GQY Video received 17.5 million yuan from Taiheng Optoelectronics 70% shares to make up for shortcom

- author:

- 2025-10-24 17:44:22

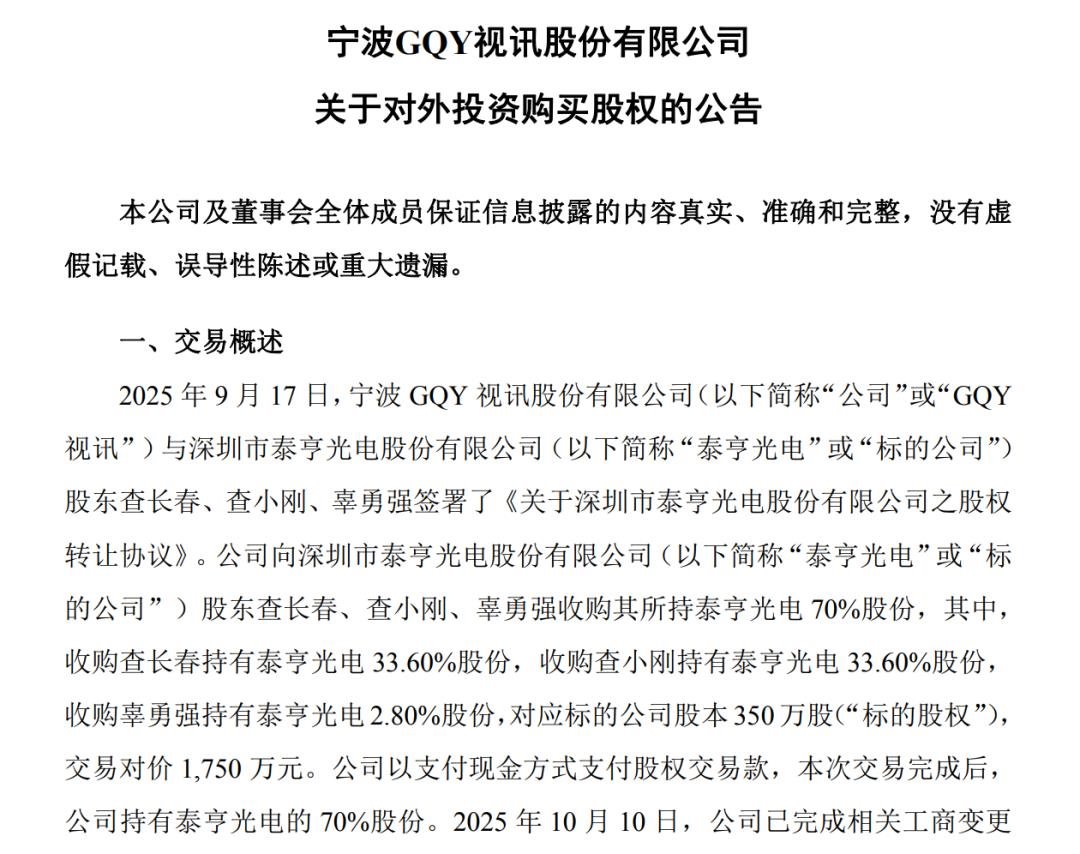

On the evening of October 20, 2025, GQY Video announced that it would acquire 70% of the shares of Shenzhen Taiheng Optoelectronics Co., Ltd.(referred to as Taiheng Optoelectronics) with its own funds of 17.5 million yuan. Against the background of a net profit loss of 22.7264 million yuan in the first half of the year and pressure on the main business, this acquisition is regarded as a key step in the strategic adjustment of GQY Video. By integrating Taiheng Optoelectronics 'resources in the LED display production and manufacturing process, it expands the layout of the large-screen display field, improves the main industry chain, and then reduces operating costs and improves operating efficiency, attempts to reverse the performance decline and inject new momentum into long-term development.

