Thirty Years of Liard: Industrial Game and Strategic Breakthrough Behind Light and Shadow

- author:

- 2025-07-16 16:45:57

Thirty years ago, when LED display technology had not yet entered the public's eye, Liard opened the door to the industry with a full-color display; thirty years later, this company has become the invisible champion in the global LED display field, from the Olympic stage to Hollywood studios, from smart cities to embodied intelligence, its technological footprint is spread across every corner of the world. In this new year, we must not only applaud its brilliant achievements, but also examine the industrial logic and market challenges behind them from a cold perspective.

1. Hidden worries on the throne of technology: microled's sweet trap"

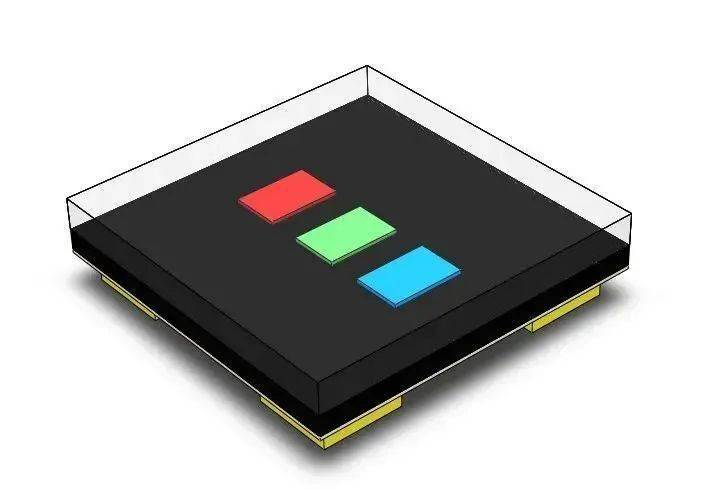

Liard's breakthrough in the field of MicroLED can be regarded as an industry benchmark. Revenue will double in 2024. The mass production technology of substrateless chips below 50 meters will lead the world, and the transfer efficiency of huge amounts will be increased by 150 times. However, there are hidden risks behind the technological advantages: on the one hand, giants such as BOE and Samsung are accelerating their catch-up. BOE has clearly identified MicroLED as its core strategy in the next ten years. Its cross-border breakthroughs in perovskite photovoltaic and glass-based packaging technologies may reshape the industrial chain. Competition pattern; On the other hand, in order to maintain its technological leadership, Liard invests 6%-7% of its annual revenue in R & D, while its net profit in the first quarter of 2025 fell by more than 90% year-on-year. The imbalance between technology investment and short-term returns has become increasingly prominent.

What is even more alarming is that there is uncertainty in the market acceptance of MicroLEDs. Although Liard has launched home theater solutions, the consumer-grade market will take time to cultivate, while the commercial market is facing price squeeze from Mini LEDs. For example, in high-end conference room scenarios, the price of Mini LED displays has dropped to 1/3 of that of MicroLED, which poses a direct challenge to Liard's market expansion.

Second, the ice and fire behind globalization"

Liard's overseas layout shows distinctive dual-track characteristics: the Asian, African and Latin American markets grew by 40% year-on-year, becoming the biggest bright spot; but the European and American markets have fallen into a growth bottleneck. The US subsidiary Natural Point has suffered from a strike in the film and television industry and a contraction in investment in the metauniverse, resulting in goodwill impairment of more than US$85 million. This regional differentiation exposes the deep contradictions in its globalization strategy:

Brand premium dilemma

: In the high-end markets in Europe and the United States, Liard still has to face brand suppression from Samsung The Wall and Sony CLEDIS. For example, although CNN TV in the United States uses Liard products, the core control room still uses Sony displays.

Shortcomings in localized operations

: The production capacity of the factory in Slovakia has doubled to 1000kk /month, but the European market share is still less than 15%, far lower than Samsung's 32%. This reflects the lag in its channel construction and after-sales service network.

Cumulative policy risks

: Although the Middle East market is growing rapidly, the commissioning of Saudi factories faces geopolitical uncertainty, and the local government has strict requirements on localization rates, which may erode profit margins.

3. Crisis on the prosperity of cultural tourism night tours Liard participated in the nine major cultural tourism projects selected as demonstration cases by the Ministry of Culture and Tourism. They may seem to be endless, but in fact they hide crises:

The fragility of the government-paying model

: More than 70% of cultural tourism night tour projects rely on the government budget. However, local financial pressure will intensify in 2024, and the payment cycle of some projects will be extended to 18 months, resulting in Liard's accounts receivable turnover days increased by 23 days year-on-year.

The ceiling of content innovation

: Despite the success of projects such as "Seeing Pingyao Again", there is serious homogenization competition in the industry. For example, there are 12 similar light show projects around Xi'an Datang Sleepless City. The marginal experience of tourists has declined, and the return on investment of continued projects has dropped by 30%.

Dimension reduction attack of technological iteration

: New technologies such as flexible electronic paper and holographic projection are reconstructing cultural and tourism scenes. The machine-washable electronic paper wearable device developed by the Sun Yat-sen University team may subvert the application model of traditional LED displays. If Liard fails to respond quickly, it will face the risk of being replaced.

4. AI and robots: The life and death speed of the new track Liard's exploration in the field of AI and spatial computing is worthy of recognition: motion capture technology serves 69% of Hollywood blockbusters, and tailored intelligent solutions have been applied to robot marathons. But this track is also full of thorns:

The technological divide across borders

: AI training requires a large amount of data support. Although Liard's existing action database has an accuracy of 0.1 mm, the data volume is only 1/5 of that of Tesla Optimus, which is difficult to meet the needs of complex scenarios.

