Analysis of the impact of Trump's additional tariffs on the LED display industry and countermeasures

- author:

- 2025-03-06 11:15:51

On February 27, U.S. Eastern Time, CNBC reported that in an interview with the media at the White House, Trump made it clear that an additional 10% tariff would be imposed on China goods starting from March 4. Trump explained in the image of 10 plus 10, that is, this tax increase is based on the 10% additional tariff that took effect on February 1. This decision instantly triggered the global trade market, especially the industry closely related to Sino-US trade. High attention.

Experts said that after in-depth review, Research pointed out that if the new 10% tariff is implemented this time, according to different commodity codes, the tariffs on related products may rise to a maximum of 45%, of which the tariff on LED displays is expected to remain at around 30%. This will undoubtedly further intensify the impact on the LED display industry. As early as February, when Trump first imposed a 10% tariff, experts said that Research had comprehensively analyzed its impact on LED display products going abroad based on actual conditions such as changes in tariff rates, export data of China's display products, and tariff transfers. impact.

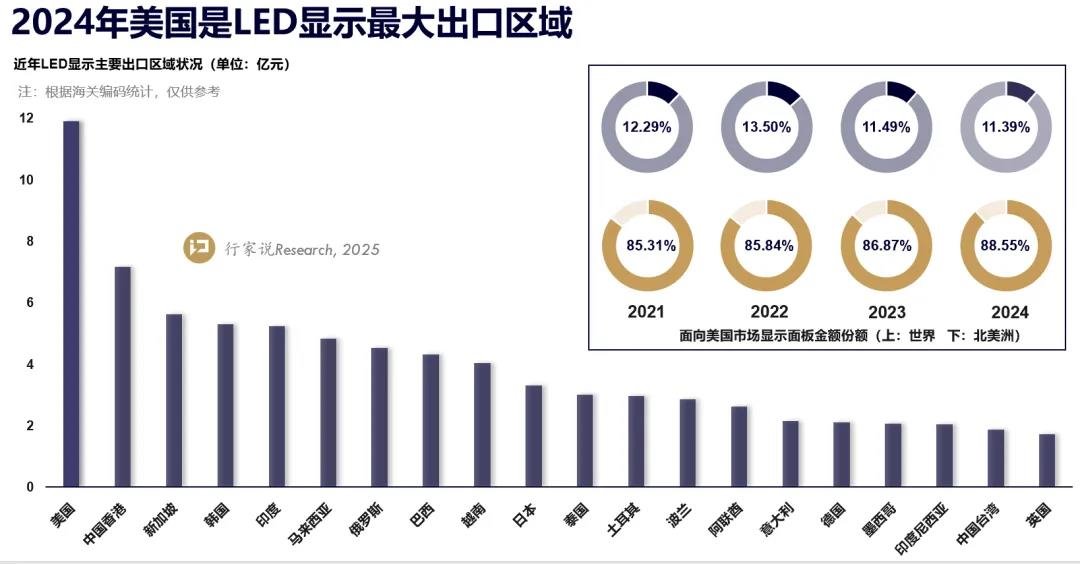

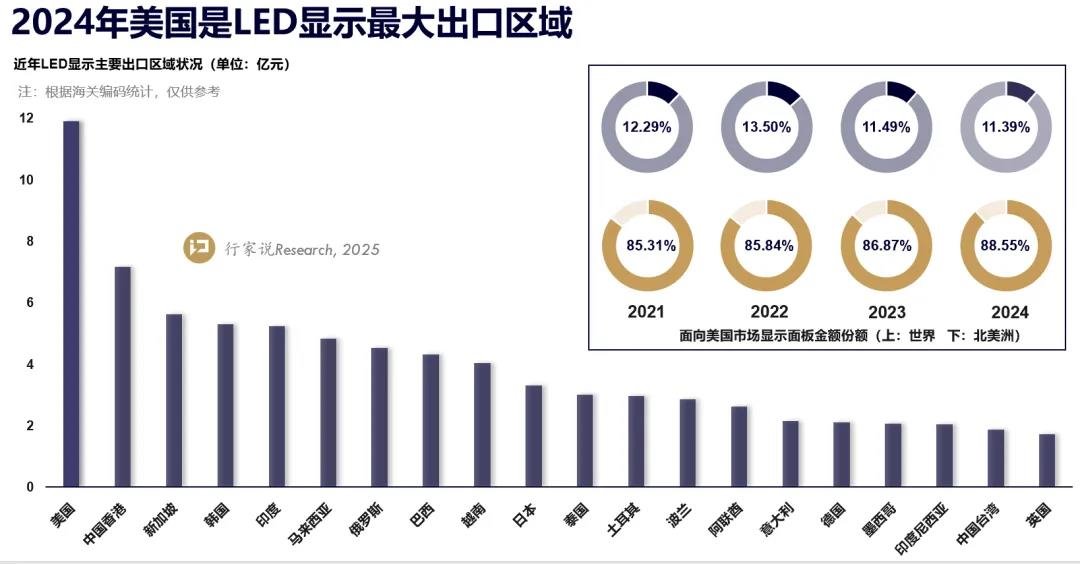

In recent years, the sea-going strategy has become an important measure for many LED display companies to expand their market footprint. The U.S. market plays a pivotal role in my country's LED display export pattern. Not only does the export volume dominate, but the single transaction amount and gross profit margin are also at a relatively high level. This time, Trump will increase tariffs on China to 20%, which will inevitably reshape the market demand pattern to a certain extent and compress corporate profit margins. In the short term, small and medium-sized enterprises are likely to bear the brunt and bear huge operating pressure; in the long run, the entire industry must deeply tap its own advantages and make every effort to build core competitiveness to cope with the complex and ever-changing external environment.

In terms of coping strategies, entrepot trade has become an effective way for some enterprises to ensure market demand and avoid tariff risks. Judging from the operating status of listed companies, many LED display companies have already made arrangements in advance and set up production bases or subsidiaries overseas. Key supply chain companies have also followed suit and reduced tariff impact by setting up factories overseas. However, under the current situation, companies still need to carefully assess supply chain risks and consider transferring production capacity to Southeast Asia, India and other regions, thereby reducing logistics