Acquisition background: Strategic breakthrough under pressure from the main business

GQY Video has faced growth challenges in the field of large-screen displays in recent years. The performance data for the first half of 2025 particularly highlights the pressure: the net profit loss of the parent company exceeded 22 million yuan, and the income from the main business dropped year-on-year. The core problems are concentrated on the incompleteness of the industrial chain and weak manufacturing capabilities. Previously, the company focused more on display solution design and marketing, relying on external cooperation in the production and manufacturing of LED displays, which not only led to insufficient cost control capabilities, but also faced dual risks of supply chain stability and delivery cycles. Especially in the environment of intensified industry competition and fluctuating raw material prices, the profit margin has been further squeezed.

In this context, the acquisition of Taiheng Optoelectronics has become an inevitable choice for GQY Video to make up for its shortcomings. The announcement clearly pointed out that the acquisition aims to enhance the company's hard power in the LED display production and manufacturing process, and achieve integrated operations of design-manufacturing-sales-service by integrating Taiheng Optoelectronics 'production capabilities into its own industrial chain system. On the one hand, it can reduce the reliance on external processing and reduce the cost of intermediate links. It is expected that the cost of production can be reduced by 15%-20%; on the other hand, it can quickly respond to customer customization needs, shorten product delivery cycles, and enhance market competitiveness., laying the foundation for subsequent expansion of high-value customers and projects.

Portrait of the standard: Taiheng Optoelectronics has a wide business coverage and outstanding performance growth in 2025

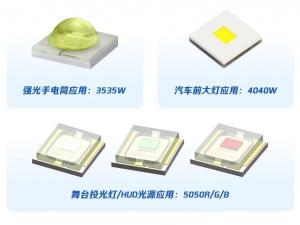

As the core target of this acquisition, Taiheng Optoelectronics was established in 2014 and has accumulated more than ten years of experience in the field of LED display. Its product line covers multiple categories such as outdoor displays, indoor displays, and rental fixed screens. Application scenarios Covering advertising, stage performances, and conference collaboration, it also extends to vertical fields such as medical care, culture, and education, forming a relatively complete product matrix and market layout.

In terms of operating results, Taiheng Optoelectronics has shown strong growth resilience in recent years: audited revenue in 2024 was 67.93 million yuan, and net profit was 3.23 million yuan; in the first half of 2025, revenue reached 34.12 million yuan, and net profit was 4.15 million yuan. In just half a year, the net profit exceeded the full-year level of 2024, with a significant growth rate. Behind this growth in performance is due to the growth in orders in the fields of rental screens and outdoor advertising screens. As cultural tourism performances and commercial activities recover, demand for rental screens has rebounded rapidly; at the same time, its high-definition display equipment customized for the medical industry has also Obtained stable orders due to the need for medical informatization upgrades.

However, Taiheng Optoelectronics also has certain financial risks: as of the end of June 2025, the company's total assets were 72.54 million yuan, net assets were 9.58 million yuan, and total liabilities were 62.96 million yuan. The asset-liability ratio was as high as 86.8%, which was at a high level. High debt may stem from capital needs such as production expansion and raw material procurement. In the future, debt pressure will need to be gradually reduced by optimizing operations and improving profits. This has also become one of the key directions of GQY Video's post-acquisition integrated management.

Performance gambling: two-way binding, balancing risks and returns

In order to ensure the acquisition effect and reduce investment risks, GQY Video and the original shareholders of Taiheng Optoelectronics have set clear performance betting terms, covering the transition period + three-year betting period. Through dual indicators of revenue and net profit, the interests of both parties are bound to ensure The target company continues to contribute value:

Transition period in 2025: Taiheng Optoelectronics needs to achieve an audited operating income of no less than 65 million yuan. This goal is basically the same as the annual revenue of 2024. Considering that it has completed revenue of 34.12 million yuan in the first half of 2025, the remaining six months It is highly feasible to complete revenue of 30.88 million yuan, laying the foundation for performance during the gambling period.

Gambling period from 2026 to 2028: Revenue and net profit indicators are increasing year by year. Specifically, revenue in 2026 will not be less than 65 million yuan, and net profit will not be less than 2 million yuan; revenue in 2027 will not be less than 70 million yuan, net profit will not be less than 3 million yuan; revenue in 2028 will not be less than 75 million yuan, and net profit will not be less than 4 million yuan. The cumulative net profit target for three years is 9 million yuan, and revenue and net profit requirements need to be met at the same time every year, which not only ensures stable growth of business scale, but also emphasizes the improvement of profit quality.

