Small and medium size OLED shipment ranking: BOE surpassed LGD and ranked second in the world

- author:

- 2023-04-04 14:05:30

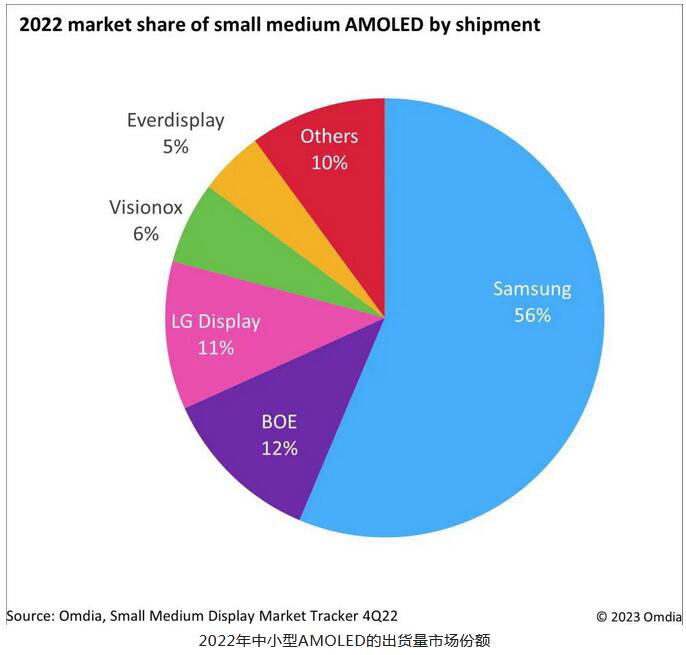

March 29 News According to Omdia's latest research "Duration Tracking Report on Small and Medium-sized size Displays", in 2022, Samsung will account for 56% of the total market share in small and medium-sized size AMoleds, ranking first, and BOE will gradually overtake Samsung, accounting for 12%.

Along with global inflation, as demand for smartphones cools, overall shipments of AMOLEDs in small and medium-sized size (9.0 inches and below) will be 762 million in 2022, a year-on-year decrease of 6%.

Samsung Display is the leading manufacturer in the AMOLED market, maintaining 429 million shipments in 2022, but its market share dropped from 61% in 2021 to 56% in 2022. LG Display will occupy 10% market share in 2021, maintaining second place, and has increased to 11% in 2022.

However, BOE has further increased shipments, accounting for 12% of the market in 2022, surpassing LG Display and ranking second. Visionox and Everdisplay, the fourth and fifth AMOLED manufacturers, are steadily increasing shipments and closing the gap with their leading South Korean rivals.

According to Hiroshi Hayase, Omdia's research manager, in the practice of display panel research: Although the gap in AMOLED shipments compared with Samsung is still large, BOE has successfully obtained orders for the iPhone 12 Flexible LTPS-AMOLED ordered by Apple and significantly improved its technical capabilities. BOE expects to gradually narrow the shipment gap with Samsung in the small and medium-sized AMOLED market in the next few years.

The AMOLED market is exploring low-power LTPO technology. Samsung has increased its extensive production capacity of LTPO-AMOLEDs to secure orders for high-end smartphones. BOE and other China display manufacturers with traditional LTPS technology have begun to increase shipments of LTPS-AMOLED to meet demand for mid-range smartphones produced by China smartphone brands located in the same region.

Hiroshi Hayase concluded that South Korean AMOLED manufacturers will maintain their technological advantages, while China AMOLED manufacturers will reduce the price of AMOLED by replacing the demand for TFT LCDs and will increase AMOLED shipments on mid-range smartphones. China AMOLED manufacturers still have room to increase shipments in the future.

TAG:

Guess you want to see it

Popular information

-

Liard's net profit in 2022 is 281 million yuan, down 53.94% year-on-year

-

Summary of the May Day color TV market in 2024: The response to holiday promotions is flat, and May

