Secret in the annual report: Zhaochi's performance in 2023 is strong. What is the strength?

- author:

- 2024-05-27 10:44:53

Since Zhaochi has adopted various actions in the past two years, indicating that it will enter the LED display industry on a large scale and strive to create the world's largest COB manufacturing factory, the industry and capital market are very concerned about Zhaochi's performance.

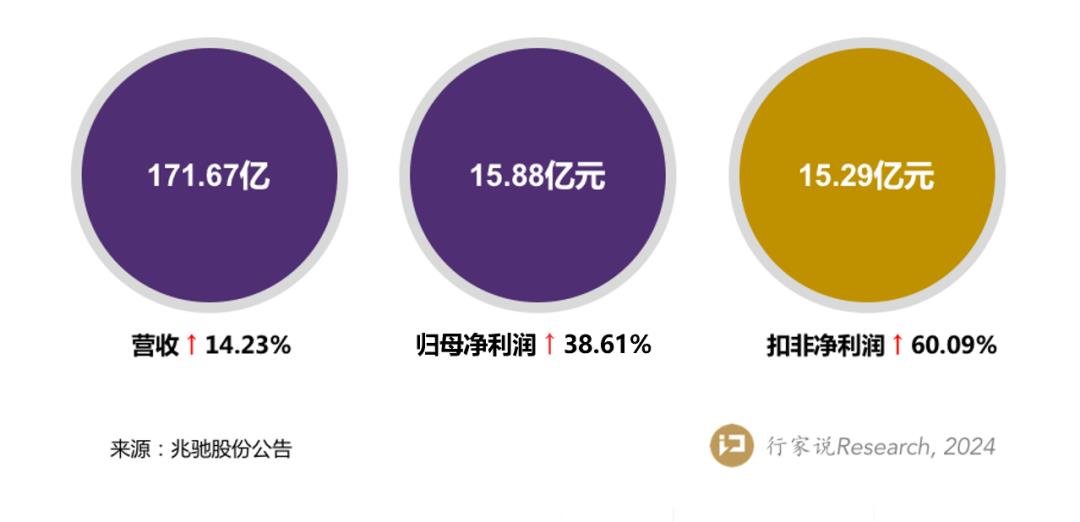

On the evening of April 12, Zhaochi disclosed its 2023 annual report that revenue, net profit, and profit deducted from fees all achieved growth, and the overall performance was strong-in 2023, the company achieved revenue of 17.167 billion yuan, a year-on-year increase of 14.23%; Net profit was 1.588 billion yuan, a year-on-year increase of 38.61%; non-net profit deducted was 1.529 billion yuan, a year-on-year increase of 60.09%, and the profitability level was significantly improved.

So what is the specific composition of the report card handed over by Zhaochi in 2023? How relevant is it to the LED industry chain and COB display products? What have changed in fundamentals and business aspects? What challenges will we face next?

We use the data in the financial report to understand the latest financial situation and operating style of Xiazhaochi.

01

Fundamentals and financial situation

In addition to the three data mentioned above, there are also the following key data worthy of attention:

1. Total assets increased by 4.36% year-on-year to 26.724 billion yuan, and net assets increased by 8.73% year-on-year to 14.8 billion yuan;

2. ROE was 11.18%, a year-on-year increase of 2.45%;

3. The asset-liability ratio dropped to 43.02%, and the net cash flow from operating activities decreased to 2.351 billion yuan.

4. Net cash flow from investing activities increased by 105.15% year-on-year, and net cash flow from financing activities decreased by 103.24% year-on-year

5. Sales expenses increased by 11.23% year-on-year, management expenses decreased by 1.73% year-on-year, and financial expenses decreased by 28.52% year-on-year

