Nanda Optoelectronics: Revenue in 2022 will be 1.581 billion yuan, an increase of 60.62% year-on-yea

- author:

- 2023-03-25 08:50:40

Nanda Optoelectronics (300346.SZ), which started with the proprietary technology of Nanjing University's MO source, has gradually improved its industrial chain after years of layout.

Recently, Nanda Optoelectronics disclosed its annual report that in 2022, the company achieved operating income of 1.581 billion yuan, a year-on-year increase of 60.62%; net profit of 187 million yuan, a year-on-year increase of 37.07%, both reaching the highest level in the ten years since the company's listing, and compared with the lowest trough period in 2016, the increase was 14.65 times and 1.48 times respectively.

As a company in the semiconductor materials industry, Nanda Optoelectronics focuses on its main business layout such as MO sources, precursors, electronic gases, photoresists and supporting materials. In 2022, Nanda Optoelectronics's two core products, MO Source and Special Gas, will achieve operating income of 213 million yuan and 1.195 billion yuan respectively, a year-on-year increase of 28.01% and 63.46%, and capacity utilization rates will be 73.15% and 112.88% respectively. With the increase in shipments and sales of major products, the overall gross profit margin of the company's main business increased by 2.82 percentage points to 46.94% during the reporting period.

It is worth mentioning that in November last year, Nanda Optoelectronics completed a convertible bond issuance of 900 million yuan for the expansion of production capacity of core products. Due to the investment in the early stage, as of the end of 2022, the overall investment progress of the company's convertible bond fundraising projects was 49.4%, making rapid progress.

Deduction and non-increase in 2022 will be 78.39%

Data shows that Nanda Optoelectronics is a high-tech enterprise engaged in the production, research and development and sales of advanced electronic materials. Its products are widely used in the production and manufacturing of integrated circuits, flat panel displays, LEDs, third-generation semiconductors, photovoltaics and semiconductor lasers.

At present, the world is undergoing the third transfer of the semiconductor industry chain. The number of new wafer manufacturing manufacturers in China has increased, entering a period of rapid expansion of production capacity, driving the continued rise in demand in the supporting semiconductor materials industry. Benefiting from this, Nanda Optoelectronics 'operating performance has once again improved.

Recently, Nanda Optoelectronics disclosed its annual report. In 2022, the company achieved operating income of 1.581 billion yuan, a year-on-year increase of 60.62%; net profit of 187 million yuan, a year-on-year increase of 37.07%; net profit after deducting non-recurring gains and losses was 126 million yuan, a year-on-year increase of 78.39%.

In this regard, Nanda Optoelectronics stated that during the reporting period, the company focused on its main businesses such as MO sources, precursors, electronic gases, photoresists and supporting materials, seizing market opportunities, carefully planning project construction, and creating an efficient growth curve. Shipments, sales and profits of the company's main products have achieved new breakthroughs in performance based on record highs in 2021.

Changjiang Business Daily reporter noticed that in fact, in the ten years since it entered the capital market, Nanda Optoelectronics has not been smooth sailing. In August 2012, Nanda Optoelectronics was listed on the GEM. One year before listing, the company achieved a net profit of 178 million yuan, reaching a phased peak. However, after listing, Nanda Optoelectronics 'performance growth was weak. From 2012 to 2016, its performance declined for five consecutive years. Among them, the company's net profit and net profit deducted from non-profit in 2016 were only 7.5487 million yuan and 208,800 yuan respectively, which was the company's lowest trough period.

However, since 2017, Nanda Optoelectronics 'performance has bottomed out. Data shows that from 2017 to 2021, Nanda Optoelectronics achieved operating income of 177 million yuan, 228 million yuan, 321 million yuan, 595 million yuan, and 984 million yuan respectively, year-on-year increases of 74.9%, 28.76%, 40.85%, 85.13%, and 65.46% respectively; Net profit was 33.8391 million yuan, 51.2423 million yuan, 55.0113 million yuan, 87.0163 million yuan, and 136 million yuan respectively, a year-on-year increase of 348.28%, 51.43%, 7.36%, 58.18%, and 56.55%. During the above reporting period, Nanda Optoelectronics experienced negative growth in net profit excluding non-profit in 2019 and 2020 respectively.

From this perspective, Nanda Optoelectronics's operating income, net profit and non-net profit deducted in 2022 have reached the highest level after listing, and increased by 14.65 times, 1.48 times and 629 times respectively compared with the lowest trough period.