-

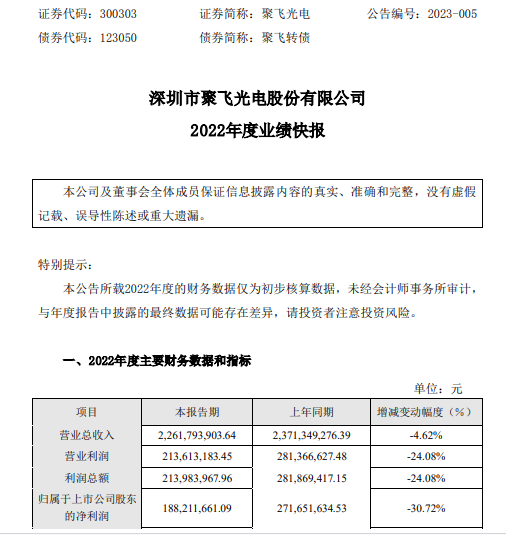

Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

-

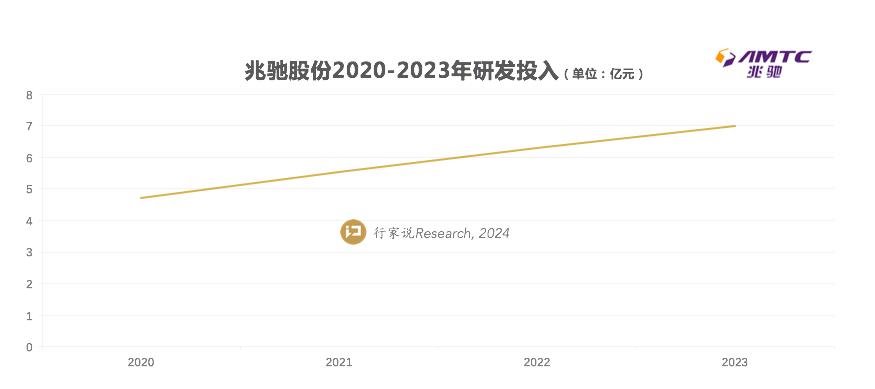

Secret in the annual report: Zhaochi's performance in 2023 is strong. What is the strength?

-

BOE's revenue in the first quarter was 45.888 billion yuan, a year-on-year increase of 20.84%

-

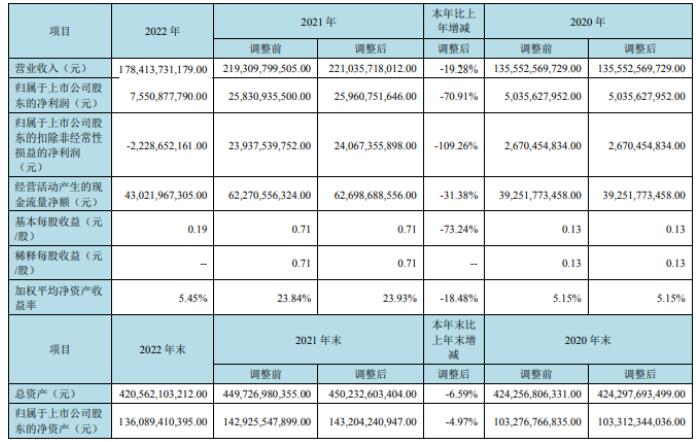

BOE A's operating income in 2022 is 178.413 billion yuan and net profit is 7.551 billion yuan

-

Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

-

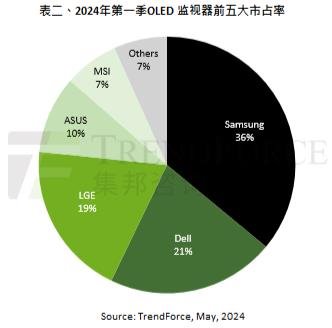

It is estimated that OLED desktop display shipments will be approximately 1.34 million units in 2024

-

Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

-

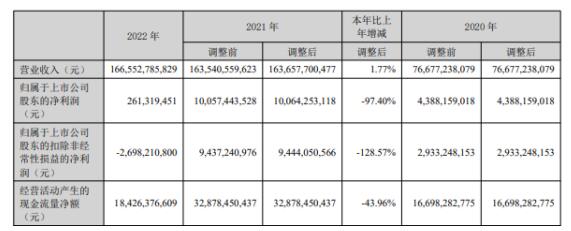

TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

the charts

- Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

- Nanda Optoelectronics: Revenue in 2022 will be 1.581 billion yuan, an increase of 60.62% year-on-yea

- Skyworth Digital: Achieve net profit of 823 million yuan in 2022, a year-on-year increase of 95.13%

- Fucai predicts that Q1 revenue will decline year-on-year, and the Micro LED production line will be

- Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

- Small and medium size OLED shipment ranking: BOE surpassed LGD and ranked second in the world

- TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

- Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

- Global OLED sales in 2023 will be 266.4 billion yuan, which will drop by 7%

- Lianchuang Optoelectronics 2022 annual net profit of 281 million with an increase of 21.31% laser bu