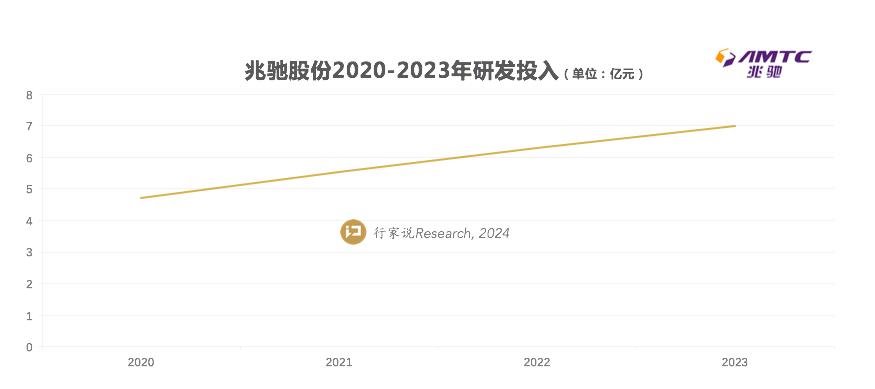

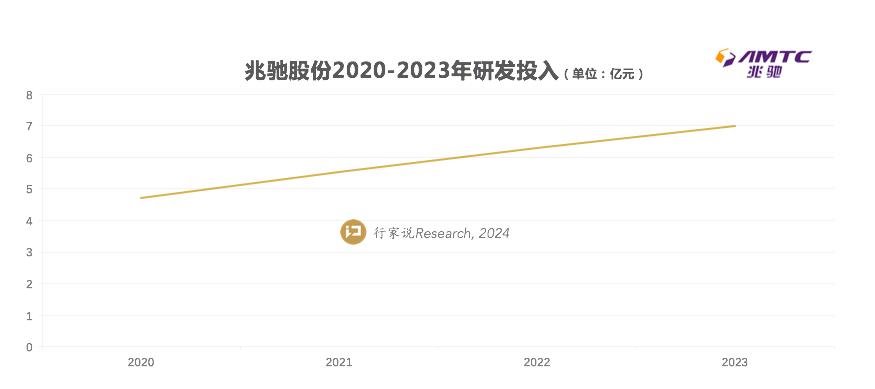

6. R & D expenses from 2020 to 2023 are 472 million yuan, 555 million yuan, 630 million yuan, and 704 million yuan respectively, increasing year by year;

It can be seen from the above data that Zhaochi shares performed well in terms of assets, ROE, and asset-liability ratio; among them, the net cash flow from operating activities decreased by 52.43% compared with the same period last year (but still much higher than net profit). The main reason was the increase in cash paid by related parties for the transfer of Evergrande's creditor's rights in the same period last year and the increase in cash paid for purchasing goods and accepting services during the reporting period.

Experts said research believes that the latter's increase in cash to purchase goods and receive services may be related to Zhaochi's expansion of production and the need to purchase more raw materials and pay for service fees.

02

Business situation

The two core sectors of Zhaochi Stock are smart display and LED entire industry chains. The specific performance of each business segment is as follows:

Financial level

1. The overall revenue of the LED industry chain reached 4.5 billion yuan, a year-on-year increase of 19.13%(an increase of approximately 720 million yuan);

2. The revenue of Zhaochi Semiconductor in the chip sector was 2.075 billion yuan (+26.29%);

3. COB's revenue is 541 million yuan, and its net profit is 35 million yuan. This is a large increase in the revenue of the LED industry chain, with an absolute increase of about 400 million yuan, and a contribution rate of more than 50%;

4. Other multimedia sectors (including TV OEM ODM, audio-visual, etc.) amounted to approximately 12.7 billion yuan, an increase of 12.58%;

5. Fengxing Online achieved operating income of 675 million yuan and net profit of 94 million yuan;

6. In addition, the gross profit margin of the LED industry chain was 25.81%, an increase of 4.95% year-on-year, much higher than the multimedia sector's 16.34%;

7. The most profitable business: multimedia audio-visual products and operation services (profit ratio 64.03%).

Production and sales

Chip segment: As of the end of December 2023, the output of gallium nitride chips was 1.05 million (4-inch chips); during the reporting period, the output of gallium arsenide chips was 50,000 (4-inch chips). The overall LED chips are fully produced and sold (equivalent to 2 inches of 4.4 million per month), and the monthly shipments of Mini RGB flip chips are 10000KK groups.

