Abbison's performance in 2025 will increase by more than 100%

- author:

- 2026-01-13 10:04:16

On January 8, Abison disclosed its full-year results forecast for 2025, and the company expects full-year results to increase significantly. Among them, the net profit attributable to shareholders of listed companies is expected to be 240 million yuan to 290 million yuan, a year-on-year increase of 105.32% to 148.09%; operating income is expected to be 4.156 billion yuan, and basic earnings per share is expected to be 0.6502 yuan to 0.7857 yuan. The overall operating situation is outstanding.

In terms of revenue structure, Abbison's overseas market will continue to make efforts in 2025. After years of deep cultivation and scientific layout, the company has continuously deepened its localized operation strategies, built an efficient and coordinated global channel network, formed differentiated brand competitive advantages, and steadily enhanced its competitiveness in the international market. At present, the company's business has covered more than 140 countries and regions, and the overseas market has achieved operating income of approximately 3.193 billion yuan, a year-on-year increase of 8.94%, continuing the steady growth momentum.

In the domestic market, against the background of weak overall demand in the LED display industry, Abison achieved counter-trend growth through precise policies. The company focuses on high-quality customer groups, optimizes the product matrix structure, and adjusts channel operation strategies. A series of key measures have achieved remarkable results. The domestic market achieved operating income of approximately 963 million yuan, a year-on-year increase of 31.56%. Profitability has improved simultaneously. During the reporting period, the company's comprehensive gross profit margin was approximately 31%, an increase of 3.5 percentage points from 2024. This achievement benefits from multi-dimensional operational optimization: the R & D side continues to increase investment, building a virtuous cycle in which R & D investment technology breaks through the market premium; the product and delivery side promotes the strategy of large single products, relying on scientific product planning and intelligent manufacturing upgrades and collaborative optimization of supply chain to achieve large-scale, standardized and efficient production; the market side continues to strengthen brand influence, build a service moat, focus on high-value projects and high-quality customer operations, and continuously improve the value of customers throughout the life cycle.

In terms of expense management and control, Abison achieved precise and efficient resource allocation in 2025. The company continues to focus on investment in core areas such as cutting-edge technology research and development, global capacity building, localized operation improvement, brand building, organizational capacity upgrading, talent incentives and channel system optimization; at the same time, it actively shrinks inefficient market investment and concentrates resources on high-value markets., core products, high-quality customers and efficient channels promote the maximization of cost investment benefits. Benefiting from this, the company's inter-period expense ratio decreased by approximately 0.8 percentage points year-on-year during the reporting period.

The cash flow performance is also outstanding. The net cash flow generated by the company's operating activities in 2025 will be approximately 824 million yuan, a significant year-on-year increase of 440%. The improvement in cash flow mainly comes from two aspects: on the one hand, the company actively screened high-quality customers, focused on high-quality orders, strictly implemented credit policies, and continued to strengthen accounts receivable management. The receivable turnover days were shortened by approximately 16 days compared with the previous year; On the other hand, relying on the large single product strategy and lean production model, inventory turnover efficiency was continuously improved, inventory turnover days were shortened by approximately 3 days, and overall operating capabilities were significantly enhanced.

In addition, the company expects the impact of non-recurring gains and losses on net profit in 2025 to be approximately 21.15 million yuan, a decrease from the same period in 2024. Non-recurring gains and losses mainly come from various government subsidies received by the company, investment income generated from the use of idle funds, and the reversal of impairment provisions for receivables that are subject to separate impairment testing.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

TCL China Star Global Display Ecology Conference: Lighting up the new future of display technology

-

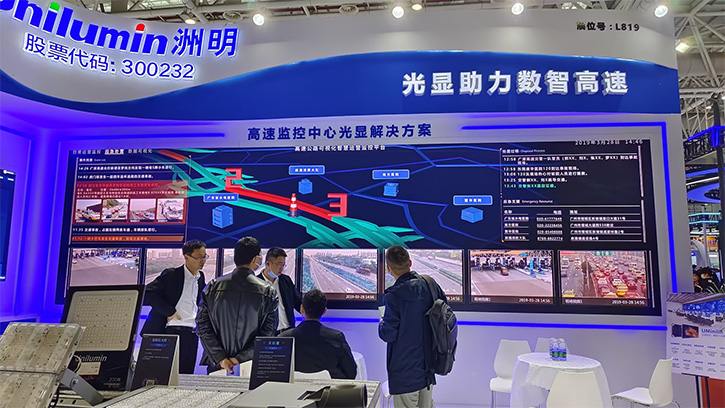

Zhouming AI products and solutions official website officially launched

-

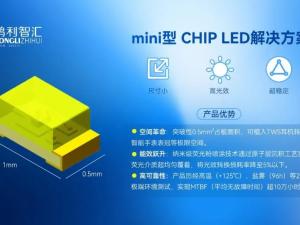

Hongli Zhihui leads industry breakthroughs, and mini CHIP LED opens a new chapter in smart devices

-

The wave of virtual production sweeps across the Asia-Pacific, Malaysia's XyperReal Stage reshapes a

-

Hongli Zhihui's operating income in 2024 will hit a record high, and its high-quality development mo

-

Thirty years of Liard: writing the legend of the leader of China's technology companies through tech

-

A number of star products were unveiled at the 2023 High-speed Exhibition to see how Zhou Mingguang

-

Alto Electronics: LDI 2024 shines brightly on smart video

-

BOE Crystal Core MLED Project: Lighting up a new journey of display technology

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e