South Korea launches Ex-OLED strategy to ensure leapfrog technology

- author:

- 2022-11-24 09:30:48

The economic downturn has led to slowing demand and the rise of China, leaving South Korea's display industry in trouble. In order to maintain competitiveness in the South Korean display industry, the expansion of the new generation oled market is the core breakthrough. Improving the price competitiveness of OLED and expanding application fields are topics. In response, Samsung Display said its goal is to OLED all IT equipment.

On February 21, the Korea Industrial Technology Evaluation Administration (KEIT) and the Korea Display Industry Association held a launch conference on the 2023 Display Technology Roadmap at the Korean Chamber of Commerce and Industry in Seoul's Central District. Samsung Display Vice President Zhao Chengcan, LG Display President Lu Junhao (executive), KEIT Park Yong-ho and others attended the day's press conference as speakers.

They agreed that the world's main display should be quickly converted from LCD (liquid crystal display) to OLED to escape the catch-up of China. With the strong support of the government, China companies are also expanding their scale in the OLED market. The industry believes that South Korea's large size OLED technology for TV is 4 to 6 years ahead of China, but the gap with China in terms of small and medium-sized size OLEDs for smartphones and notebook computers is only 2 years. Following LCD, China's catch-up in the field of OLED (Organic Light Emitting Diodes) is also becoming increasingly intense. In order to maintain the technology gap, the South Korean government, Samsung Display and LG Display have launched Ex-OLED and plan to cultivate the display industry through the commercialization of Ex-OLED (Extended OLED) in 2027.

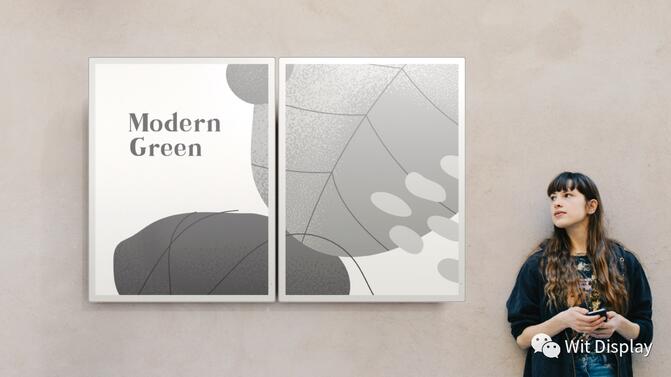

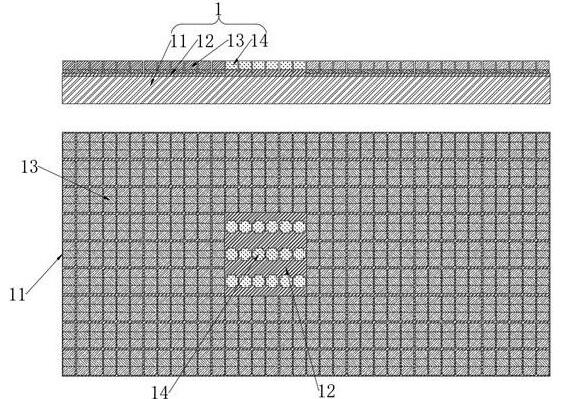

Ex-OLED is the abbreviation for extension of application products and expansion of the market. It refers to OLED and application products based on Formfree whose existing characteristics such as high brightness and long life have been greatly expanded.

To make matters worse, after the epidemic, the display panel industry is deteriorating due to a sharp drop in demand for home appliances and IT equipment. South Korea's panel exports have decreased for eight consecutive months since June last year. The size of the global display equipment market, as an investment indicator, also dropped significantly year-on-year.