However, despite the improvement in operating results in 2022, the net cash flow generated by Nanda Optoelectronics 'operating activities during the same period was 229 million yuan, a year-on-year decrease of 12.49%.

Core product revenue increased by 46.94%

It is understood that Nanda Optoelectronics has a development history of more than 22 years. The company was first established by Suzhou Industrial Park Investment Co., Ltd., Suzhou Industrial Park Sucai Real Estate Co., Ltd., Suzhou Industrial Park Technology Development Co., Ltd., Nanjing University and Zhonghe Asset Management Co., Ltd. Five shareholders, including Co., Ltd., jointly initiated the establishment in 2000.

Among them, Nanjing University initiated the establishment of Nanda Optoelectronics's main asset is its MO source proprietary technology, which is the manufacturing of LEDs, new generation solar cells, phase change memories, semiconductor lasers, radio frequency integrated circuit chips, etc. One of the core raw materials, as long as before its launch, Nanda Optoelectronics has fully reached the international advanced level in terms of MO source synthesis and preparation, purification technology, analysis and testing, packaging containers, etc. Successfully broke the monopoly position of foreign countries in this important optoelectronic raw material field.

Changjiang Business Daily reporter noted that after Nanda Optoelectronics went public, it undertook a number of national special projects. Among them, the R & D and industrialization project of high-purity special electronic gases successfully realized the industrialization of high-purity arsine, phosphorane and other special electronic gases, breaking the blockade and monopoly of foreign technology, providing core electronic raw materials for my country's large-scale integrated circuit manufacturing and the revitalization of national industries. At the same time, two major projects in the photoresist field will also pass the acceptance of the national special expert group in 2020 and 2021.

At present, Nanda Optoelectronics 'business is divided into three segments: advanced precursor materials, electronic special gases, and photoresist and supporting materials. Among them, MO source products belong to the advanced precursor materials segment. However, in terms of revenue composition, special gases have become the core source of performance for Nanda Optoelectronics.

The annual report shows that in 2022, Nanda Optoelectronics MO source products achieved operating income of 213 million yuan, a year-on-year increase of 28.01%, accounting for 13.47% of current revenue, and the gross profit margin was 40.1%, a slight decrease of 0.12 percentage points year-on-year. In the same period, the company's special gas products realized operating income of 1.195 billion yuan, with a year-on-year growth of 63.46%, accounting for 75.58% of revenue, and the gross profit margin was 48.88%, an increase of 3.87% year-on-year, driving the overall gross profit margin of the company's main business to increase by 2.82% to 46.94%. During the reporting period, the capacity utilization rates of Nanda Optoelectronics 'special gas and MO source products were 112.88% and 73.15% respectively.

It is worth mentioning that in November last year, Nanda Optoelectronics completed a convertible bond issuance of 900 million yuan for the expansion of production capacity of core products. By the end of 2022, the investment progress of the Company's convertible bond offering project with an annual output of 45 tons of precursor products for advanced semiconductor processing, the annual output of 140 tons of high-purity phosphine, arsine expansion and arsine technological transformation project, and the annual output of 7200T electronic-grade nitrogen trifluoride project were 9.28%, 16.14% and 36.2% respectively, and the overall investment progress of the project including supplementary working capital was 49.4%. Since its own funds have been used for project investment in the early stage, the investment progress of the Nanda Optoelectronics project is relatively rapid.

TAG:

Guess you want to see it

Popular information

-

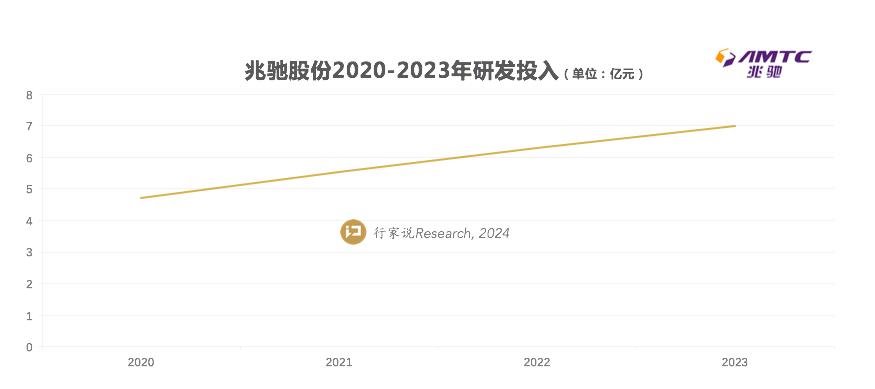

Secret in the annual report: Zhaochi's performance in 2023 is strong. What is the strength?