costs and tariff expenditures, and thereby enhancing the price competitiveness of their products. However, what needs to be vigilant is that if the United States insists on containing China goods, it is likely to impose additional tariffs on relevant goods from countries that undertake production capacity transfers, and even on goods imported from China by these countries, which will undoubtedly add a lot of uncertainty to the company's future strategic layout.

In addition to making adjustments in strategic layout, innovative competition is also the key direction for LED display companies to break through the current dilemma. China companies have made remarkable progress in the Mini/Micro LED field. Leading technologies and products are expected to stimulate new market demand and help companies seize more market share. At the same time, companies must fully consider the characteristics of overseas markets and carry out product research and development work according to local conditions. For example, overseas markets pay great attention to the practicality and energy-saving performance of products. Enterprises should take this as a guide to create unique and differentiated products and enhance product added value and market competitiveness.

According to expert Research analysis, after the additional 10% tariff is imposed this time, although the current maximum tariff of 45%(LED display is expected to be around 30%) is slightly lower than the previously estimated worst-case scenario of 60%, there are still many variables in the future. If the United States cancels its most-favored-nation status for China, tariffs on China may rise further, approaching the 60% mentioned by Trump in the policy agenda of the Republican Conference. Therefore, relevant companies must always remain highly vigilant, pay close attention to policy developments, and formulate comprehensive response plans in advance.

In the complex and ever-changing international economic and trade environment, collaborative cooperation across the LED display industry has become increasingly important. By integrating industrial chain resources, jointly expanding market scale, and jointly resisting external risks, it has become a solid foundation for the steady development of the industry. At the same time, formulating a forward-looking and feasible development plan and clarifying the evolution path of key technologies such as COB and MIP is of far-reaching significance for accurately grasping the development context of the LED display industry in 2025 and achieving sustainable development goals. Companies in the industry need to unite closely and work together in terms of technological innovation, market expansion, and strategic layout to jointly respond to external challenges and push the LED display industry to a new stage of development.

