Financial reports of three LED display companies are released: Multi-dimensional track competition,

- author:

- 2025-04-24 09:41:35

Recently, the three leading companies in the LED display industry chain-Tianma Microelectronics, Azure Lithium Core and Han's Laser have successively disclosed their 2024 annual reports or the first quarterly report of 2025. Against the background of a complex and ever-changing market environment, the three companies have demonstrated strong development resilience and growth potential with their differentiated business layout and technological innovation, providing a new perspective for industry development.

From the perspective of business segments, Tianma Microelectronics presents a" multi-point development" pattern. The mobile phone display business grew steadily, laying the foundation for overall performance; the car display business became the biggest highlight. In the first quarter, revenue increased by more than 30% year-on-year, and business profits achieved both year-on-year and month-on-month increases. The company has deeply participated in the screen matching of Xiaopeng's 2025 G6 coupe SUV, helping it create a new smart cockpit experience, and joined hands with Garmin to launch a new generation of digital cockpit solutions, further consolidating its leading position in the field of in-vehicle displays. The dedicated display business also performed well, with revenue and business profits achieving year-on-month growth, of which revenue increased by more than 30% year-on-year. CUHK's size business continued to expand, and the 50-inch commercial display project steadily advanced.

In terms of technological innovation, Tianma Microelectronics has always been at the forefront of the industry. Its 8-inch Micro LED IRIS PHUD panoramic head-up display won the Electronic Displays Award at the EW2025 exhibition in Germany with its ultra-high pixel density (PPI) technology. This product not only represents a major breakthrough for the company in the field of Micro LED technology, but also demonstrates its competitiveness in the high-end display market.

Although the LED display-related business has not been disclosed in detail, Azure Lithium Core relies on its diversified layout in lithium batteries, LED chips and other fields to continue to optimize its product structure and enhance market competitiveness. Through technology research and development and production capacity expansion, the company continues to enhance its voice in market segments, laying a solid foundation for the future extension and development of the LED display industry chain.

Han's laser's business covers three categories: general components and industry-popular products, industry-specific plane products, and extreme manufacturing products. In the field of semiconductor equipment (including pan-semiconductors), the company will achieve operating income of 1.775 billion yuan in 2024. Although revenue from this business fell by 16.55% year-on-year due to the impact of the industry cycle, technological breakthroughs were remarkable. A variety of mass production equipment such as SiC ingot laser peeling and grinding machine and laser debonding equipment have successfully obtained orders from major customers in the industry, marking that the company's technical strength in the field of semiconductor core equipment has been recognized by the market.

In the pan-semiconductor industry, as the prosperity of the display panel industry rebounds, Han's Laser is actively promoting technological upgrades of laser cutting, drilling, repair and other equipment. The company has successfully developed a number of domestic first sets of equipment, breaking the long-term monopoly of foreign companies in the field of high-end display equipment, obtaining bulk purchase orders from leading customers in the industry, and injecting new impetus into the company's continued growth in the display equipment market.

By focusing on core businesses, increasing technology research and development, and expanding application scenarios, the three companies have demonstrated different development paths and competitive advantages in LED display and related fields. In the future, with the continuous advancement of technological innovation and the continuous release of market demand, they are expected to further consolidate their leading position in industry transformation and inject new vitality into industrial development.

Tianma Microelectronics: In-vehicle displays become growth engines, technological innovation gains international recognition

On the evening of April 21, Tianma Microelectronics announced its first quarter 2025 financial report, delivering a bright answer sheet. During the reporting period, the company achieved operating income of 8.312 billion yuan, a year-on-year increase of 7.25%; net profit attributable to the parent company was 96.4089 million yuan, a surge of 397 million yuan compared with the same period last year. Although the net profit deducted from non-profit is still at a loss, reaching-137 million yuan, many businesses have shown strong growth momentum.

