, and logistics in the Laguna region of Durango, Mexico. Integrated production and technology complex. The project has a total investment of US$261.7 million (approximately RMB 1.88 billion) and will be gradually advanced in three stages. After completion, it will become a core hub for Mulinsen to radiate to North American and Latin American markets.

According to the project plan, the first phase of the factory will be opened in February 2026, which is expected to create about 200 jobs; from 2026 to 2027, it will enter the stage of industrial scale expansion to further increase the scale of production capacity; from 2028 to 2030, it will be built a high-yield engineering and development center. After the project is fully put into operation, it is expected that 3500 people will be directly employed. At the same time, it will effectively drive the agglomeration of upstream and downstream supporting enterprises to form a localized industrial ecosystem.

Liu Bruce, global vice president of Mulinsen, said that the newly built base will play a key strategic role and become the company's most important manufacturing and export hub in Mexico and even North America. Its products will be mainly oriented to the United States and Latin American markets. Taking advantage of Mexico's location advantages, it can fully enjoy the tariff exemption benefits brought by the US-Mexico-Canada Agreement (USMCA), significantly reduce trade costs, and enhance product market competitiveness.

According to public information, Mulinsen's main business covers multiple core areas such as LED packaging, lighting, display modules, and Mini/Micro LED. It owns two well-known brands, MLS and Roundvance. Its products are exported to Europe, America, Asia Pacific, and the Middle East. More than 100 countries and regions such as Africa. In terms of global production capacity layout, the company has set up multiple production bases in Guangdong, Jiangxi, Zhejiang, Germany, Mexico and other places, forming a global manufacturing and service network.

In fact, Mulinsen's layout in Mexico has long been paved. Its Mexican factory has been officially put into operation at the end of the third quarter of 2024, and its products are mainly supplied to the United States and Latin American markets. This additional investment in the construction of a production complex is an important measure for the company to further expand the scale of production in Mexico and increase its market share on the existing basis. Mulinson previously stated that the company's products exported from Mexico have complied with the relevant provisions of the US-Mexico-Canada Agreement and can enjoy reciprocal tariff exemption policies. In the future, on the premise that the U.S. tariff policy remains stable, the company will further leverage the advantages of its Mexican factories, gradually transfer the production of some products to the local area, and optimize the layout of the global supply chain.

LED companies are clustered in Mexico, spreading risks in overseas markets as their core appeal. In recent years, affected by factors such as intensifying geopolitical uncertainty, the global supply chain is facing restructuring challenges. More and more LED companies have begun to accelerate the pace of setting up overseas factories to avoid overseas market business risks, among which Mexico has become the first choice for many companies to deploy overseas.

From the perspective of location and market, northern Mexico borders the United States, and it takes only a few days for products to be sold to the United States by land, which can greatly shorten the delivery cycle, improve response speed to North American customers, and effectively enhance customer satisfaction. At the cost level, Mexico's local labor cost is lower than that of China. Superimposing the cost advantages of land, energy and other resources and preferential tax policies can reduce overseas operation costs and improve profit space for LED enterprises. In addition, Mexico has gradually formed a mature electronics manufacturing supporting system, and LED-related components can be purchased locally, further reducing logistics costs and supply chain disruption risks.

More importantly, Mexico is a member of multiple free trade agreements, which provides convenient access for LED companies to enter the entire American market, helping companies circumvent trade barriers and broaden market coverage. Against the background of the diversification of global supply chain layout, Mexico has become a strategic location for LED companies to disperse regional risks and enhance production capacity flexibility. Layout in Mexico not only allows companies to respond more quickly to the needs of North American customers, but also lays a solid foundation for further expansion of the Latin American market.

In addition to Mulinsen, many LED-related companies have actively promoted the construction and operation of Mexican factories since 2025, involving LED lighting, LED lights, drive power and other sub-fields:

Shanpu Lighting: Focusing on residential, commercial and industrial lighting, the construction of the headquarters in Nuevo León, Mexico was launched in November this year. The total investment of the project is 1 billion yuan. The total construction area of the first phase will reach 200,000 square meters. After completion, it will focus on meeting the North American market demand;

Igor: The LED lighting business is mainly in the North American market. The company revealed in its latest financial report that it is actively promoting the construction of bases in Mexico and the United States and strengthening the supply chain layout in the North American market;

Infit: A well-known company in the field of LED drive power supplies stated in its semi-annual report this year that it has increased investment in Mexican factories and dispatched professional management teams to improve local supply chain support capabilities;

Lianjia: An LED lamp module company started the construction of a new factory in Mexico in February this year. It is expected to officially mass production and shipment in 2026, which will further strengthen its supply and service capabilities in Mexico, Central and South America and European markets;

Li Qing: Focusing on the LED lamp business, we will continue to expand our global layout this year and promote the division of labor strategies among local cooperative manufacturers in Thailand and Mexico. The company stated that the Mexican factory will adopt a local manufacturing model, and products will be transferred to the U.S. market through customers, fully complying with the US-Mexico-Canada Agreement (USMCA) origin conditions, which will not only reduce the tariff burden, but also strengthen the flexibility of the supply chain, which will help in the long run. Disperse risks and expand the global market landscape;

Changcheng Group: A company in the field of automotive lighting announced in August this year that it had completed the groundbreaking ceremony for a new factory in Aguascalientes, Mexico, with a total investment of US$50 million. It will realize localized production of smart lighting solutions and focus on serving General Motors North America supply chain.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Lehman Optoelectronics GM series won the 2025 German Red Dot Design Award, innovation leading new ch

-

Changzhi High-tech Zone and Chongqing Konka Optoelectronics reached cooperation on MLED project

-

TCL Huaxing shines at MWC2025, leading the trend of display technology innovation

-

Abbison shines at the 2025 ISLE exhibition, leading the innovative experience of LED display

-

Zhouming Technology's UMini W series LED outer arc flexible screen helps Fortune 500 companies creat

-

Exploring Liard·Virtual Motion-point Mini AI holographic toy: The dream collision of technology and

-

Alto Electronics Middle East Studio Project: The Market Reef Behind Technological Breakout

-

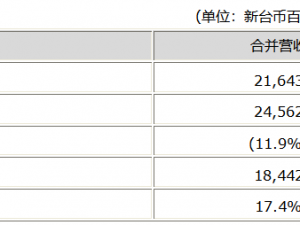

AU Optronics 'consolidated revenue in January 2025 reached 21.6 billion yuan, a slight decline from

-

BOE's 2025 semi-annual report is eye-catching: revenue and profits are rising, and diversified busin

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e