COB segment: As of April 2024, the company's monthly production capacity is 16000 square meters (calculated based on P1.25 point spacing products). Products cover P0.625-P2.5, and actual shipments are mainly P1.25 and P0.9. At the beginning of 2024, new COB modules suitable for P1.5-P2.5 were launched. The penetration rate has increased in commercial displays such as consumer-oriented educational screens and conference all-in-one machines, and home theaters. This means that the penetration rate of Zhaochi's COB display technology above P1.56 in point-to-point products will gradually increase, which is expected to occupy a larger market share in the future.

Mini LED backlight segment: As the cost of Mini LED-backlit TVs has decreased and the penetration rate has increased, the company's TV ODM segment has begun to accept orders for Mini LED TVs. In addition, the announcement in the first quarter of 2024 shows that the main reasons for the year-on-year increase in net profit are: ODM operating results are stable, while the LED industry chain has grown significantly year-on-year. (The LED chip sector completed production expansion and increased production in July 2023. The COB direct display sector increased orders and production expansion was carried out simultaneously in the second half of 2023. This situation continued until Q1.)

03

Experts say research summary

In 2023, Zhaochi shares will continue to stabilize the company's fundamentals, maintaining a growth rate of around 10%. In the second growth pole, the LED industry chain, it has achieved a growth of nearly 20%, and the gross profit margin has increased by nearly 10 percentage points. From a strategic perspective, it is creating a better business model that transcends itself.

As far as the LED industry chain is concerned, chips are already one of the few typical representatives in the industry that has achieved full production and full sales and has a large profit after deducting non-profit. Starting from "scale and advantages" to "scale value";Mini LED Backlighting has become a representative of leading companies in the industry, especially the backlight module customers of Mini LED TV have covered domestic and foreign leading TV brand customers.

Look again at COB, which has high hopes. From an industry perspective, since Sony demonstrated Micro LED TVs based on COB technology in 2016, which stunned the industry. In the following years, COB has attracted much attention from the industry, but the market performance has been tepid. In the past two years, Zhaochi has broken this deadlock through various actions such as polishing manufacturing, expanding production capacity, and adjusting product technical routes.

There are two important supports behind this:

1. The new display industry has entered the era of technological upgrading. No matter what route, whoever grasps chip resources will have the pricing power and iteration speed, and whoever has more options and winning chips. Zhaochi's business model in the LED industry chain is the layout of the entire industry chain. The brilliant thing is that before the COB technology route was significantly increased, Zhaochi Semiconductor had already taken the lead, laid the chip cornerstone, and grasped the highest cost ratio. Material control.

2. Behind the lukewarm COB, there are two major pain points: one is cost; the other is effect. Chips can solve most cost problems, while the TV thinking supplied by the main business and the world's top intelligent manufacturing experience can quickly empower COB full-process manufacturing, open up key processes in each link, and ultimately improve manufacturing efficiency.

The final result presented to everyone is that COB's revenue has experienced significant growth, its market share of P1.2 and below exceeds 50%, and it has led the penetration of P1.5-P2.5 markets.

Of course, what is very important behind this is the determination and speed of the helm.

At present, the momentum of Zhaochi COB will indeed put a lot of pressure on COB competitors, but it has also successfully broadened the overall COB market. For new manufacturers, it has greater cost control and yield efficiency. Threshold and challenges. As a result, the industry has divided into two camps: one is the large-scale and standardized route led by Zhaochi Jingxian; the other is the subdivision and customized route.

It can be said that Zhaochi's "momentum has emerged and is ready to be prosperous" in the COB sector, but it is also facing increasingly fierce competition-catching up by its peers, strong defense on the competitive technical route, etc., so whether it can continue to stride forward and make great achievements will still test the strategic determination, execution courage, alliance ability and industry patience of the helm.

Note: This article is limited to industry and enterprise analysis only and does not constitute investment advice.

END

Related reading:

What signals did Zhaochi Crystal Display Micro LED Direct Display TV release when going out to sea?