From the perspective of business segments, Tianma Microelectronics presents a" multi-point development" pattern. The mobile phone display business grew steadily, laying the foundation for overall performance; the car display business became the biggest highlight. In the first quarter, revenue increased by more than 30% year-on-year, and business profits achieved both year-on-year and month-on-month increases. The company has deeply participated in the screen matching of Xiaopeng's 2025 G6 coupe SUV, helping it create a new smart cockpit experience, and joined hands with Garmin to launch a new generation of digital cockpit solutions, further consolidating its leading position in the field of in-vehicle displays. The dedicated display business also performed well, with revenue and business profits achieving year-on-month growth, of which revenue increased by more than 30% year-on-year. CUHK's size business continued to expand, and the 50-inch commercial display project steadily advanced.

In terms of technological innovation, Tianma Microelectronics has always been at the forefront of the industry. Its 8-inch Micro LED IRIS PHUD panoramic head-up display won the Electronic Displays Award at the EW2025 exhibition in Germany with its ultra-high pixel density (PPI) technology. This product not only represents a major breakthrough for the company in the field of Micro LED technology, but also demonstrates its competitiveness in the high-end display market.

Azure Lithium Core: Rapid growth in performance, diversified layout releases development momentum.

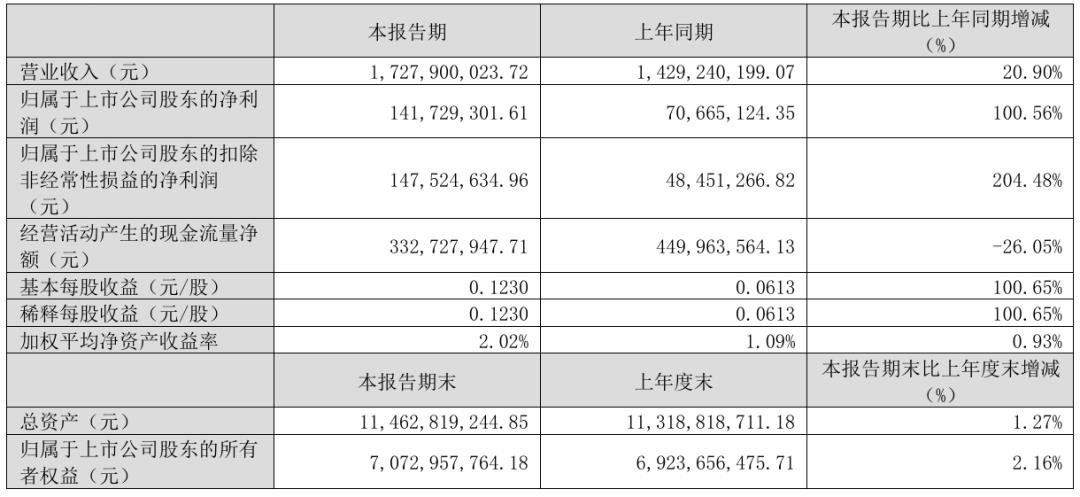

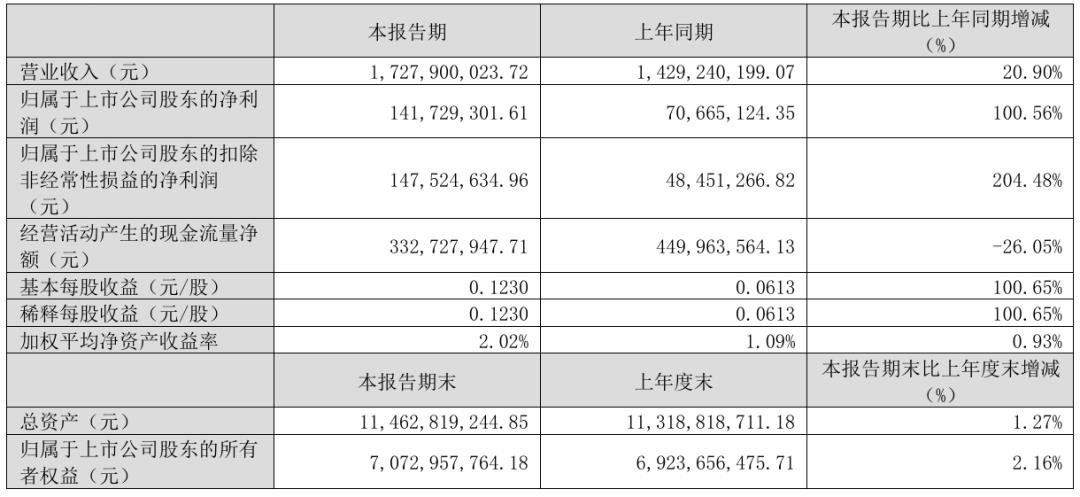

Azure Lithium Core's financial report for the first quarter of 2025 also performed well, showing strong profitability. During the reporting period, the company achieved operating income of 1.730 billion yuan, a year-on-year increase of 20.90%; net profit attributable to the parent company was 142 million yuan, a significant increase of 100.56% year-on-year; net profit deducted from non-parent company reached 148 million yuan, a year-on-year increase of 204.48%. All three core indicators achieved rapid growth.

Although the LED display-related business has not been disclosed in detail, Azure Lithium Core relies on its diversified layout in lithium batteries, LED chips and other fields to continue to optimize its product structure and enhance market competitiveness. Through technology research and development and production capacity expansion, the company continues to enhance its voice in market segments, laying a solid foundation for the future extension and development of the LED display industry chain.

Dazu Laser: Revenue grew steadily, with two-wheel drive for semiconductors and display equipment.

