POB and COB: Who will dominate the future of Mini LED applications?

- author:

- 2024-05-27 16:50:06

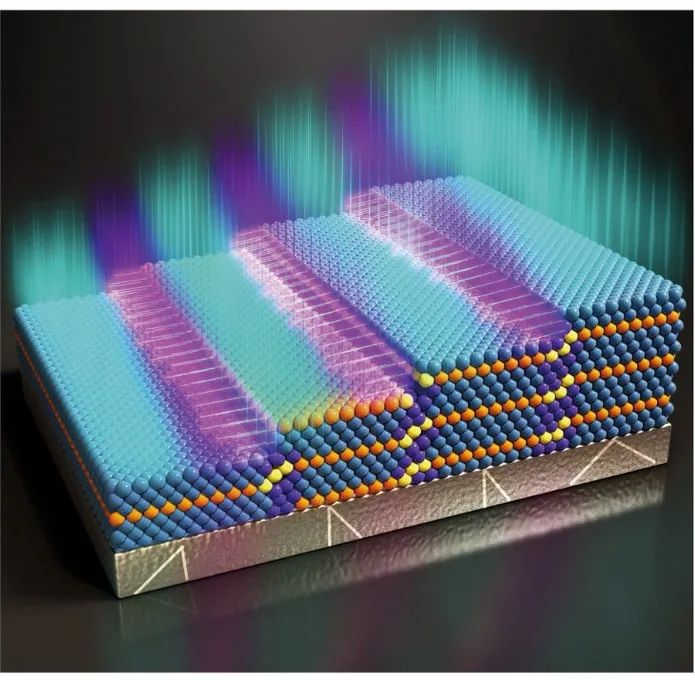

With the entry of more first-line brands and the coverage of more application markets, Mini LED, as an essential technology for LCD development, has become increasingly important. However, Mini LED backlights face many challenges in the commercialization process, among which the dispute between POB and COB solutions has become the focus of attention. In this context, it is of great practical significance to discuss which of POB or COB can better cater to market demand and release volume.

So, at the stage of fierce competition in the commercialization of Mini LED backlights, who can better meet market demand and release volume?

At the 2022 Display Home Mini LED Backlight Mass Production and Application Trend Conference, companies such as Guoxing Optoelectronics, Dongshan Precision, Jingtai Co., Ltd., Jingke Electronics, Ruifeng Optoelectronics, and Yimei Xinchuang also discussed the application choices and changes of POB, COB and other solutions, and shared their latest views.

在"2022 显示之家 Mini LED 背光量产与应用趋势大会"上,国星光电、东山精密、晶台股份、晶科电子、瑞丰光电、易美新创等企业也就 POB、COB 等方案的应用选择和变化,分享了各自的最新观点。

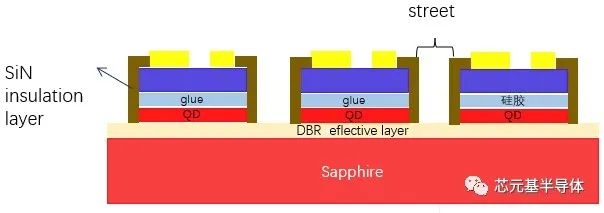

Guoxing Optoelectronics believes that Mini POB has low difficulty in process and strong mass production, but is limited by the package size. It is currently mainly used in large OD modules, targeting the middle and low-end TV, MNT and automotive markets.