-

Summary of the May Day color TV market in 2024: The response to holiday promotions is flat, and May

-

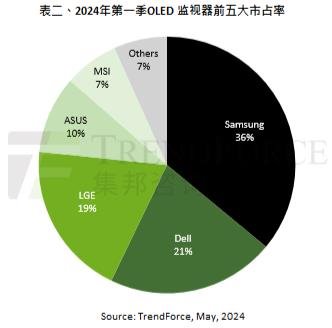

It is estimated that OLED desktop display shipments will be approximately 1.34 million units in 2024

-

Liard's net profit in 2022 is 281 million yuan, down 53.94% year-on-year

-

BOE's revenue in the first quarter was 45.888 billion yuan, a year-on-year increase of 20.84%

-

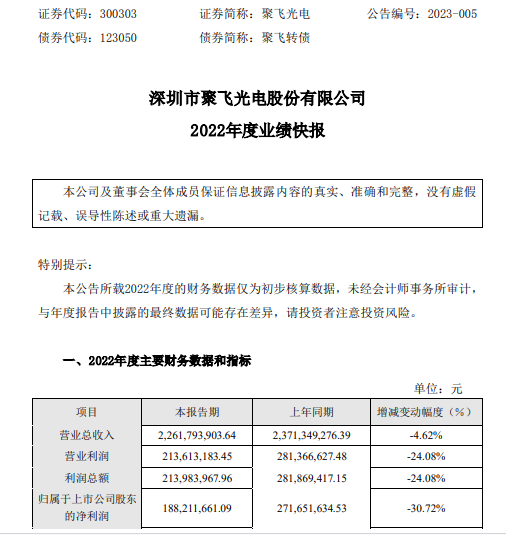

Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

-

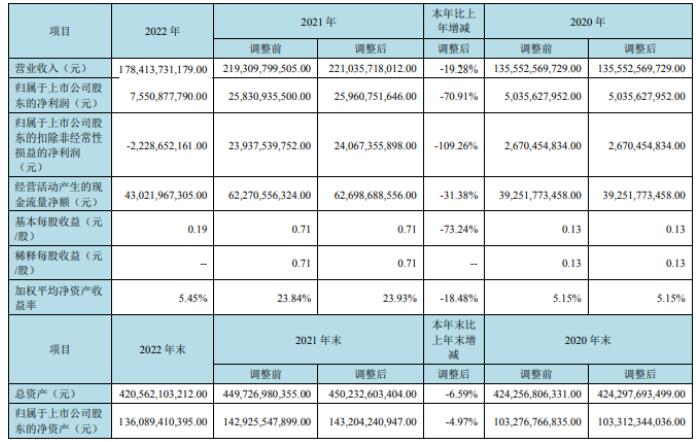

BOE A's operating income in 2022 is 178.413 billion yuan and net profit is 7.551 billion yuan

-

Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

-

Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

-

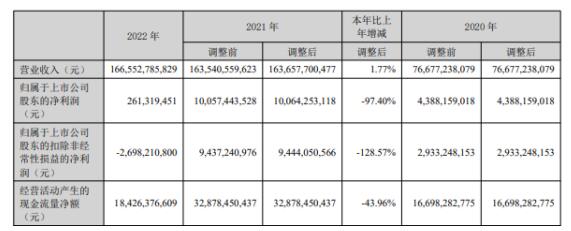

TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

the charts

- Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

- Nanda Optoelectronics: Revenue in 2022 will be 1.581 billion yuan, an increase of 60.62% year-on-yea

- Skyworth Digital: Achieve net profit of 823 million yuan in 2022, a year-on-year increase of 95.13%

- Fucai predicts that Q1 revenue will decline year-on-year, and the Micro LED production line will be

- Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

- Small and medium size OLED shipment ranking: BOE surpassed LGD and ranked second in the world

- TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

- Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

- Global OLED sales in 2023 will be 266.4 billion yuan, which will drop by 7%

- Lianchuang Optoelectronics 2022 annual net profit of 281 million with an increase of 21.31% laser bu