San 'an Optoelectronics' acquisition of Lumileds equity was unconditionally approved, adding high-en

- author:

- 2025-12-04 14:50:26

On November 27, 2025, the official website of the State Administration for Market Regulation released information on the conclusion of cases involving concentration of operators. In the list of cases unconditionally approved on November 17 and November 23, 2025, San 'an Optoelectronics Co., Ltd. acquired Lumileds Holding B.V. The equity case (referred to as Lumileds) is on the list, and the case will be concluded on November 17. This progress marks the smooth implementation of key regulatory approval aspects of the acquisition and clears important obstacles for the advancement of subsequent transactions.

According to public information, Lumileds is a well-known company in the LED field. Its core business focuses on automotive lighting, camera flash and special LED products, and has deep industry accumulation in the global high-end automotive lighting market. Its production bases are mainly located in Singapore and Malaysia, and its customers cover first-line lamp manufacturers around the world. The two parties have a history of cooperation for more than 20 years, and they have significant advantages in industry channels and customer resources. However, in terms of financial performance, Lumileds is still at a loss: in 2024, it achieved operating income of US$589 million and a net loss of US$67 million; in the first quarter of 2025, the company's operating income was US$141 million and a net loss of US$17 million.

The acquisition plan was first exposed in August this year. On August 1, Sanan Optoelectronics announced that it plans to join forces with foreign investor Inari Amertron Berhad to jointly acquire 100% equity of Lumileds. The corporate value of this transaction is set at US$239 million. After the regulatory approval is implemented, both parties will subsequently advance relevant processes such as equity delivery.

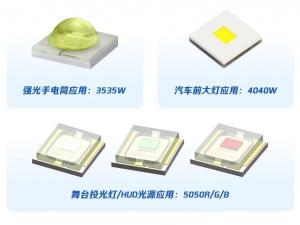

For this acquisition, San 'an Optoelectronics clearly stated that its strategic value is significant. On the one hand, the acquisition will form a strong complementary effect with the company's existing LED chip and packaging business. San 'an Optoelectronics has core technology and production capacity advantages in the field of LED chips, while Lumileds has irreplaceable product design, market channels and customer resources for high-end application scenarios. Competitiveness, the combination of the two will achieve synergy upstream and downstream of the industrial chain. On the other hand, through this acquisition, San 'an Optoelectronics will quickly enter the international high-end LED supply chain, especially to achieve breakthroughs in the high value-added track of automotive lighting; at the same time, it can use Lumileds to deploy overseas production capacity and mature channels to improve its own global business layout, further enhance its global market competitiveness in the fields of automotive lighting and special LEDs, and open up new growth space for the company's long-term development.

TAG:

Guess you want to see it

Popular information

-

CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

-

Huike temporarily suspends IPO

-

Shendecai's strength empowers Spring Festival Gala everywhere and lights up the visual glory of the

-

Zhaochi shares won another victory in patent disputes, demonstrating its technical strength and indu

-

Ruifeng Optoelectronics Mini LED backlighting empowers, Audi E5 Sportback Smart Island opens a new c

-

Zhouming Technology's Light and Shadow Empowers Shenzhen Joy City: It will be the top spot after ope

-

Lehman Optoelectronics COB ultra-high-definition energy-saving cold screen lights up Hong Kong Tseun

-

Sitan Technology shines at CES 2025, leading the new trend in Micro-LED technology

-

Guoxing Optoelectronics 'all-bright level 2727: Decoding a new paradigm of outdoor display and light

-

Sony's 2025 TV product line released, multi-technology integration opens a new chapter in audio-visu

the charts

- CEO of TV IKLAN Group, Indonesia's largest media company, led a delegation to inspect MNLED and the

- Innolux joins hands with Yuantai, TPV and others to introduce large size color electronic paper into

- Xida Electronics signs a strategic cooperation agreement with Changbai Mountain Chixi District Manag

- Liard joins hands with "Three-Body" to open a new era of science fiction drama in China

- Zhaochi Semiconductor joins hands with Li Xing Semiconductor. Want to do big things?

- Zhou Ming joins hands with the Guangdong Basketball Association to produce another masterpiece! The

- ISE2023 Abbison's first exhibition in the new year has received frequent good news, and the immersiv

- Samsung Display and APS "work together" to create 3500ppi Micro OLED

- Zhouming Technology and Perfect World officially reached an educational ecological partnership!

- Longli Technology:Mini-LED has been shipped in batches to some in-vehicle customers, VR customers, e