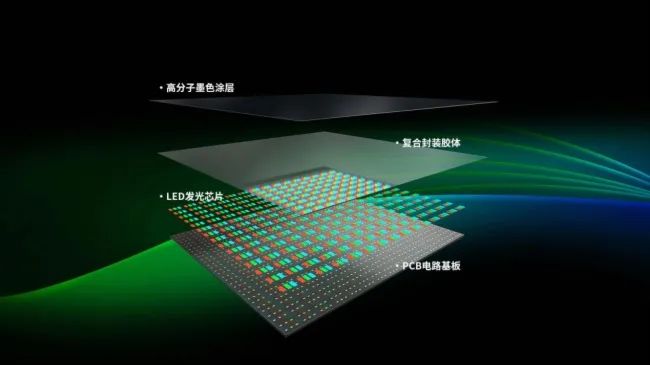

The Mini COB can be ultra-thin and has an OD of 0mm and above; however, at this stage, its process difficulty, equipment investment, and material requirements are relatively high, and the module yield is low. However, as the technological maturity of each link in the industrial chain improves, the yield problem will be solved, and its development prospects far exceed Mini POB, which can be applied in all fields.

Judging from the current technical situation, as of 2025, Mini POB will still be the mainstream, more suitable for 43-85-inch TVs, 17-39-inch MNT and car displays, etc., with the highest overall cost performance; while Mini COB is more suitable for small and medium-sized size applications such as 13-16-inch NB and 8-12.9-inch PAD. Single board products are conducive to improving yield and reducing costs. In the future, with the further improvement of technological maturity in all links of the industrial chain, it is believed that mainstream disruption will be achieved after 2025.

Jingtai shares cited the choices of Apple and Samsung as examples and believed that the above-mentioned first-line brands chose COB solutions based on product needs. The COB solution can achieve 0OD, extremely thin and light, and meets the needs of tablets, notebooks and other products.

However, in small and medium-sized size applications such as tablets and notebooks, Mini LEDs not only face its own cost pressure, but also need to face the threat of oled"", such as the competitive pressure brought by the mature industrial chain of small and medium-sized size OLED, and the consumer awareness brought by years of OLED marketing.

In contrast, large size applications such as televisions and monitors are the main battlefields for Mini LED backlight technology. The development of large size markets pays more attention to cost optimization. However, the POB solution has simple process, low material costs, good optical effects, low application requirements, mature mass production solutions, and more possibilities for zoning in the future. Therefore, the mainstream solution for Mini LEDs must be POB.

Jinko Electronics is also very optimistic about the application of Mini LEDs in TVs. It believes that Mini LED+8K will become the mainstream product for TVs above 75 inches; among TVs above 65 inches, Mini LED+8K is the best combination for high-end TVs to achieve high selling prices, but its competitiveness still depends on cost.

In particular, COB belongs to the chip level, and the yield of its lamp board production and the impact of one-time through-pass rate, rework efficiency, and yield on cost are crucial. The maturity of these processes requires the joint promotion of the supply chain.