In terms of reward and punishment mechanism, the terms are designed to take into account" constraints" and" incentives": if the cumulative net profit of Taiheng Optoelectronics during the gambling period is less than 9 million yuan, or the net profit of any year fails to meet the standards, the original shareholders must compensate Taiheng Optoelectronics in cash to make up for the performance difference; on the contrary, if the annual revenue meets the standards and the cumulative net profit is more than 9 million yuan, GQY Video will reward 50% of the excess as a bonus to Taiheng Optoelectronics management team to stimulate its business enthusiasm; More importantly, if all gambling results are completed, GQY Video promises to acquire the remaining 30% of the shares, which means that the original shareholders can completely withdraw their shares through performance standards and obtain higher returns, and GQY Video can also realize the 100% shareholding in Taiheng Optoelectronics further strengthens the integration effect of the industrial chain.

Strategic significance: Improve the industrial chain + expand scenarios to accumulate strength for performance rebound

This acquisition has multiple strategic values to the long-term development of GQY Video. It is not only a short-term measure to make up for shortcomings, but also an important step in the long-term layout of the large-screen display field:

From the perspective of industrial chain integration, after the acquisition of Taiheng Optoelectronics, GQY Video will have its own LED display manufacturing capabilities, which can realize the full chain control of solution design-core component production-finished product assembly-market delivery. For example, when undertaking large-screen projects such as large-scale conference centers and sports venues, there is no need to rely on external manufacturers to produce displays, which can not only reduce costs, but also optimize product performance and improve the overall profit margin of the project through collaboration between the production and design ends.

From the perspective of market expansion, Taiheng Optoelectronics 'customer resources and project experience in vertical fields such as medical care and education will help GQY Video expand its application scenarios. Previously, GQY Video focused more on the fields of government, enterprise and commercial advertising, while Taiheng Optoelectronics 'medical display equipment has entered many hospitals, and educational display solutions serve many schools. The introduction of these scenarios will bring new revenue to GQY Video. Growth points, especially under the trend of medical informatization and education digitalization, relevant market demand continues to grow and has greater room for expansion.

From the perspective of performance improvement, if Taiheng Optoelectronics can successfully complete its gambling performance, it is expected to contribute a net profit of no less than 2 million yuan to GQY Video every year (starting from 2026). Coupled with the increase in profits caused by the decline in production costs, it is expected to help GQY Video gradually reverse the loss situation and achieve a rebound in the profit of its main business. At the same time, the integrated operating model will also enhance the company's ability to resist risks and provide a competitive advantage when the industry fluctuates.

However, this acquisition also faces certain challenges: Taiheng Optoelectronics 'high debt needs GQY Video's assistance to optimize to avoid dragging down the overall financial situation; the integration of the two parties in corporate culture and management system also takes time to ensure efficient coordination in production, sales and other aspects. In the future, GQY Video will need to help Taiheng Optoelectronics improve operational efficiency and reduce debt through financial support and managed output, and at the same time give full play to the resource synergy between both parties, so that the acquisition can truly become a booster for performance growth.

Overall, GQY Video's acquisition of Taiheng Optoelectronics is a proactive strategic adjustment under the pressure of its main business. Through the acquisition + gambling model, it not only fills for the shortcomings of the industrial chain, but also binds future development benefits. If integration and performance betting can be successfully completed, the company is expected to achieve both volume and profit growth in the field of large-screen displays, opening up new space for long-term development.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

LG's 136-inch Micro LED display makes its first public appearance

-

Xinyasheng, a frequent visitor to international events, is making another effort! 1142㎡ transparent

-

Suzhou Liqian showcases Micro-LED innovation achievements and plans at CIOE 2025

-

Zhouming Technology: A shining star at the Chain Expo, and its innovation shines on the global stage

-

Guoxing Optoelectronics shines at the 2025 ISLE International Smart Display Exhibition, opening a ne

-

Guoxing Optoelectronics: Outstanding leader in ultra-high power density LED technology

-

Powerful giant color: a shining star in the journey of great country brands

-

Zhaochi shares shine in the 2025 Spring Canton Fair, demonstrating its excellence in technology

-

Zhouming Technology Xingyao Usurface PL1: Leading new changes in outdoor LED displays

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e