Zhaochi Shares 'performance forecast: COB's monthly production capacity is 10000 square meters

TAG:

Guess you want to see it

Popular information

-

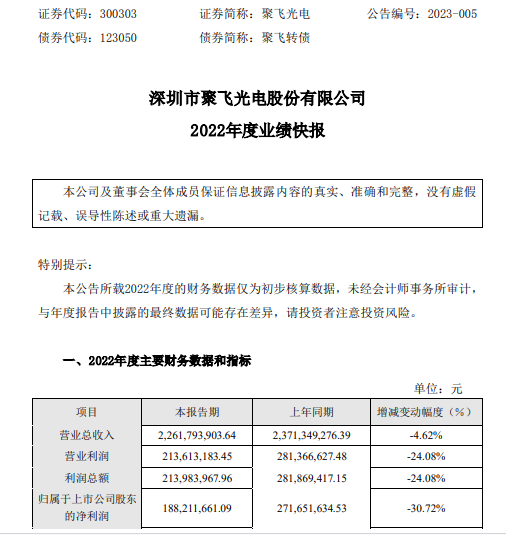

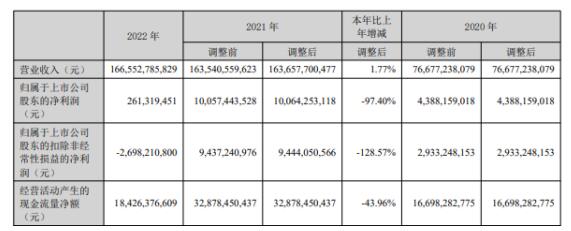

Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

-

Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

-

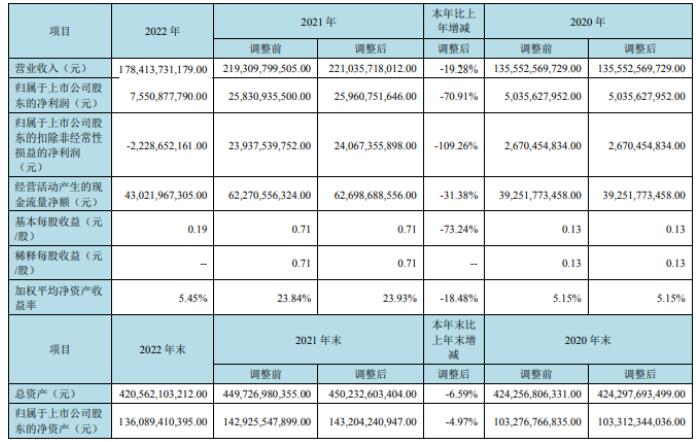

BOE A's operating income in 2022 is 178.413 billion yuan and net profit is 7.551 billion yuan

-

Liard's net profit in 2022 is 281 million yuan, down 53.94% year-on-year

-

TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

-

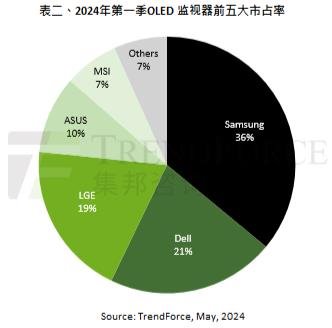

It is estimated that OLED desktop display shipments will be approximately 1.34 million units in 2024

-

Summary of the May Day color TV market in 2024: The response to holiday promotions is flat, and May

-

Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

-

Secret in the annual report: Zhaochi's performance in 2023 is strong. What is the strength?

-

BOE's revenue in the first quarter was 45.888 billion yuan, a year-on-year increase of 20.84%

the charts

- Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

- Nanda Optoelectronics: Revenue in 2022 will be 1.581 billion yuan, an increase of 60.62% year-on-yea

- Skyworth Digital: Achieve net profit of 823 million yuan in 2022, a year-on-year increase of 95.13%

- Fucai predicts that Q1 revenue will decline year-on-year, and the Micro LED production line will be

- Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

- Small and medium size OLED shipment ranking: BOE surpassed LGD and ranked second in the world

- TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

- Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

- Global OLED sales in 2023 will be 266.4 billion yuan, which will drop by 7%

- Lianchuang Optoelectronics 2022 annual net profit of 281 million with an increase of 21.31% laser bu