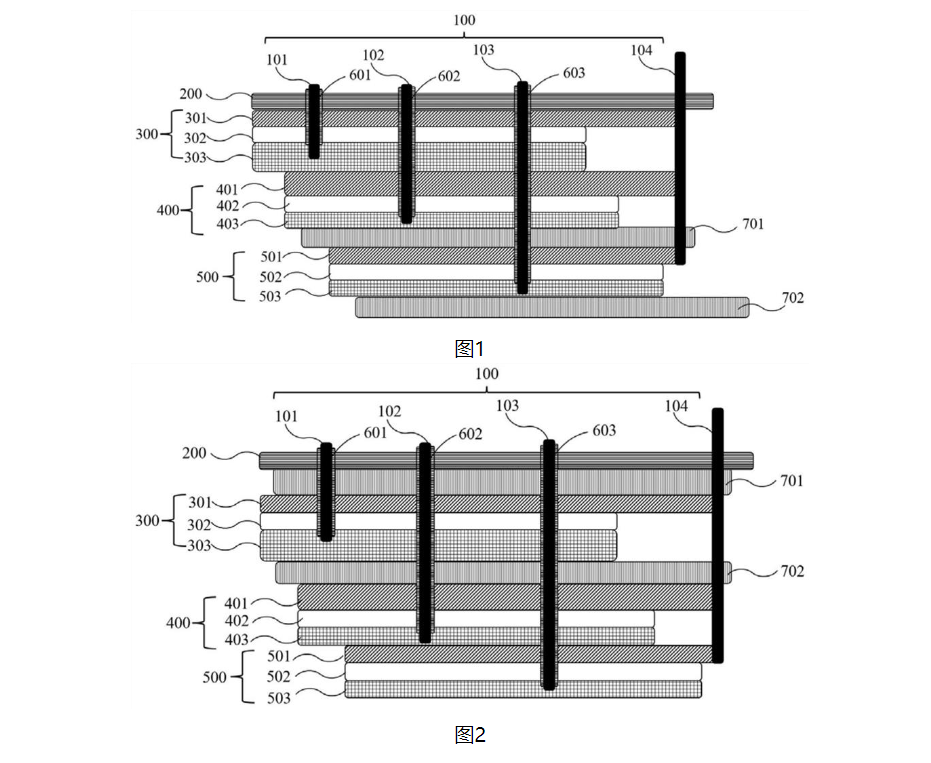

Consistent with Jinko Electronics, Dongshan Precision also believes that the pain points and strategic opportunities for technology iteration of Mini LED products lie in the challenge of higher process yields and the cost of meeting market demand for large quantities. Taking TVs and displays as examples, the cost is mainly concentrated in packaging, PCB, driving and other aspects, while the driving cost of Mini LEDs is determined by the number of partitions.

From a technical perspective, the Mini COB packaging route has added auxiliary methods such as SPI (testing solder paste), AOI (testing appearance), lighting test (testing performance), and aging to effectively ensure the through-rate.

Regarding their views on the packaging route, Ruifeng Optoelectronics and Yimei said that POB and COB have no absolute advantages and disadvantages for a period of time, which is closely related to the completeness of the supply chain and the application scenarios of the product.

summary

Display Home noticed that currently Jingtai shares mainly focus on the POB solution; Jingke Electronics is targeting the COB solution; while manufacturers such as Guoxing Optoelectronics, Dongshan Precision, Zhaochi Guangyuan, Ruifeng Optoelectronics, and Yimei Xinchuang are simultaneously laying out POB and COB solutions to promote commercial development with their own advantages.

Based on the above expert views, we can draw the following conclusions:

- POB's technology and industry are mature and have low costs. They meet the needs of large size applications such as TVs and displays. They are currently the mainstream route of Mini LED backlights in non-Apple and Samsung supply chains;

- With the high-end extension of large size application scenarios, COB has become the mainstream choice for mid-to-high-end positioning products for Mini LED backlights;

- At present, various manufacturers are more inclined to market demand in terms of solution selection, but with the goal of promoting the commercialization of Mini LED backlights, they will not let go of any possibility;

- With the promotion of many manufacturers, the large-scale production, yield and cost of COB solutions will be optimized, and significant changes will be brought about in the next 3-5 years. To sum up, Mini LED backlight technology faces many challenges in the commercialization process, of which the dispute between POB and COB solutions is the key. Through an analysis of the views of the six major packaging factories, we can see that the POB process and industrial supporting facilities are mature and have low costs. They meet the needs of large size applications such as TVs and displays. They are currently the mainstream route of Mini LED backlighting in non-Apple and Samsung supply chains. With the high-end extension of large size application scenarios, COB has become the mainstream choice for mid-to-high-end positioning products for Mini LED backlights. At present, various manufacturers are more inclined to market demand in terms of solution selection, but with the goal of promoting the commercialization of Mini LED backlights, they will not let go of any possibility. With the promotion of many manufacturers, the large-scale production, yield and cost of COB solutions will be optimized, and significant changes will be brought about in the next 3-5 years. Display Home noticed that currently Jingtai shares mainly focus on the POB solution; Jingke Electronics is targeting the COB solution; while manufacturers such as Guoxing Optoelectronics, Dongshan Precision, Zhaochi Guangyuan, Ruifeng Optoelectronics, and Yimei Xinchuang are simultaneously laying out POB and COB solutions to promote commercial development with their own advantages.