Experts said that after in-depth review, Research pointed out that if the new 10% tariff is implemented this time, according to different commodity codes, the tariffs on related products may rise to a maximum of 45%, of which the tariff on LED displays is expected to remain at around 30%. This will undoubtedly further intensify the impact on the LED display industry. As early as February, when Trump first imposed a 10% tariff, experts said that Research had comprehensively analyzed its impact on LED display products going abroad based on actual conditions such as changes in tariff rates, export data of China's display products, and tariff transfers. impact.

In recent years, the sea-going strategy has become an important measure for many LED display companies to expand their market footprint. The U.S. market plays a pivotal role in my country's LED display export pattern. Not only does the export volume dominate, but the single transaction amount and gross profit margin are also at a relatively high level. This time, Trump will increase tariffs on China to 20%, which will inevitably reshape the market demand pattern to a certain extent and compress corporate profit margins. In the short term, small and medium-sized enterprises are likely to bear the brunt and bear huge operating pressure; in the long run, the entire industry must deeply tap its own advantages and make every effort to build core competitiveness to cope with the complex and ever-changing external environment.

In terms of coping strategies, entrepot trade has become an effective way for some enterprises to ensure market demand and avoid tariff risks. Judging from the operating status of listed companies, many LED display companies have already made arrangements in advance and set up production bases or subsidiaries overseas. Key supply chain companies have also followed suit and reduced tariff impact by setting up factories overseas. However, under the current situation, companies still need to carefully assess supply chain risks and consider transferring production capacity to Southeast Asia, India and other regions, thereby reducing logistics costs and tariff expenditures, and thereby enhancing the price competitiveness of their products. However, what needs to be vigilant is that if the United States insists on containing China goods, it is likely to impose additional tariffs on relevant goods from countries that undertake production capacity transfers, and even on goods imported from China by these countries, which will undoubtedly add a lot of uncertainty to the company's future strategic layout.

In addition to making adjustments in strategic layout, innovative competition is also the key direction for LED display companies to break through the current dilemma. China companies have made remarkable progress in the Mini/Micro LED field. Leading technologies and products are expected to stimulate new market demand and help companies seize more market share. At the same time, companies must fully consider the characteristics of overseas markets and carry out product research and development work according to local conditions. For example, overseas markets pay great attention to the practicality and energy-saving performance of products. Enterprises should take this as a guide to create unique and differentiated products and enhance product added value and market competitiveness.

According to expert Research analysis, after the additional 10% tariff is imposed this time, although the current maximum tariff of 45%(LED display is expected to be around 30%) is slightly lower than the previously estimated worst-case scenario of 60%, there are still many variables in the future. If the United States cancels its most-favored-nation status for China, tariffs on China may rise further, approaching the 60% mentioned by Trump in the policy agenda of the Republican Conference. Therefore, relevant companies must always remain highly vigilant, pay close attention to policy developments, and formulate comprehensive response plans in advance.

In the complex and ever-changing international economic and trade environment, collaborative cooperation across the LED display industry has become increasingly important. By integrating industrial chain resources, jointly expanding market scale, and jointly resisting external risks, it has become a solid foundation for the steady development of the industry. At the same time, formulating a forward-looking and feasible development plan and clarifying the evolution path of key technologies such as COB and MIP is of far-reaching significance for accurately grasping the development context of the LED display industry in 2025 and achieving sustainable development goals. Companies in the industry need to unite closely and work together in terms of technological innovation, market expansion, and strategic layout to jointly respond to external challenges and push the LED display industry to a new stage of development.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

N1 TV at the Milan International Furniture Fair: From art to MicroLED TV

-

Haier adds high-end display technology: Dual-track layout of Mini and Micro LEDs leads a new dimensi

-

Create a new chapter: Xinleguang Mini LED Backlight &Direct Display Industrial Park Phase I producti

-

Alto Electronics helps Shanghai Film Academy, and virtual studio opens a new chapter in film and tel

-

Liard·virtual moving points help the development of embodied intelligent robots and unlock new skill

-

Hon Hai plans to build a Micro LED AR ecosystem

-

Alto Electronics helps technology giant build the world's first metaverse display center

-

AUO Optronics: Innovation leads, patents empower, and move forward green

-

Liard 2025 Ecological Partner Conference: Gathering momentum and symbiosis, drawing a new blueprint

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e