Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

- author:

- 2023-04-04 14:07:39

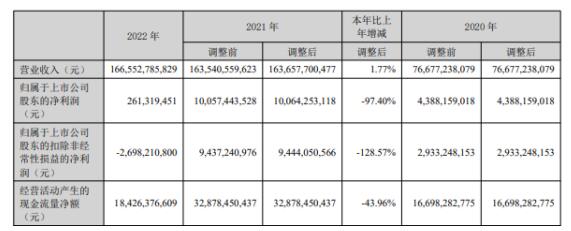

On March 30, Silan Micro (600460) recently released its 2022 annual report. During the reporting period, the company achieved operating income of 8,282,201,633.03 yuan, a year-on-year increase of 15.12%; net profit attributable to shareholders of listed companies was 1,052,416,787.13 yuan, a year-on-year decrease of 30.66%.

During the reporting period, the net cash flow from operating activities was 203,754,613.49 yuan, and the net assets attributable to shareholders of the listed company were 7,373,712,748.30 yuan.

In 2022, the operating income of the company's IPM modules will reach 1.42 billion yuan, an increase of more than 65% over the same period last year. At present, the company's IPM modules have been widely used in frequency conversion products of downstream home appliances and industrial customers, including air conditioners, refrigerators, washing machines, range hoods, ceiling fans, household fans, industrial fans, water pumps, elevator door machines, sewing machines, power tools, industrial frequency converters, etc. In 2022, many domestic mainstream white electricity manufacturers used more than 78 million Silan IPM modules on white electricity machines such as inverter air conditioners, an increase of 105% over the same period last year. In 2022, the company launched an IPM solution for driving new energy vehicle air conditioner compressors, and completed batch supply from TOP domestic automotive air conditioner compressor manufacturers; it is expected that the operating income of the company's IPM modules will continue to grow rapidly in the future.

The announcement shows that the total remuneration of directors, supervisors and senior management during the reporting period was 21.1449 million yuan. Chairman Chen Xiangdong received a total pre-tax remuneration of 1.55 million yuan from the company, Vice Chairman and General Manager Zheng Shaobo received a total pre-tax remuneration of 1.546 million yuan from the company, and Chen Yue, Chief Financial Officer and Secretary of the Board of Directors, received a total pre-tax remuneration of 2.435 million yuan from the company.

The announcement disclosure shows that the profit distribution plan or the plan for converting provident fund into share capital for the reporting period approved by the resolution of the board of directors: the company plans to distribute profits based on the total share capital registered on the equity registration date of the implementation of equity distribution in 2022. The company plans to distribute a cash dividend of 1.00 yuan (including tax) for every 10 shares to all shareholders. As of December 31, 2022, the company's total share capital is 1,416,071,845 shares, based on this calculation, the total proposed cash dividend is 141,607,184.50 yuan (including tax). For example, during the period from the disclosure date of the profit distribution plan to the equity registration date of implementing the equity distribution, the company's total share capital changes due to convertible bond conversion/share repurchase/equity incentive grant share repurchase and cancellation/material asset reorganization share repurchase and cancellation. If the company plans to keep the total allocation unchanged and adjust the distribution ratio per share accordingly.

Data show that Slanwei's business scope is: design, manufacturing and sales of electronic components, electronic parts and other electronic products; import and export of mechanical and electrical products. The main products include three categories: integrated circuits, semiconductor discrete devices, and LED (Light Emitting Diode) products.

TAG:

Guess you want to see it

Popular information

-

Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

-

Liard's net profit in 2022 is 281 million yuan, down 53.94% year-on-year

-

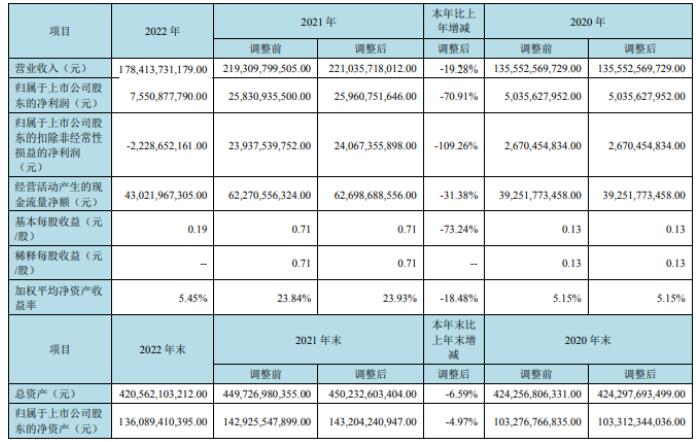

BOE A's operating income in 2022 is 178.413 billion yuan and net profit is 7.551 billion yuan

-

BOE's revenue in the first quarter was 45.888 billion yuan, a year-on-year increase of 20.84%

-

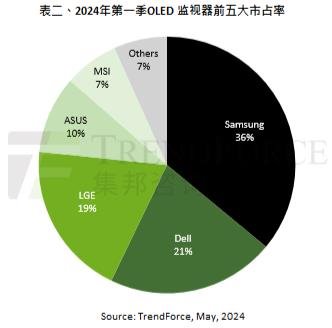

It is estimated that OLED desktop display shipments will be approximately 1.34 million units in 2024

-

Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

-

Summary of the May Day color TV market in 2024: The response to holiday promotions is flat, and May

-

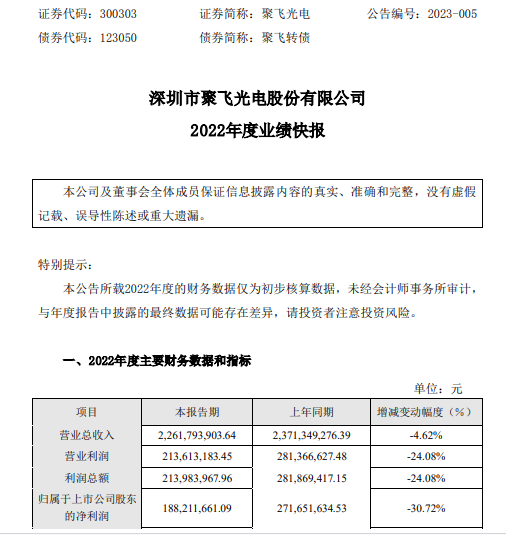

Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

-

Secret in the annual report: Zhaochi's performance in 2023 is strong. What is the strength?

-

TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

the charts

- Hikvision's 2022 net profit of 12.827 billion yuan, down 23.65% year-on-year

- Nanda Optoelectronics: Revenue in 2022 will be 1.581 billion yuan, an increase of 60.62% year-on-yea

- Skyworth Digital: Achieve net profit of 823 million yuan in 2022, a year-on-year increase of 95.13%

- Fucai predicts that Q1 revenue will decline year-on-year, and the Micro LED production line will be

- Jufei Optoelectronics '2022 net profit of 188 million yuan fell 30.72% year-on-year

- Small and medium size OLED shipment ranking: BOE surpassed LGD and ranked second in the world

- TCL Technology's net profit in 2022 will be 261 million yuan, down 97.4% year-on-year

- Slanwei's net profit in 2022 is 1.052 billion yuan, down 30.66% year-on-year

- Global OLED sales in 2023 will be 266.4 billion yuan, which will drop by 7%

- Lianchuang Optoelectronics 2022 annual net profit of 281 million with an increase of 21.31% laser bu