Regarding the severe industrial environment, Samsung Display Vice President Zhao Chengcan emphasized the awareness of crisis and selected OLED for IT as a future career. Zhao Chengcan said: I think the display market that has been explored before is at a disadvantage in price competitiveness, so I face it with urgency. In the end, with the sense of crisis that if we cannot open up new markets, we cannot expand our market share, and we are making every effort to ensure that technology exceeds the gap. quot;

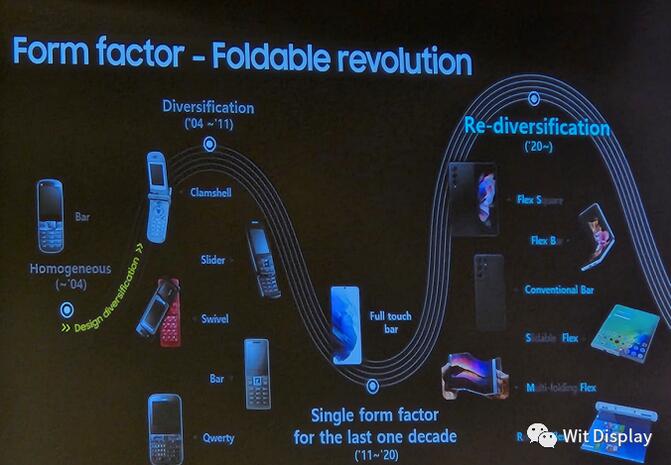

He also said: With the emergence of the new coronavirus pneumonia, the market has changed, and displays are scattered in all spaces in the home, and the display can be seen everywhere. Companies are considering a lot to deal with personal mobility.& quot; Some people believe that the future of displays lies in the personalization of IT equipment such as smartphones, tablets, VR, and AR.

Zhao Chengcan said: So far, compared with the previous area of high-end TVs, IT monitors have much greater advantages in terms of area and selling price. From this perspective, IT is a very important market, and our goal is to convert the entire IT display market into OLED.& quot;

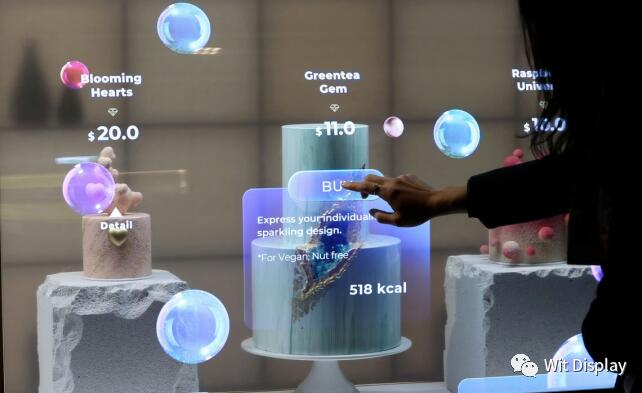

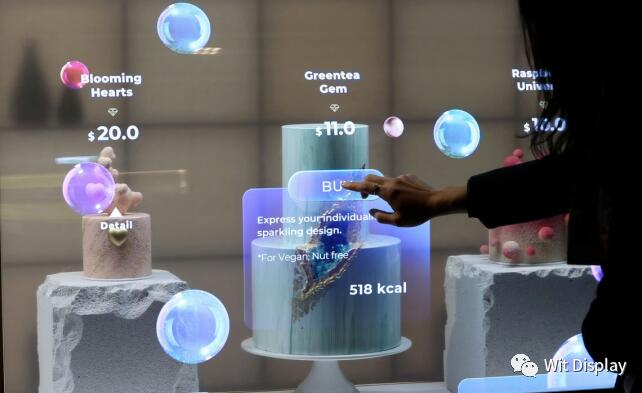

Lu Junhao, President of LG Display, emphasized the market expansion possibilities of LG Display's first transparent OLED developed and successfully mass-produced in the world. Lu Junhao said: Transparent display is a technology that leverages OLED's own luminous advantages to the extreme, and can be applied to various fields such as billboards and mobile travel. quot; In addition to the existing 55-inch, we will launch a 70-inch product by the end of this year." quot;

Experts suggest that in the face of China companies launching a quantitative offensive, South Korean companies should increase OLED market share based on ultra-gap technology. Kang Min-soo, chief analyst at market research firm Omdia, said: OLED is the most reliable weapon for Korean companies. Apple, a major industry customer, said that in addition to smartphones, tablet and notebook displays will also be equipped with OLED, and competition among panel companies will become more intense. quot; He said: OLED has the characteristics of larger area, lower power consumption, so additional technologies suitable for each device must be developed as soon as possible. In order to catch up with China companies, they must be backed by differentiated technical policies and talent exploration. quot;