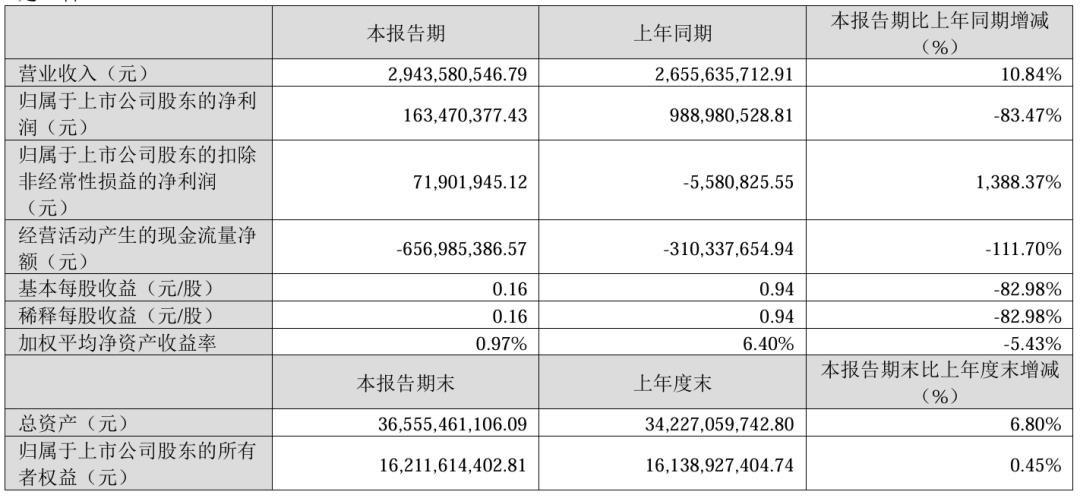

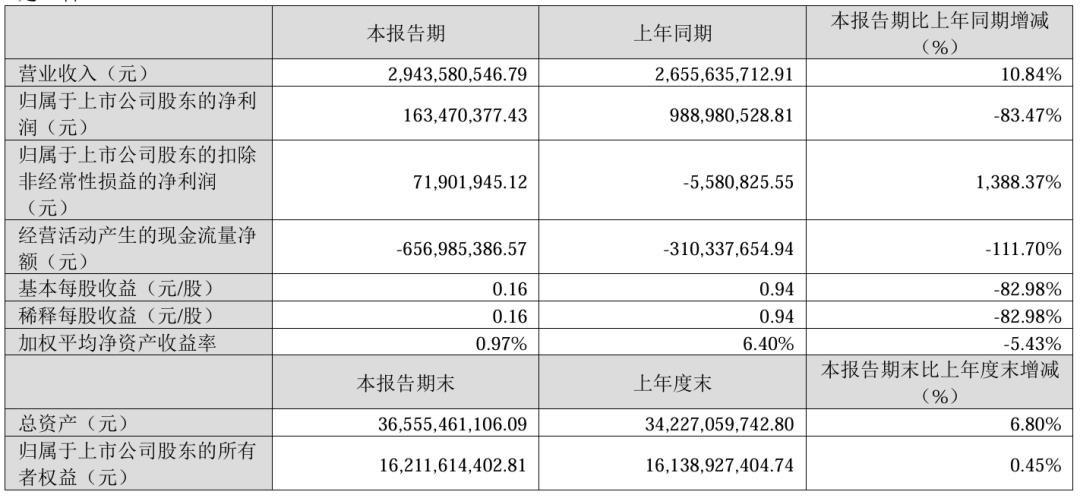

On April 21, Dazu Laser released its 2024 annual report and the 2025 quarterly report at the same time, showing the company's steady development trend under a multi-field layout. In 2024, the company achieved operating income of 14.771 billion yuan, a year-on-year increase of 4.83%; net profit attributable to the parent company was 1.694 billion yuan, a year-on-year increase of 106.52%. In the first quarter of 2025, although the net profit attributable to the parent company fell by 83.47% year-on-year to 163 million yuan, the net profit deducted from non-profit achieved a significant increase of 1388.37%, reaching 71.9019 million yuan, highlighting the resilience of the company's profitability.

Han's laser's business covers three categories: general components and industry-popular products, industry-specific plane products, and extreme manufacturing products. In the field of semiconductor equipment (including pan-semiconductors), the company will achieve operating income of 1.775 billion yuan in 2024. Although revenue from this business fell by 16.55% year-on-year due to the impact of the industry cycle, technological breakthroughs were remarkable. A variety of mass production equipment such as SiC ingot laser peeling and grinding machine and laser debonding equipment have successfully obtained orders from major customers in the industry, marking that the company's technical strength in the field of semiconductor core equipment has been recognized by the market.