TAG:

Guess you want to see it

Popular information

-

JCDecaux Chemical Corporation: The development of new Mini display-related products is progressing,

-

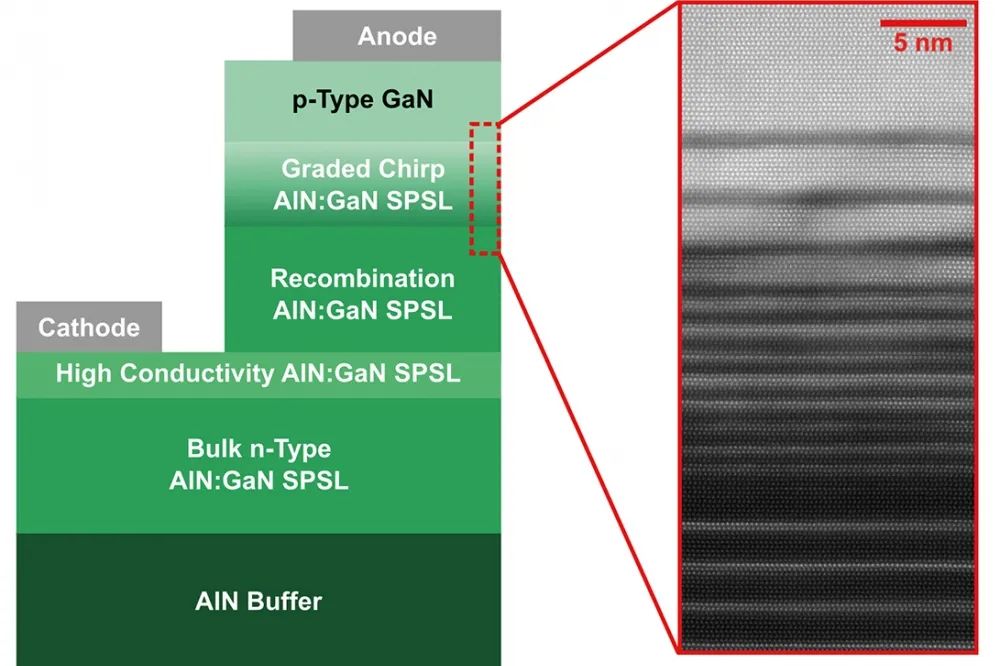

Soochow University makes new progress in white perovskite LED research

-

Core-based high-efficiency pure red light quantum dot chip has been achieved, and QD-Mini LED is abo

-

Australia company Silanna UV achieves mass production of ultraviolet LEDs

-

The internal quantum efficiency has been increased to 70%, and this team has made a breakthrough in

-

Division 5184! TCL launches Mini LED TV with peak brightness of 5000nit

-

MIT researchers demonstrate perovskite nanoscale LED arrays

-

This company has obtained invention patents related to MINI LED

-

The latest research on UV LED solves 2 problems

-

Milestone breakthrough? UVC-LED new lens appears

the charts

- JCDecaux Chemical Corporation: The development of new Mini display-related products is progressing,

- The total investment exceeds 26 billion yuan! This year's Mini/Micro LED is something to watch!

- Involving key patents involving Mini LED, Zhaoyuan Optoelectronics, Xinruida, etc. disclosed...

- Division 5184! TCL launches Mini LED TV with peak brightness of 5000nit

- Mini/Micro LED equipment manufacturer Keyun Laser has completed Series B financing of over RMB 100 m

- Lenovo releases a new 34-inch hairtail display equipped with Mini LED backlight technology

- POB and COB: Who will dominate the future of Mini LED applications?

- The internal quantum efficiency has been increased to 70%, and this team has made a breakthrough in

- High-precision optical processing, this team used MINI-LED technology as a breakthrough point

- Analysis of Mini/Micro LED driving technology