Dr. Park Yong-ho from the Korea Institute of Industrial Technology Evaluation said: With China investing in the 10.5th generation panel production line, the dominance of displays has shifted to China. In terms of manufacturing technology, South Korea is in an advantageous position, but China and South Korea's CAPAs (production) are almost at the same level. If they hesitate in research and development or create new markets, they will eventually be eaten by China. quot;。He pointed out that the domestic industry urgently needs to ensure technology and supply chains that break through OLED limitations. He also said: Currently, the proportion of LCD in China and OLED in South Korea is good at is 2:1. In order for OLED to become the main display, South Korea to regain its position as the world's number one market share and needs to develop technologies to improve price competitiveness. quot;

Li Dongxu, vice president of the Display Industry Association, said it is necessary to quickly amend the issue of expanding investment tax credits under the Special Tax Law currently being discussed in Congress.

Jeon Yoon-jong, director of the Korea Institute of Industrial Technology Evaluation, said: We will strengthen our support for the development of scalable OLED and inorganic light-emitting display technologies. These technologies have been receiving much attention as next-generation display technologies. Through unity and cooperation with industry, learning and research, we strive to create an unmatched cutting-edge display power.& quot;

In addition, the global display market size last year was 150 trillion won, with LCD and OLED accounting for 64% and 36% respectively. According to market research firm Omdia, new generation OLEDs such as OLED and Micro OLED will account for more than 40% of global display sales in 2029.

TAG:

Guess you want to see it

Popular information

-

Black Wukong: A fantasy epic blooming on the LED screen

-

Mojo Vision develops the world's highest density Micro LEDs

-

Sharp launches a 42-inch e-ink screen poster: it can be displayed even when power is turned off

-

South Korea launches Ex-OLED strategy to ensure leapfrog technology

-

The world's first 120-inch 4K Mini LED direct-display super TV

-

Hisense released a 100-inch thousand-level zone TV E8K, opening a new era of 100-inch giant screens

-

New Vision·Towards the Future| Abbison's 2023 spring conference came to a successful conclusion

-

Zhaochi Semiconductor: Announced two invention patents related to Micro LED chips

-

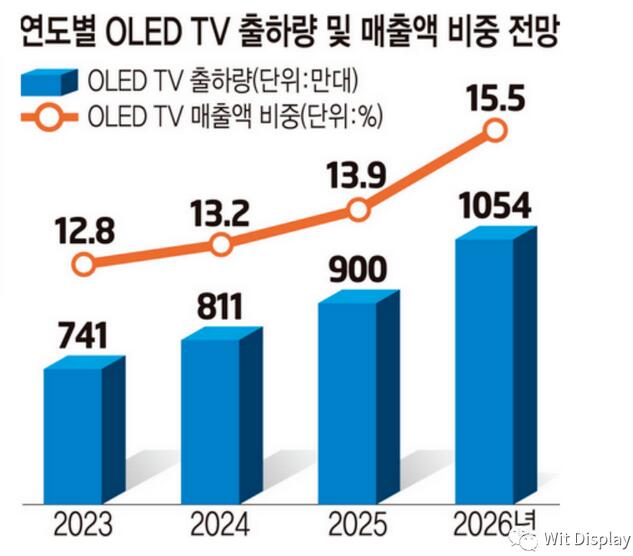

The OLED TV market has exploded 1500 times in 10 years: it will exceed 10 million units in three yea

-

South Korean university research team proposes thin film transistor technology to improve the perfor

the charts

- The OLED TV market has exploded 1500 times in 10 years: it will exceed 10 million units in three yea

- The world's first 120-inch 4K Mini LED direct-display super TV

- Mojo Vision develops the world's highest density Micro LEDs

- Zhouming Group's Lampu brand renewal and upgrade have been released!

- First in Europe! Sony Black Crystal virtual production studio completed

- Zhaochi Semiconductor: Announced two invention patents related to Micro LED chips

- South Korean university research team proposes thin film transistor technology to improve the perfor

- South Korea launches Ex-OLED strategy to ensure leapfrog technology

- Sony launches new Crystal LED black crystal BH and CH series small-pitch LED displays launched in Ap

- Changhong released 8K high brush Mini-LED TV