In the pan-semiconductor industry, as the prosperity of the display panel industry rebounds, Han's Laser is actively promoting technological upgrades of laser cutting, drilling, repair and other equipment. The company has successfully developed a number of domestic first sets of equipment, breaking the long-term monopoly of foreign companies in the field of high-end display equipment, obtaining bulk purchase orders from leading customers in the industry, and injecting new impetus into the company's continued growth in the display equipment market.

By focusing on core businesses, increasing technology research and development, and expanding application scenarios, the three companies have demonstrated different development paths and competitive advantages in LED display and related fields. In the future, with the continuous advancement of technological innovation and the continuous release of market demand, they are expected to further consolidate their leading position in industry transformation and inject new vitality into industrial development.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Hongli Zhihui Group won two China patent awards, demonstrating its semiconductor lighting technical

-

Zhaochi Shares: Twenty years of hard work, wisdom and innovation

-

Lehman Optoelectronics helps Xi'an Xianyang International Airport open a new chapter in smart travel

-

Six companies showed that the half-year exam results of companies were released, and some were happy

-

Kopin wins $10 million military contract, Micro LED technology reshapes military AR display landscap

-

Hongshi Intelligent held a new product launch conference, and Micro LED technology made another brea

-

Guoxing Optoelectronics Xinli Electronics debuted at the 137th Canton Fair: Technology empowers ligh

-

Liard OptiTrack helps Meta: The technical game and market challenges behind smart wear

-

Guoxing Optoelectronics: Innovation journey in the field of Micro LED

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e