The passivity of ecological cooperation

: In the field of specific intelligence, Liard mainly provides hardware support, while the core algorithm still relies on cooperation with companies such as Songno Power. This role of Party B may limit its role in the industrial chain. The right to speak.

Long cycle of market verification

: Robot training services currently only contribute 2.3% of revenue, and the main customers are concentrated in scientific research institutions. It will take 3-5 years to be commercialized. During this window period, competitors such as Boston Dynamics and Universal Choice may have completed technical iteration.

5. The way to break the situation: Facing multiple challenges from display companies to visual ecosystem builders, Liard needs to achieve three major transformations at the strategic level:

Addition and subtraction of technical routes"

:

addition

: Increase investment in research and development of cross-border technologies such as perovskite displays and quantum dot materials, learn from the collaborative model of BOE display + photovoltaic, and explore the application of MicroLEDs in the new energy field.

subtraction

: Divest the traditional LED display business with low margin, such as outsourcing the monochrome screen production line and focusing on high-end customized products.

Precision scalpel for global strategy"

:

Consolidate Asia, Africa and Latin America

: While the Saudi factory is put into operation, it cooperates with local universities to establish a joint laboratory to cultivate localized technical teams and improve policy compliance.

Deep cultivation in Europe

: Acquired small and medium-sized system integrators in Europe and cut into the core scenarios of smart cities through the technology + service bundling model.

shrinking North America

: Transform Natural Point into an AI data service provider and leverage its advantages in motion capture technology to expand into autonomous driving, medical rehabilitation and other fields.

Genetic mutations in business models"

:

From selling products to selling services

: Launched a Display as a Service (DaaS) model, charging based on the duration of use, and also providing value-added services such as AI content generation and device operation and maintenance.

Build a visual ecological platform

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Liard's new generation high-end MIP production line: A major breakthrough and transformation in the

-

2025 Red Dot Award: Four Zhouming products are on the list

-

Nova Nebula, Abison, BOE, and Lianjian Optoelectronics have their own highlights and challenges in i

-

Alto Electronics helps Amazon Cloud Technology AWS build a new virtual reality studio XR Studio

-

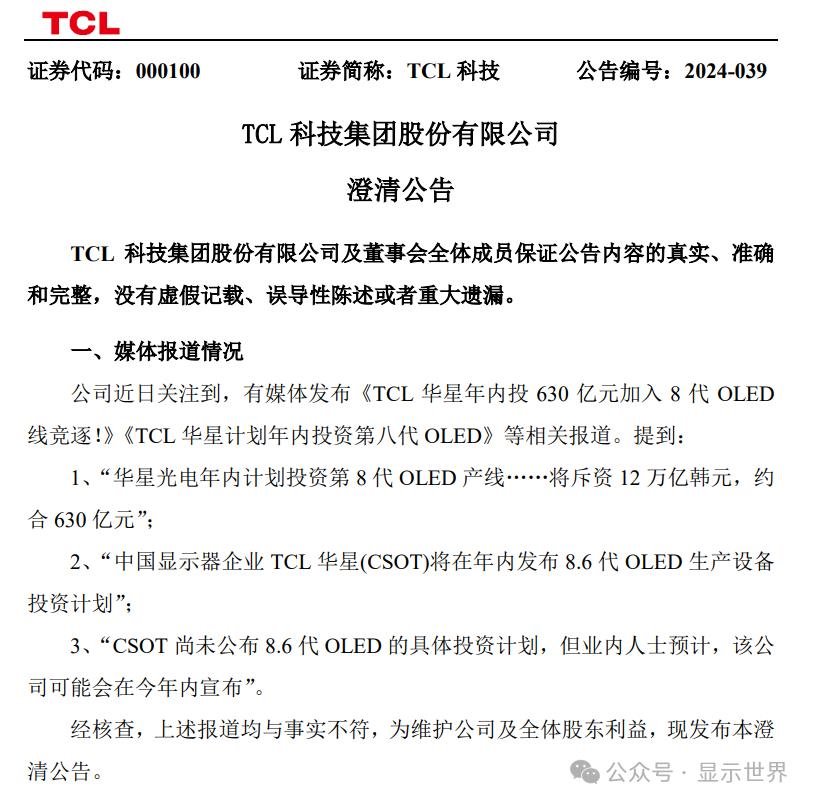

TCL Technology: Currently, there is no investment plan to build a new 8th or 8.6th generation OLED p

-

Riyadh and Saudi EHG Group join hands to illuminate a new future of display and lighting in the Midd

-

Aixinwei and BOE join hands to create new glory in intelligent interactive equipment

-

Azure Lithium Core is deployed overseas and plans to invest more than 600 million yuan in Malaysia t

-

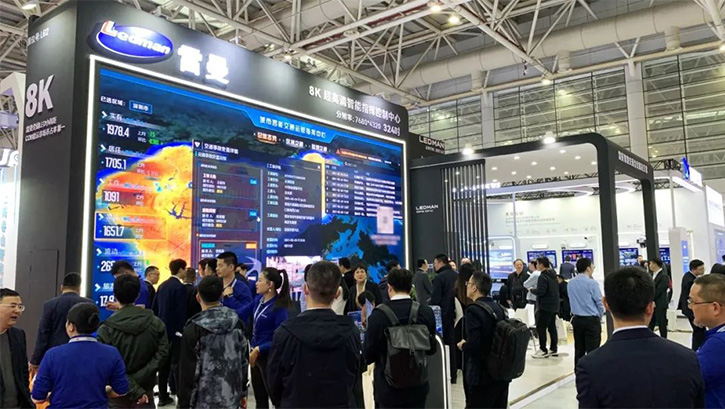

Lehman Appears at the 25th China High-Speed Exhibition to Help Digital Upgrade of Smart Transportati

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e